The odds of peace talks between Russia and Ukraine remain far off, or so the latest comments from a high-level Russian official suggest. Ukrainian President Volodymyr Zelensky’s demand that Russia withdraw all troops from Ukraine’s borders is “idiocy,” says Dmitry Medvedev, deputy chairman of the Russian Security Council.

Russia and China vetoed a US-drafted United Nations Security Council resolution to strengthen sanctions on North Korea. The vote follows more than a dozen North Korean ballistic missile tests this year, which violated previous UN resolutions.

Global equity funds report biggest inflows in 10 weeks, led by US shares. Roughly $20 billion flowed into global stocks during the week through May 25, led by investments to the US, according to Bank of America via data supplied by EPFR Global.

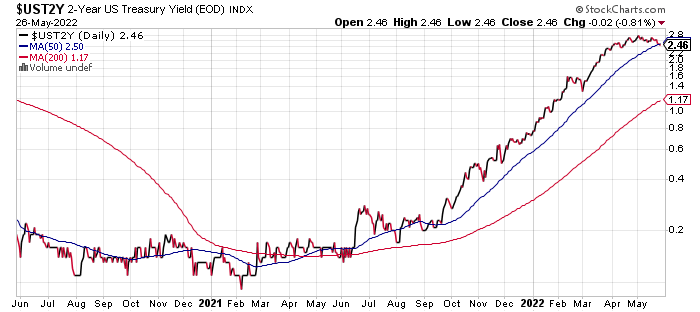

Policy-sensitive 2-year Treasury yield slips to 5-week low:

US Dollar Index continues retreating in early trading on Friday morning (NY time), trading at the lowest level in a month:

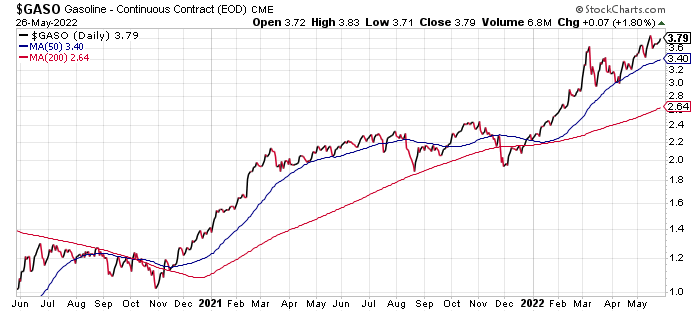

US gasoline prices trading near record high. To combat the price surge Biden is considering putting limits on gasoline exports. Meanwhile, there are signs that demand for gasoline is sliding.

The US housing market appears to be slowing, but Zillow’s forecast remains bullish for the sector.

The real estate data firm advises that:

“Zillow’s housing market outlook has been revised down from April” but the company “forecasts 11.6% home value growth over the next 12 months (May 2022-April 2023).”

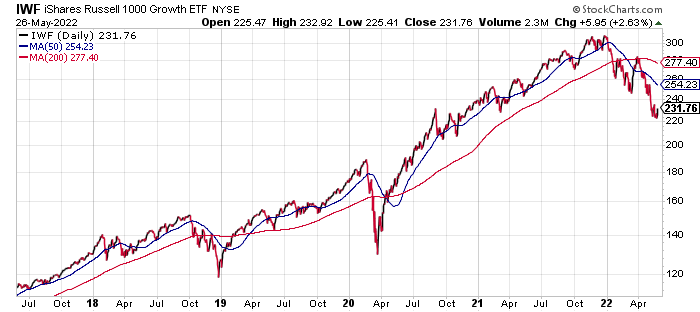

Investment firm GMO expects more pain for growth stocks. This slice of the equities market is expected to slide until “a full unwinding of the growth bubble occurs,” predicts Ben Inker, co-head of GMO’s Asset Allocation team.

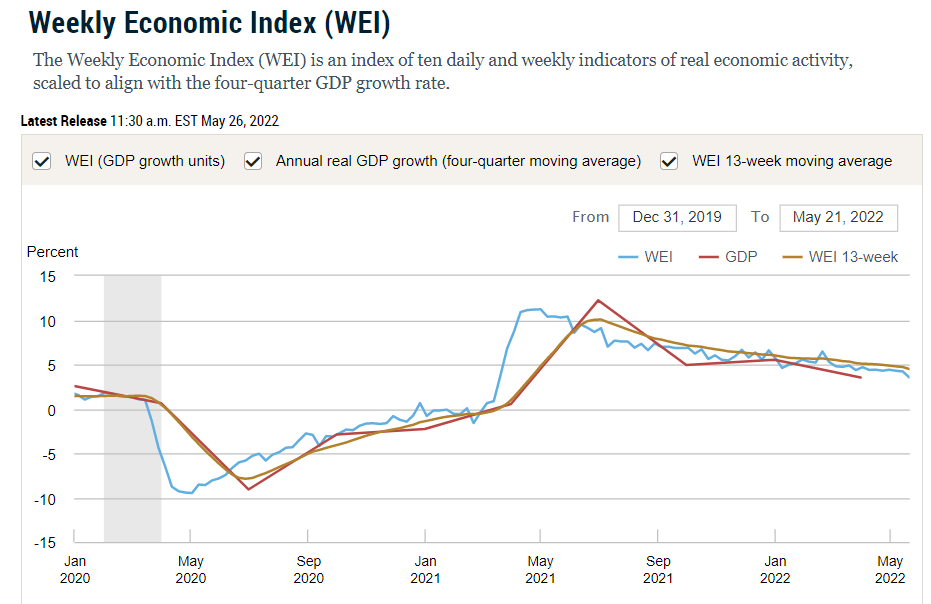

NY Fed Weekly Economic Index (WEI) continues to indicate slowing US growth but no sign of recession for near-term horizon.

But the deceleration rolls on as WEI eased to its lowest reading in more than a year for the week through May 21: