This week the world’s biggest gathering of business executives, politicians and thought leaders will commence.

Usually referred to as Davos, The World Economic Forum’s Annual Meeting in Davos begins Thursday. The gathering focuses on a range of economic and social issues, which it has done since 1973 following the collapse of Bretton Woods and the Arab-Israeli war.

The media go crazy for it, often focussing more on the glamour than the outcome, while protestors demonstrate against globalization and environmental issues. But does the world’s biggest powwow actually make any difference?

We can’t comment on poverty rates, CO2 emissions or trade tariffs, but we think our area of expertise -- gold -- is one of the top indicators as to the success of the annual meeting.

It’s not an unreasonable approach to take. After all, the price of gold is the best indicator of confidence in the global economy.

Confidence And The Price Of Gold

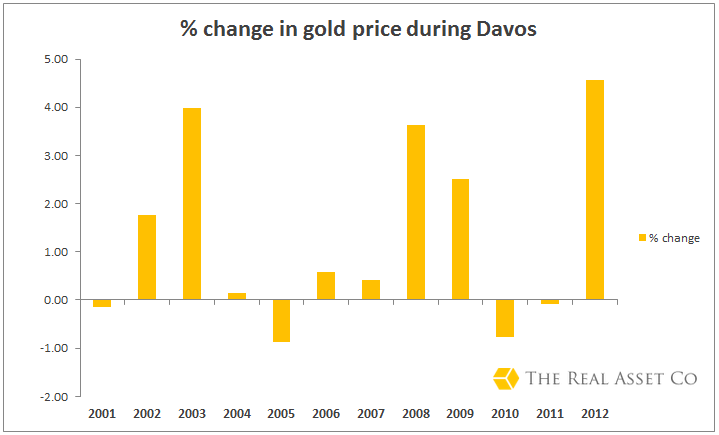

The Real Asset Company decided to look into how gold's price reacts over the course of the meeting. Looking back over gold’s 12-year bull market we looked at the price at the beginning of the gathering then again at the end to see if there was an impact.

The truth is there’s very little difference at all. Considering the gold-price moves we have seen following press conferences from central bankers, which in truth haven’t said much at all, one would think that we would at least see some sort of a change.

What this shows is that the conference has very little impact on confidence in the economy. If it did, then we would see far greater decreases in gold's price, as opposed, say, to the -0.86% we saw back in 2005.

What we do see is that there has been far more increases than decreases in the price of gold over the last 12 years, which suggests that when it comes to the global financial system, the gathering does very little to instil confidence in how the world’s greatest can pull together and find a solution.

Then The Bottom Fell Out

In 2008, just as the severity of the financial crisis was peeling off the scales on everyone’s eyes, gold increased by nearly 4% in less than a week during the Davos gathering. The general feeling at the conference was that government intervention would soften the impact of the events in the preceding year. Economist Nouriel Roubini warned that a “severe recession” could last 12 months saying, this time round the U.S. suffers a protracted pneumonia, and we can only guess what happens in the rest of the world.

In 2009, conference attendees were said to be surprised at the drastically bleaker world outlook than the one they had discussed the previous year. Thanks to the ongoing crisis enveloping Wall Street, few bankers turned out, leaving it to governments to get the show on the road. Once again they failed to restore confidence in the system, resulting in gold’s rise of 2.5% across just five days.

By 2010 bankers began to return to the fold, prompting a less than congenial atmosphere as industry CEOs slammed the financial system and bankers their risky practices. Financial regulation was high on the agenda, but wasn’t enough to reverse the loss of confidence in the markets. Gold declined by less than one percent as it made its way into its ninth year of the metal's runaway bull market.

Biggest Run Yet

For both 2011 and 2012, the euro zone was scapegoated for the gloomy atmosphere, as Jamie Dimon admitted he was fed up with all the blame placed on bankers. Very little change was seen in the gold price over the 2011 meeting, which perhaps suggests that no one paid much attention. 2011 ended with a 10 billion euro bailout for Greece, which meant 2012 was particularly sombre, with the mood not helped by the presence of the Occupy Movement. As world leaders acknowledged that the crisis was not ‘solvable’ overnight, gold saw its biggest Davos climb in this bull-run.

One has to ask whether if all the discussion and great thoughts being exchanged can’t boost confidence in how the global economy is managed, then what can?

