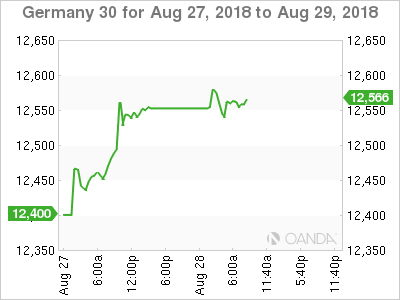

The DAX is steady in the Tuesday session, after starting the week with strong gains. Currently, the index is at 12,556, up 0.14% on the day. In economic news, there are no major eurozone indicators. On Wednesday, Germany releases GfK Consumer Climate.

German automaker shares continue to climb this week, in response to news that the U.S and Mexico have reached a new trade deal. The news has pushed BMW up 2.00%, Daimler 1.19% and Volkswagen (DE:VOWG_p) 1.87%. Under the agreement, 75% of automobile content must be manufactured in North America, up from NAFTA’s current level of 62.5%. European car makers can breathe a sigh of relief, as Mexican plants will continue to manufacture their cars and send them on to the U.S and Canadian markets without the imposition of heavy tariffs. This agreement comes after months of escalating trade tensions, which have shaken global equity markets. The announcement of the US-Mexico deal, which likely will be extended to Canada, has improved risk appetite for equities this week.

There was good news out of Germany on Tuesday, following a strong business confidence report in Germany. The Ifo Business Climate report improved to 103.8, easily beating the estimate of 101.9 points. This marked the first time this year that business confidence has improved, thanks to a strong German economy and a pause in the global trade war. Germany releases inflation and consumer spending data later in the week, and the strength of these readings could determine which direction the DAX takes later this week.

Economic Calendar

Monday (August 27)

- 4:00 German Ifo Business Climate. Estimate 101.9. Actual 103.8

*All release times are DST

*Key events are in bold

DAX, Monday, August 28 at 7:40 DST

Previous Close: 12,538 Open: 12,575 Low: 12,535 High: 12,595 Close: 12,560