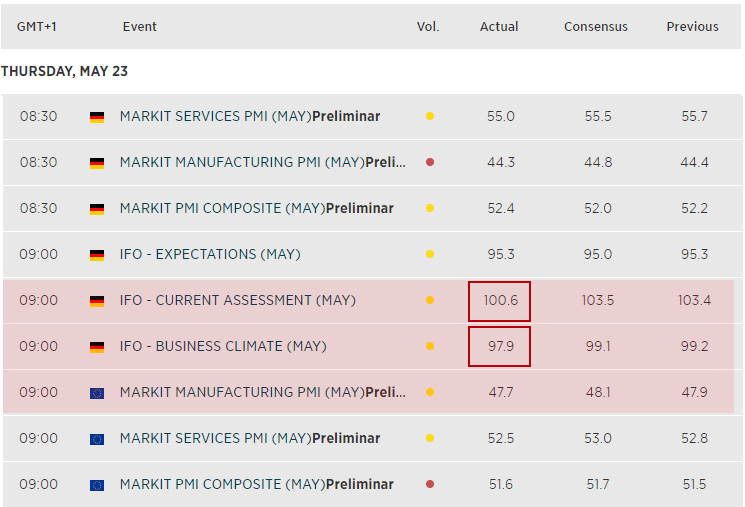

The DAX (Germany 30 CFD) and European equities in general took quite a hit yesterday when Germany’s IFO business sentiment plummeted and European PMI contracted a little further. Yet there was little time to recover after US extended the gloom with Market PMI data hitting its lowest level since May 2016. Indeed, with forward looking indicators heading towards contraction levels, it further lowers growth expectations and therefore company earnings. Traders were quick to dump stocks and move into bonds, which saw TLT break to new highs with the US 10 year yielding just 2.3%, its lowest since 2017.

Now clinging onto its 2019 bullish channel, the DAX finds itself at a pivotal moment. If risk-on can resurrect itself, then we can seek bullish setups within the channel. Yet if the negative vibe persists, we may need to ‘look out below’ if key support gives way or the potential large reversal pattern on the Dow Jones Industrial (Wall Street 30 CFD) kicks into action.