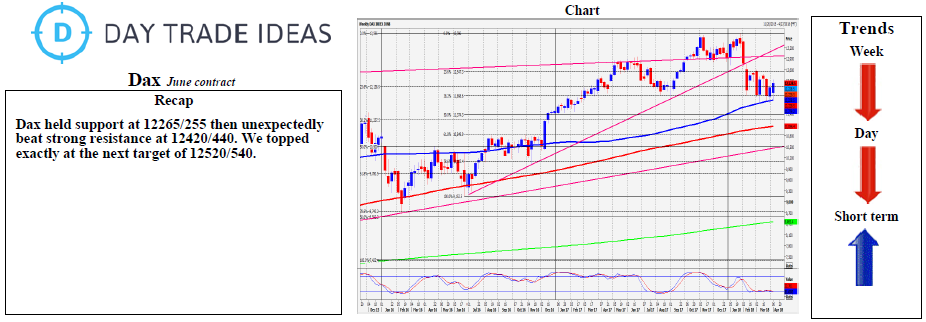

DAX holding above 12420/440 is positive for today but strong resistance at 12520/540 is a selling opportunity with stops above 12595. Despite a great 2 week performance and break above 12440, the outlook is very negative if we fail to beat 12520/540.

Obviously held below 12410 is more negative for today targeting 12370 and minor support at 12345/335. A bounce from here is likely on the first test but may only reach 12410/430. Further losses meet quite good support at 12290/280 and the best chance of a low for the day in the short term sideways trend. A break lower however targets 12225/215, perhaps as far as 12170/160. Strong resistance at 12520/540 is a selling opportunity in overbought conditions, with stops above 12595. A break above 12600 however runs in to the 200 day moving average at 12660/670. Another big challenge. Above here we hit the 100 dma and January low at 12720/730 and I very much doubt this can be beaten.