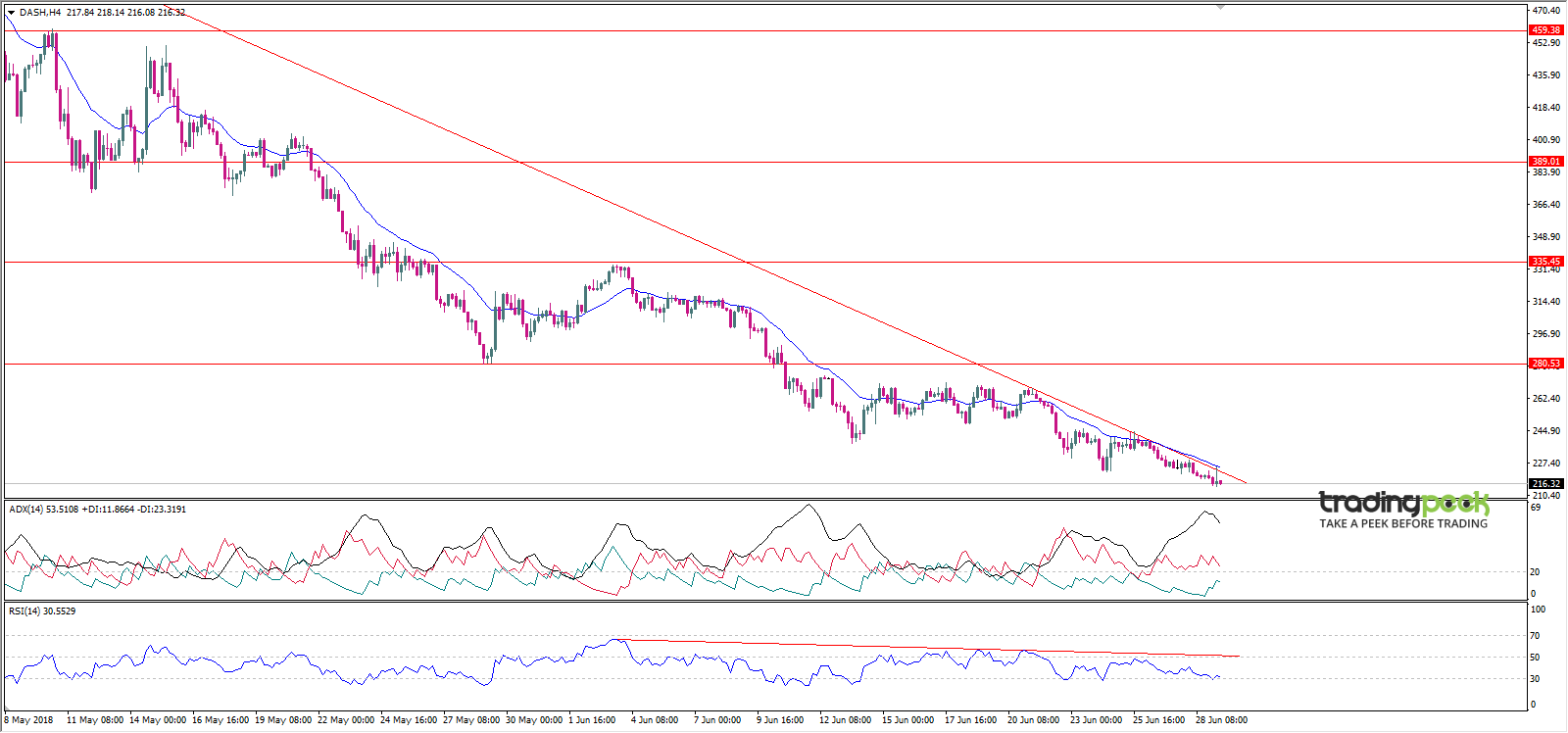

Dash against USD broke during the morning trading yesterday the bottom area of $ 223.16 on the 4-hour interval as a result of the sellers pressure on the encrypted currency.

Dash is trading in a bearish direction so far, and this trend suffers from weakness as a result of decreasing the bear's determination in the digital currency. Therefore, we do not recommend rushing to open positions today.

The exponential moving average 21 is currently bearish.

Momentum RSI 14 is trading in a bearish direction and we also notice from its analysis weakness of momentum and decreasing strength of sellers.

Outlook:It is expected that, in the case of breaking the electronic currency levels of $ 215.14 may target areas of $ 205.40.

On the other hand, if a breach of $ 230.00 might target $ 262.52.

Support: 205.40 - 178.99- 126.77

Resistance: 280.53 - 335.45 - 389.01

Trend: Down