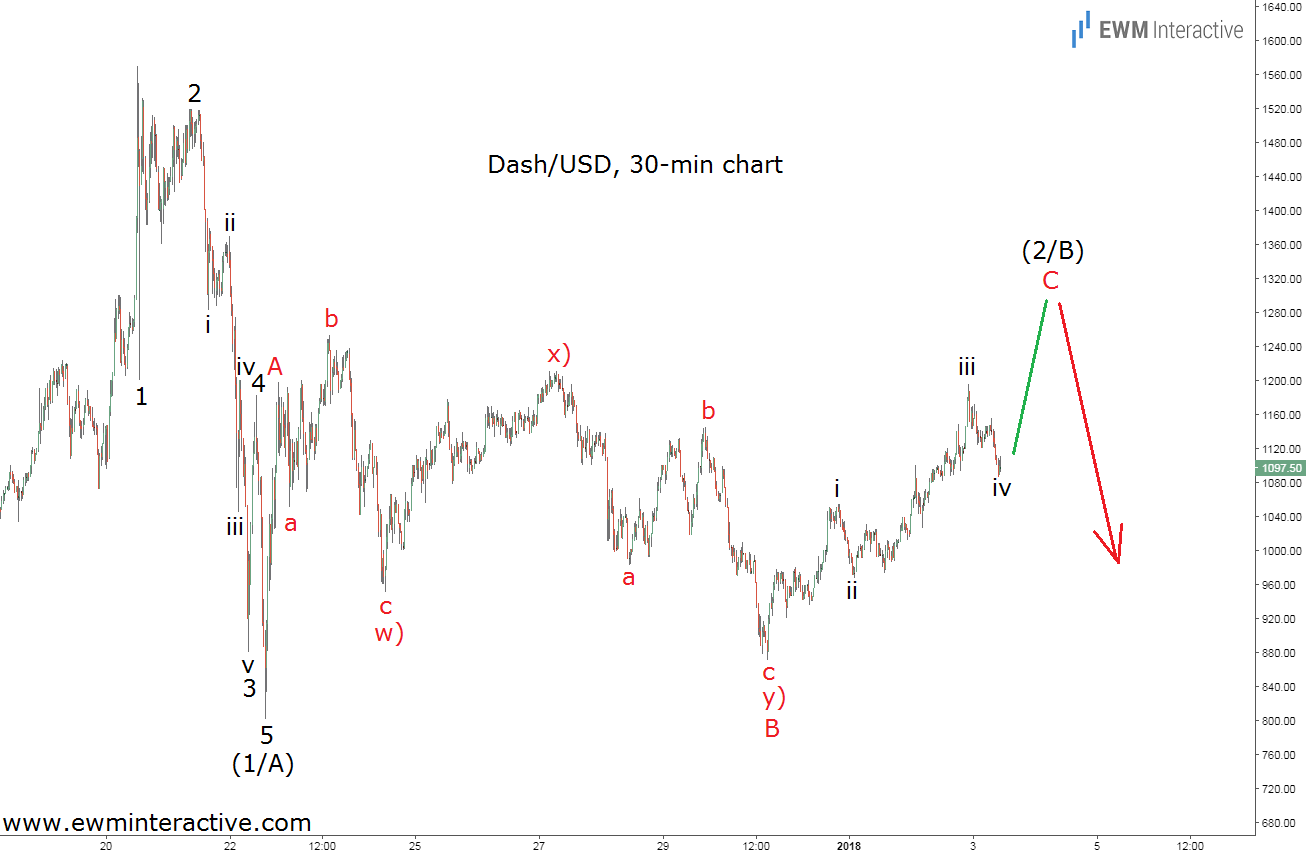

Similarly to most other cryptocurrencies, Dash had an amazing 2017, climbing to as high as $1569 in December. However, the second half of last month was not that good, after DSH/USD fell by nearly 49% to $801 per coin by December 22nd and still has not been able to fully recover. As the tenth largest virtual currency trades slightly above the $1100 mark, let’s see what the recent developments mean in the context of the Elliott Wave Principle on the 30-minute chart below.

The 30-minute chart gives us an insight into the wave structure of the selloff to $801 and the following recovery to $1253. As visible, the crash from $1569 could be seen as a five-wave impulse, whose wave 3 is extended. Since every impulse is followed by a three-wave correction, the current rally is not surprising. It appears to be a simple A-B-C zig-zag, whose wave B is a corrective combination between an expanding flat correction in wave w) and a simple zig-zag in wave y).

If this count is correct, wave C to the upside is currently under construction. We could expect a new swing high in wave “v” of C of (2/B) to lift Dash prices to the $1300 level. Once there, the 5-3 wave cycle would be complete and the trend should resume in the direction of the five-wave sequence. In other words, at least in the short-term, Dash bears remain in charge, as long as DSHUSD trades below $1569.