The DAX index has posted slight gains in the Wednesday session, continuing the trend we saw on Tuesday. Currently, the pair is trading at 12,409, up 0.21% on the day. On the release front, the sole German event is the 10-Year bond yield. In the U.S, the Federal Reserve will publish the minutes of the August policy meeting. On Thursday, Germany and the eurozone release PMI reports and the ECB will publish the minutes of its July meeting.

The DAX continues to post slow-but-steady gains this week. Although the index is in the red in the month of August, investor risk appetite has improved since last week, following the announcement that the U.S and China had agreed to hold trade talks, which begin on Wednesday in Washington. This follows months of escalating trade tensions, which have dampened risk appetite. The U.S is unhappy with the Chinese protection of local markets and technology transfers required in order for U.S businesses to operate in China, but it’s questionable if the Chinese will show much flexibility. If the talks show signs of progress, such as the suspension of a $16 billion tariff scheduled to take effect on Wednesday, German stock markets could continue to gain ground.

All eyes are on the Federal Reserve, which publishes the minutes of its meeting from August 1. The Fed statement from that meeting described the economy as “strong”, the first time it used that term since 2006. Fed policymakers reiterated their commitment to raise interest rates gradually, as economic conditions remain strong. In the second quarter, GDP grew 4.1%, inflation has moved closer to the Fed’s target of 2%, and unemployment remains at record lows. The minutes are expected to underscore the Fed’s intent to raise rates twice more this year, in September and December. The Fed’s approach to rate hikes appears economically sound, but enter the undiplomatic President Trump, who has criticized the Fed, saying he was “not thrilled” with higher rates. Trump’s comments have fuelled the euro’s rally, as the currency pushed above the 1.16 line on Wednesday, for the first time since August 9.

Economic Calendar

Wednesday (August 22)

- 5:35 German 10-year Bond Auction. Actual 0.33/1.2

- 14:00 US FOMC Meeting Minutes

Thursday (August 23)

- 3:30 German Flash Manufacturing PMI. Estimate 56.5

- 3:30 German Flash Services PMI. Estimate 54.3

- 4:00 Eurozone Flash Manufacturing PMI. Estimate 55.1

- 4:00 Eurozone Flash Services PMI. Estimate 54.4

- 7:30 ECB Monetary Policy Meeting Accounts

- Day 1 – Jackson Hole Symposium

*All release times are DST

*Key events are in bold

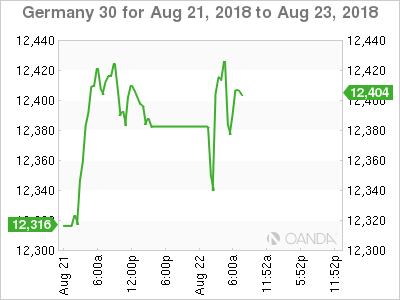

DAX, Wednesday, August 22 at 7:05 DST

Previous Close: 12,384 Open: 12,342 Low: 12,342 High: 12,441 Close: 12,409