The DAX index has gained ground in the Friday session. Currently, the DAX is trading at 11,191, up 0.47% on the day. On the release front, German Final GDP declined 0.2%, matching the forecast. German and eurozone manufacturing PMIs softened in October.

It was a tumultuous week for global stock markets, as investors were greeted with a sharp correction early in the week, triggered by a downturn in technology stocks. The DAX continues to head south – the index declined 2.16% last week and has dropped 1.63% this week. On Tuesday, the DAX dropped to a low of 11,009, its lowest level since December 2016. Investor risk appetite has waned, as the ongoing global tariff war between the U.S. and its major trading partners has dampened global growth. The markets are hoping for a breakthrough at the G20 summit in Argentina next week, when President Trump meets with Chinese leader Xi Jinping. If there is any progress, traders can expect the DAX to respond with gains.

German economic data disappointed on Friday, but the DAX has nonetheless managed to post gains. Final GDP declined 0.2% in the third quarter, in line with expectations. This marked the first decline since 2014 and was identical to Preliminary GDP, which was released last week. Manufacturing PMI fell to 51.6, pointing to a stagnant manufacturing sector. This marked a fourth straight drop in manufacturing activity. Services PMI dropped lower, with a reading of 53.3 points. Both indicators missed their forecasts. The contraction in growth has weak PMIs is bound to raise concerns – is the long German expansion over? German officials attributed the weak GDP releases to new emission standards for German cars, but it’s likely that the drop can also be attributed to the ongoing trade war between the U.S. and China, which has dampened global economic growth.

Economic Calendar

Friday (November 23)

- 2:00 German Final GDP. Estimate -0.2%. Actual -0.2%

- 3:30 German Flash Manufacturing PMI. Estimate 52.3. Actual 51.6

- 3:30 German Flash Services PMI. Estimate 54.6. Actual 53.3

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 52.0. Actual 51.5

- 4:00 Eurozone Flash Services PMI. Estimate 53.6. Actual 54.6

*Key events are in bold

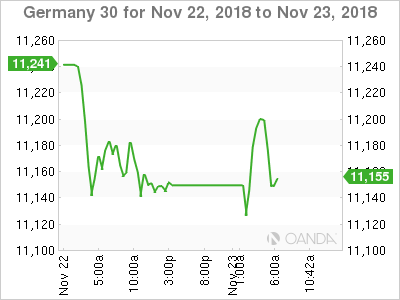

DAX, Friday, November 23 at 5:10 EST

Open: 11,146 Low: 11,206 High: 11,126 Close: 11,191