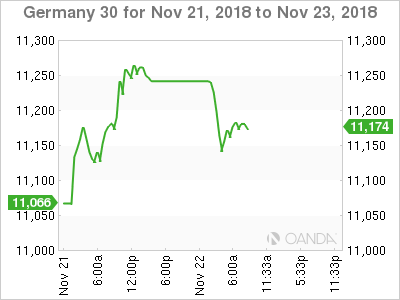

The DAX index has lost ground in the Thursday session. Currently, the DAX is trading at 11,171, down 0.38% on the day. On the release front, The ECB will release the minutes of its policy meeting in October and Eurozone consumer confidence is expected to come in at -3 points for a third straight month. On Friday, Germany releases Final GDP for the third quarter, with the markets braced for a decline of 0.2 percent. As well, the eurozone and Germany will release services and manufacturing PMI reports.

The DAX continues to show volatility this week. After sharp losses early in the week, the index posted gains on Wednesday, but has again headed lower in Thursday trade. The slide was caused by a sharp fall in technological stocks, which sent U.S markets nosediving and spread to the Asian and European markets. The DAX has had a dismal fourth quarter, losing 6.67% in October and 2.1% in November. This is reflective of sharp losses in global equity markets, as nervous investors fret over the economic ramifications from the escalating trade war between the U.S. and China. The trade war has already caused a slowdown in the Chinese economy, and analysts are expecting the U.S economy to slow, with talk of a recession being bandied about. With no signs that the U.S or China will back down, traders can expect more headwinds for global stock markets, many of which have given up their year-to-date gains.

Who will blink first over the contentious Italian draft budget? On Wednesday, the European Commission rejected Italy’s draft 2019 budget, saying it was in breach of EU deficit and debt rules. Italy’s debt stands at a staggering 132% of GDP, and the EU is concerned that the high-spending budget could cause another debt crisis in the eurozone. The EU could impose severe financial sanctions on Italy, with fines of up to 0.2% of the country’s GDP. Senior Italian officials have vowed not to bend on the budget, but the EU will risk its credibility if it does not take follow up its scolding of the Italian government with some firm action. At the same time, the European Commission has yet to sanction a member for flouting fiscal rules and will be hesitant to do so at a time of economic uncertainty in the eurozone.

European open – Europe higher in fragile markets

The global rout pauses for breath

Economic Calendar

Thursday (November 22)

- 7:30 ECB Monetary Policy Meeting Accounts

- 10:00 Eurozone Consumer Confidence. Estimate -3

Friday (November 23)

- 2:00 German Final GDP. Estimate -0.2%

- 3:30 German Flash Manufacturing PMI. Estimate 52.3

- 3:30 German Flash Services PMI. Estimate 54.6

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 52.0

- 4:00 Eurozone Flash Services PMI. Estimate 53.6

*All release times are DST

*Key events are in bold

DAX, Thursday, November 22 at 7:00 EST

Open: 11,216 Low: 11,221 High: 11,119 Close: 11,167