Investing.com’s stocks of the week

The coronavirus outbreak is a convenient explanation for everything market-related these days. According to the media, investors across the globe panicked last week that the virus, which has taken over 3000 lives already, is going to become a pandemic. Major stock market indices in the U.S. lost roughly 14% in the past five trading days. In Europe, the DAX 30 was one of the hardest hit.

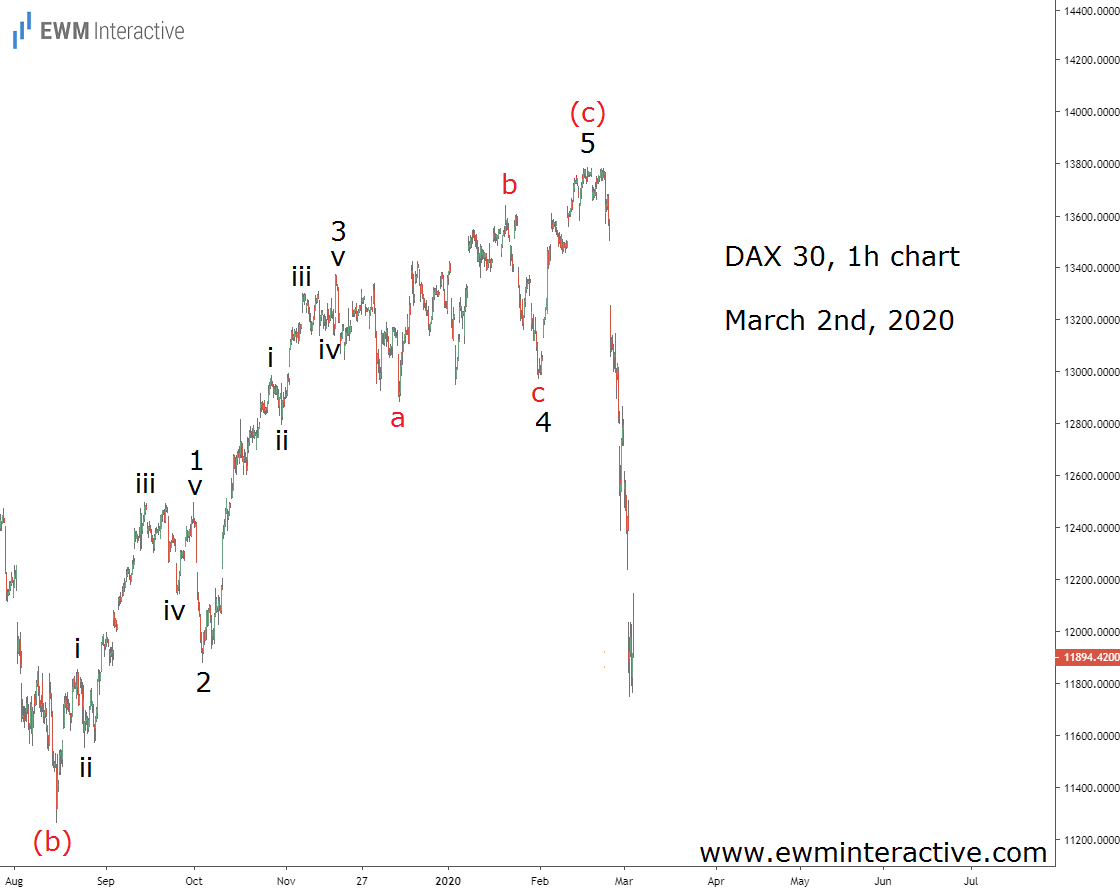

The German benchmark index is not among our seven premium instruments. However, we still send DAX 30 Elliott Wave analyses to several clients who’ve ordered it on-demand. The chart below was part of the analysis we sent to them before the market open on Monday, February 24th.

The hourly chart reveals a complete five-wave impulse, labeled 1-2-3-4-5. Normally, a three-wave correction follows every impulse. Here, however, we thought this pattern was wave (c) of a larger (a)-(b)-(c) zigzag. Hence, instead of just a small retracement down to the support of wave 4 near 12 900, we expected something much bigger.

Ahead of the DAX 30 Coronavirus Panic

In other words, there was already a bearish Elliott Wave setup in place long before the media started touting the coronavirus explanation. Does this mean stocks were going to decline with or without the outbreak? We’ll never know for sure. In our experience, explanations are easy to find after the fact. Fortunately, staying ahead of them is possible with proper Elliott Wave analysis.

The move was definitely faster than expected, but in the right direction. The DAX 30 fell to 11 724 last week, losing 13.7% in the process. The coronavirus might have been the catalyst, but from an Elliott Wave perspective a decline was supposed to happen anyway. Investors, who waited for the media to tell them what is happening, were inevitably late to react.