Darden Restaurants, Inc. (NYSE:DRI) is one of the largest casual dining restaurant operators worldwide. The company is on a growth trajectory, gathering momentum from Cheddar's acquisition, various sales boosting initiatives.

Darden posted better-than-expected second-quarter fiscal 2018 results with both earnings and revenues surpassing the Zacks Consensus Estimate. In fact, this quarter marked the 12th consecutive earnings beat for Darden.

Notably, the company has beaten the Zacks Consensus Estimate in each of the trailing four quarters, delivering an average positive surprise of 2.97%. In the past 30 days, the Zacks Consensus Estimate for the fiscal third quarter has increased $1.46 to $1.50.

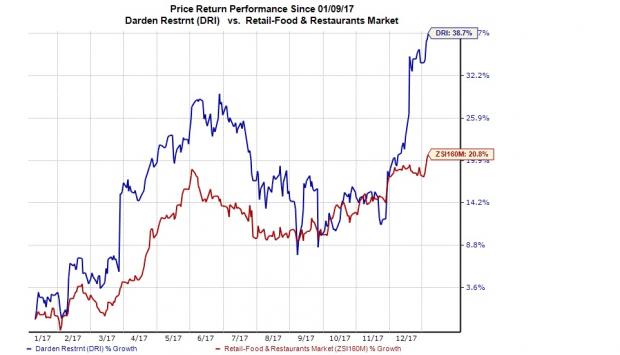

Shares of Darden have gained 38.7% year to date, significantly outperforming the industry’s 20.8% rally.

Cheddar's Acquisition Drives Top Line

Darden’s acquisition of small restaurant chain, Cheddar's Scratch Kitchen (Cheddar's), in April 2017 added an undisputed casual dining value to the company’s portfolio of differentiated brands. It also helped Darden to further enhance its scale.

In the fiscal second quarter, total sales were favored by the addition of 153 Cheddar’s and 28 other new restaurants. Total sales increased 14.6% driven by 11.5% growth from these additions. Segmental sales also improved owing to Cheddar’s integration in the other business segment.

Darden Restaurants, Inc. Revenue (TTM)

Apart from making good progress with the integration of Cheddar’s, the company seems to gain more confidence of its outcome. In fact, management expects to realize synergies in the range of $22 million to $27 million by the end of fiscal 2019. This year, Darden plans to make significant non-guest facing changes, which is expected to have an impact on restaurant level execution.

Brand Renaissance Plan for Olive Garden Boosts Comps

The company implemented a set of initiatives under its Brand Renaissance Plan to boost the performance of the Olive Garden brand. These include simplifying kitchen systems, improving sales planning and scheduling, operational excellence to improve guest experience, developing new core menu items, allowing customization and making smarter promotional investments.

Also, the brand is focusing on remodeling and bar refreshes. The revamped restaurants are already generating high same-restaurant sales and returns. In fact, the remodeling program gained momentum in the last couple of quarters and the company intends to continue investing in re-modeling for optimal returns. In fact, supported by these initiatives, Olive Garden posted the 13th consecutive quarter of positive comps in second-quarter fiscal 2018.

Meanwhile, the company is also focusing on technology-driven initiatives, like the system wide rollout of tablets in order to capitalize on the digital wave that has hit the U.S. fast casual restaurant sector. Olive Garden’s To Go business, which offers online ordering at selected locations, is also growing rapidly (increasing 12% year over year in the fiscal second quarter). The company has also launched catering in the United States, which is expected to add to its top line.

LongHorn to Attract More Guests

At LongHorn, the company strives to attract its guests by focusing on core menu, culinary innovation and providing regional flavors. It is also working on its marketing strategy to improve execution; customer relationship management and digital advertising as well as promotional pipeline that leverages the segment’s expertise.

Further, the company continues to focus on strengthening its in-restaurant execution through strategic investments in quality and simplification of operations in order to augment the guest experience. Owing to these efforts, segment comps have grown for the past 19 consecutive quarters.

Zacks Rank and Stocks to Consider

Darden carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks in the same space are Famous Dave's of America, Inc. (NASDAQ:DAVE) , McDonald's (NYSE:MCD) and Domino's Pizza, Inc. (NYSE:DPZ) . While Famous Dave's sports a Zacks Rank #1 (Strong Buy), McDonald's and Domino's carry a Zacks Rank #2.

McDonald's and Domino’s earnings in 2018 are expected to improve 8.9% and 23.5%, respectively. Fourth quarter 2017 earnings for Famous Dave's is estimated to grow 70%.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Famous Dave's of America, Inc. (DAVE): Free Stock Analysis Report

Original post

Zacks Investment Research