Next week is going to be full of data in the United States. Meanwhile, it will be interesting to see how the political negotiations on the upward review of the debt ceiling will begin to develop, but also the evolution of one of the parameters that the Fed has set in its sights on its monetary policy, which is inflation. On January 15, we will know the producer prices (the retail sales on the same day) and on January 16, the consumer prices too. Both parameters suffered a loss in November, or a symptom of deflation, something the Fed wants avoid at all costs. Also, on January 16, the U.S. will release data on net purchases of foreign securities (TIC) and the industrial production in December. Finally, on January 17, attention to the Phily Fed and on January 18, consumer confidence.

Opportunities In the UK

If the euro zone economic data offer a few ideas (it starts with the industrial production on January 14 and then, on January 16, inflation), Great Britain will attract the attention of all traders. On January 15, the numbers of producer prices and inflation will be released while on January 18 retail sales.

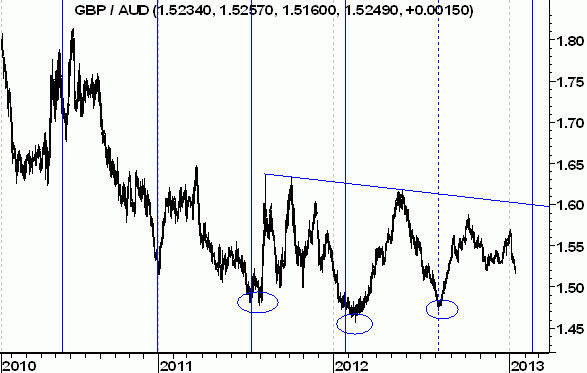

On the GBP/AUD cross, the last session correction has created an interesting buying opportunity. At this point, the cyclic deadline at 140 days that has been able to intercept precisely the primary bottoms of GBP/AUD is approaching. Furthermore, considering the potential formation of a bullish head and shoulder, we think that entering long on these levels is not so risky.

USD/ZAR, The Volatility Barometer

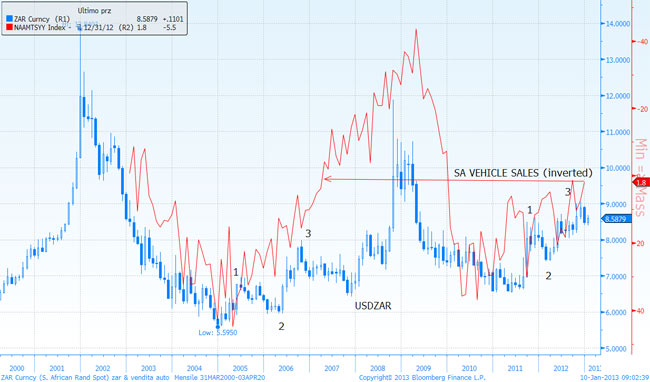

It is the fifth element of the so-called BRICs, but South Africa, with its own currency, the Rand, always offers many volatility opportunities to traders. In the coming week, January 16 will be a basic day for USD/ZAR, as the business confidence index (Kagiso) will be released, together with retail sales, coming back from the previous month -1.7%. But there is another indicator, the sale of vehicles released last week, which makes us not so optimistic on the Rand and that urges us to be bullish on USD/ZAR during the next few weeks. As we can see from the chart, the correlation between vehicle sales and USD/ZAR is very high and the current dynamic of the macroeconomic data (here of reverse scale) seems to be very similar to the one in 2006, when the percentage change became negative. As long as there are no signs of improvement on this front, we will remain bullish on USD/ZAR.

BRICs

Coming week full of data for the other components of the BRICs too.

China: Gdp, industrial production and retail sales on January 18

India: Inflation on January 14

Brazil: Retail sales on January 15

Last Trades: Comment

The long entry of EUR/USD in area 1.30 is proving to be perfect and now the short oscillators near the oversold should allow EurUsd to head towards 1.349. At the moment, the short indication on USD/JPY is not so lucky, but we believe that the excess of pessimism about JPY will soon feel its effects in a contrary optics. The reaction of XAU/USD, repositioned above 1650, is positive and EUR/TRY is back close to our entry level.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Data Dates To Come

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.