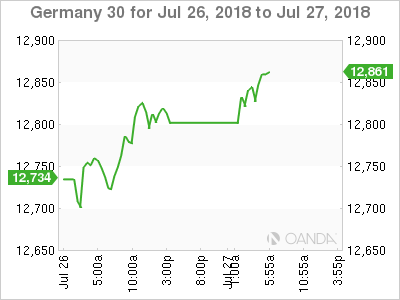

The DAX index is slightly higher in the Friday session, continuing the upward trend seen on Thursday. Currently, the DAX is at 12,844, up 0.27% on the day. On the release front, the sole event is German Import Prices. The indicator dropped 0.5% in June, down sharply from the 1.6% gain a month earlier. Still, this beat the estimate of 0.5%. The U.S will release Advance GDP for Q2, with the markets expecting a strong gain of 4.2%.

It was more of the same from the ECB, which maintained its monetary policy at its Thursday policy meeting. The main refinancing rate remained at 0.0%, where it has been pegged since January 2016. In a policy statement, policymakers reiterated that rates would remain at current levels “through the summer of 2019”, and “as long as necessary to boost inflation to the target of just under 2.0%. There has been some quibbling among analysts as to the exact meaning of “through the summer”, but what is clear is that the ECB plans to keep rates at a flat 0.00% after winding up its bond-purchase scheme at the end of the year. Low interest rates are bullish for stocks, and the DAX responded with gains on Thursday after the ECB statement. Still, a rate hike seems likely sometime in 2019. The exact timing of a rate increase will depend on the strength of the eurozone economy and inflation levels – if the second half of 2018 is marked by stronger growth and higher inflation, there will be pressure on the ECB to raise rates earlier rather than later in 2019.

It’s been an excellent week for the DAX, which has climbed 2.6% and is at its highest level since mid-June. Market sentiment improved on Thursday on Wednesday, after a meeting between EU Commission President Jean-Claude Juckner met with President Trump went better than expected. The two leaders agreed to take concrete steps to eliminate tariffs and improve the trade relationship between the U.S and the EU, which has been battered in recent weeks. President Trump agreed to hold back on any further tariffs while talks are ongoing. This is a major concession from Trump, who just last week had threatened to impose tariffs on European car imports. U.S tariffs on European aluminum and steel will remain in place, but Juckner pointed out that the U.S has agreed to reassess these measures. The surprise agreement triggered strong gains in bank and automakers shares on the DAX, boosting the index. With fears of a full-blown transatlantic trade war easing, the markets are hoping that the conciliatory tone shown by the Trump administration with the Europeans will extend to China as well.

Economic Calendar

Friday (July 27)

- 2:00 German Import Prices. Estimate 0.3%. Actual 0.5%

- 8:30 US Advance GDP. Estimate 4.2%

*Key events are in bold

DAX, Friday, July 27 at 5:10 DST

Previous Close: 12,809 Open: 12,823 Low: 12,816 High: 12,855 Close: 12,844