European markets are starting a crucial week with bulls facing a bearish pattern formed a week ago. As we mentioned in one of our previous post, bears are slowly taking control in European markets. Although this might come as a surprise as European markets are near their multi month highs, the downward pattern finished last week gives rise to some concerns that maybe it is time for the markets to make a correction. These posts should be your alarm in order for bulls to be more cautious as to what could be next. We mentioned last week that we expect the indices that completed the downward 5 wave move to pull back up towards their 61.8% retracements. That would be the point were traders could sell as that was an important resistance and the most possible level for the upward move to end.

DAX has reached the 61.8% retracement at 7740 and pulled back down, only to close with more than 100 points lower. If you followed our analysis, you could have profited those 100 points and more. What is in store next? Support is found at the lows of wave i or 7537 area. If our bearish concern comes true, then we expect prices to reach 7200 at least. Short positions should be covered above wave ii highs or 7738.

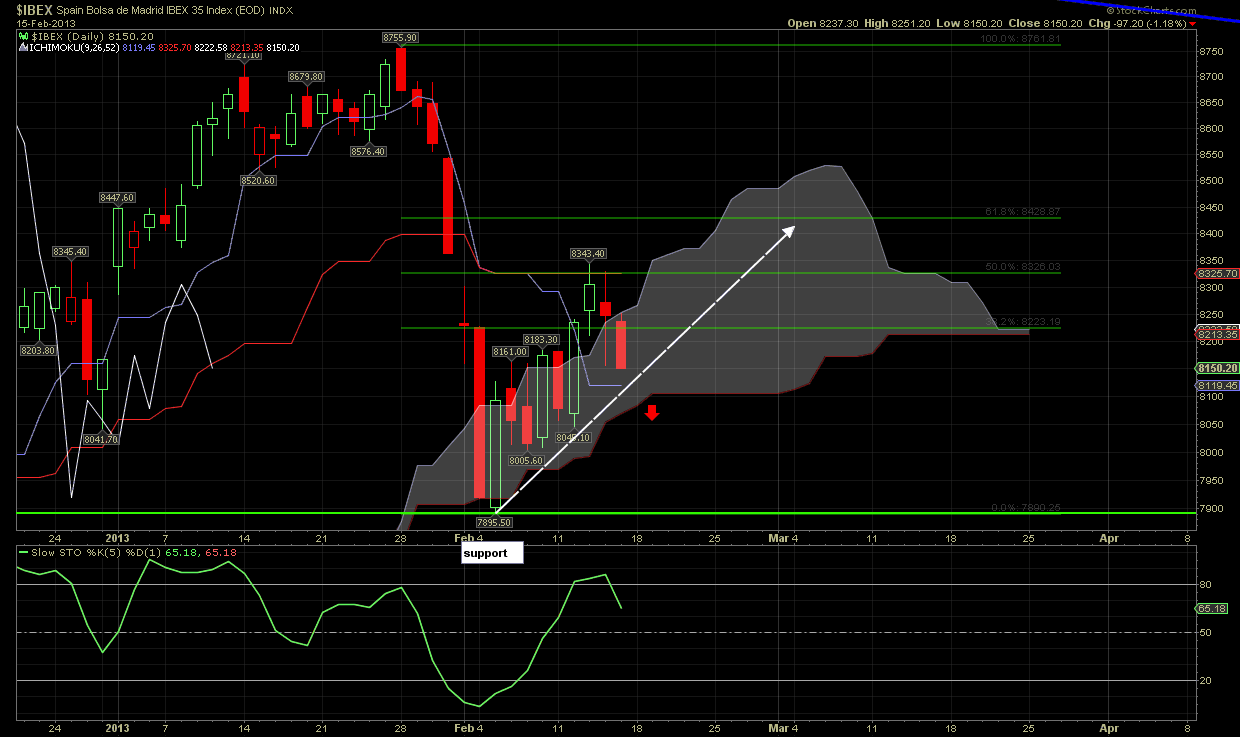

IBEX as shown in the above chart is in a similar position with DAX. The upward move that we expected ended just above the 50% retracement. If you recall our analysis, we would enter short positions either at the 50 and 61,8% retracements or at the making of new lows. In this case IBEX reacted stronger than the Italian MIB (38% retracement) and is now resuming the down move we were expecting. Confirmation will come with lower lows from 7895. Short positions should be covered above 8430 (61,8% retracement).

Concluding we see two major European indices follow the path of our analysis. This means that the correction has started. This scenario has the most probabilities for us. Therefore we should take advantage of it. No short positions allowed above the resistance levels we mentioned. For more info and details on how to trade these indices, become a subscriber and receive our newsletter and our exclusive tweets.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DAX And IBEX Balancing On A Rope

Published 02/17/2013, 11:50 PM

Updated 07/09/2023, 06:31 AM

DAX And IBEX Balancing On A Rope

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.