Usually referred to as Davos, The World Economic Forum’s Annual Meeting in Davos begins Thursday. The gathering focuses on a range of economic and social issues, which it has done since 1973 following the collapse of Bretton Woods and the Arab-Israeli war.

The media go crazy for it, often focussing more on the glamour than the outcome, while protestors demonstrate against globalization and environmental issues. But does the world’s biggest powwow actually make any difference?

We can’t comment on poverty rates, CO2 emissions or trade tariffs, but we think our area of expertise -- gold -- is one of the top indicators as to the success of the annual meeting.

It’s not an unreasonable approach to take. After all, the price of gold is the best indicator of confidence in the global economy.

Confidence And The Price Of Gold

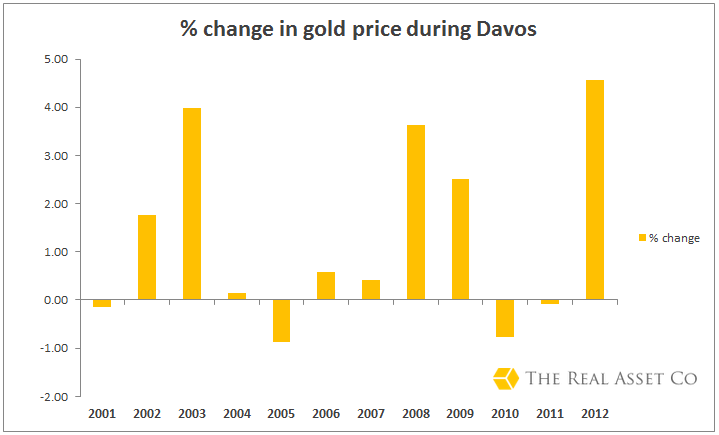

The Real Asset Company decided to look into how gold's price reacts over the course of the meeting. Looking back over gold’s 12-year bull market we looked at the price at the beginning of the gathering then again at the end to see if there was an impact.

The truth is there’s very little difference at all. Considering the gold-price moves we have seen following press conferences from central bankers, which in truth haven’t said much at all, one would think that we would at least see some sort of a change.

What this shows is that the conference has very little impact on confidence in the economy. If it did, then we would see far greater decreases in gold's price, as opposed, say, to the -0.86% we saw back in 2005.

What we do see is that there has been far more increases than decreases in the price of gold over the last 12 years, which suggests that when it comes to the global financial system, the gathering does very little to instil confidence in how the world’s greatest can pull together and find a solution.

Then The Bottom Fell Out

In 2008, just as the severity of the financial crisis was peeling off the scales on everyone’s eyes, gold increased by nearly 4% in less than a week during the Davos gathering. The general feeling at the conference was that government intervention would soften the impact of the events in the preceding year. Economist Nouriel Roubini warned that a “severe recession” could last 12 months saying, this time round the U.S. suffers a protracted pneumonia, and we can only guess what happens in the rest of the world.

In 2009, conference attendees were said to be surprised at the drastically bleaker world outlook than the one they had discussed the previous year. Thanks to the ongoing crisis enveloping Wall Street, few bankers turned out, leaving it to governments to get the show on the road. Once again they failed to restore confidence in the system, resulting in gold’s rise of 2.5% across just five days.

By 2010 bankers began to return to the fold, prompting a less than congenial atmosphere as industry CEOs slammed the financial system and bankers their risky practices. Financial regulation was high on the agenda, but wasn’t enough to reverse the loss of confidence in the markets. Gold declined by less than one percent as it made its way into its ninth year of the metal's runaway bull market.

Biggest Run Yet

For both 2011 and 2012, the euro zone was scapegoated for the gloomy atmosphere, as Jamie Dimon admitted he was fed up with all the blame placed on bankers. Very little change was seen in the gold price over the 2011 meeting, which perhaps suggests that no one paid much attention. 2011 ended with a 10 billion euro bailout for Greece, which meant 2012 was particularly sombre, with the mood not helped by the presence of the Occupy Movement. As world leaders acknowledged that the crisis was not ‘solvable’ overnight, gold saw its biggest Davos climb in this bull-run.

One has to ask whether if all the discussion and great thoughts being exchanged can’t boost confidence in how the global economy is managed, then what can?