For this issue of Danske's FX Thermometer , clients were asked: (1) rate your central bank's performance, (2) should the Fed, in your opinion, cut rates this year? and (3) do you expect the Riksbank to hike this year? In addition, they gave their three-month (10 September) forecasts on EUR/SEK, EUR/NOK and EUR/USD.

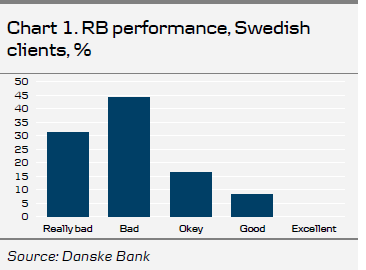

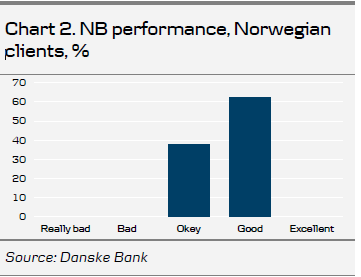

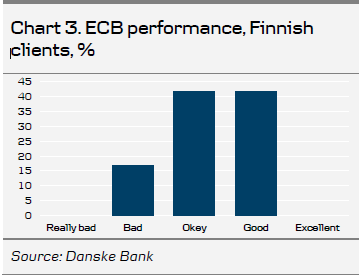

Rate your central bank. Clients were asked to rate how their central banks have conducted monetary policy in the past years on a scale of 1 to 5, where 1 is " Really bad" and 5 is " Excellent" . Swedish clients are clearly dissatisfied with the Riksbank. The vast majority rated the bank as either " Bad" (44%) or " Really bad" (31%). The Riksbank got an overall rating of 2.0 . Notably, the strong discontent is widely spread across sectors, and applies to importers, exporters and financial institutions. Norwegian clients are much more satisfied with how their central bank has conducted monetary policy. Norges Bank got an average rating of 3.6 , where 37% rated it as " Okay" and 63% as "Good" . The ECB got an overall rating of 3.3 , which shows that Finnish clients are almost as happy with their central bank as the Norwegians are, where 83% rated the bank as either "Okay" or "Good" . No client gave their central bank the highest rating, "Excellent" . Hence, Norges Bank is ranked number one, the ECB is ranked number two and the Riksbank is way behind and ranked number three in terms of how it has conducted monetary policy in the past couple of years. The results are summarised in the charts below.

Should the Fed cut this year? While the market is pricing in c.60bp of rate cuts this year, only a slim majority of 52% consider it wise - and this is a normative question - that the Fed should go ahead and cut rates. Norwegians are a bit more hawkish on the Fed than the Nordic average is, as only 37% think that the Fed should cut.

Do you expect a Riksbank hike this year? 17% of the respondents expect a hike this year (in March, that number was 57%, while a few even expected two hikes back then). Hence, there has been a clear shift in only a few months, which is not unreasonable given the Riksbank's dovish message in April, when rate hikes were delayed. Danske Bank does not expect any hikes this year.

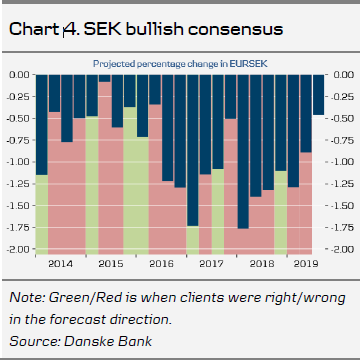

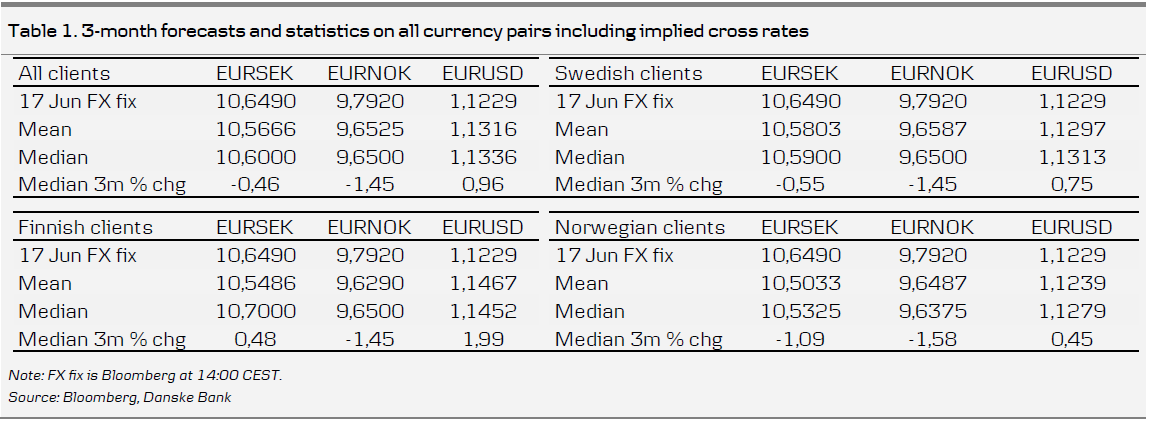

EUR/SEK? Clients have become less bullish on the SEK, although they still forecast a lower EUR/SEK, at 10.60. This is the smallest (0.5%) projected SEK appreciation in three years, see SEK bullish consensus on the next page. Finnish clients stand out, expecting the krona to weaken in 3M (NYSE:MMM). Danske Bank sees EUR/SEK at 10.80 in 3M.

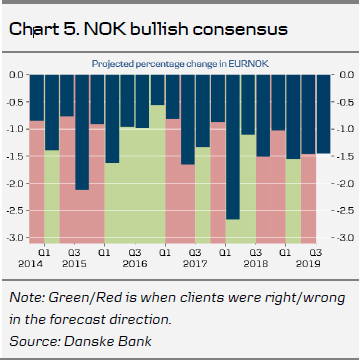

EUR/NOK? Bloomberg consensus is still expecting a stronger NOK, where clients on average see a 1.5% drop in EUR/NOK, to 9.65. Norwegians are only slightly more bullish on the NOK than the rest. Danske Bank sees EUR/NOK at 9.60 in 3M.

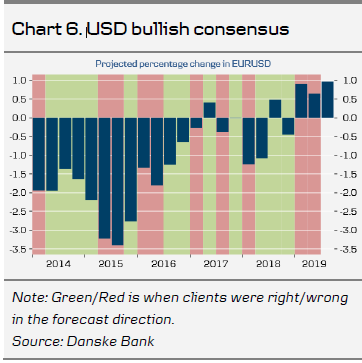

EUR/USD? For the third consecutive quarter, clients are bullish on EUR/USD. The median forecast is 1.1336, a 1% appreciation of the euro in 3M. Here, we find a strong home bias, where Finnish clients are more bullish on the EUR than non-Finnish clients. The median Finn has EUR/USD at 1.1452, 2% higher. Danske Bank is even more bullish, seeing the cross at 1.15 in 3M.

Previous survey

In the 26 March survey, we asked our clients for three-month (by 17 June, 14:00 CEST fix) forecasts on EUR/SEK, EUR/NOK and EUR/USD. EUR/SEK was expected to drop to 10.35 from 10.44, but instead it rose to 10.649. Fredrik Janson (Robur), Carl-Johan Axsäter (Robur), Jyrki Lalla (Hintsa Performance) and Tuomas Gynther (Ilmarinen) were close(est) at 10.65. EUR/NOK was expected to drop to 9.5150 from 9.66, but instead it rose to 9.792. Patrik Fors (Jaguarverken) had the best forecast at 9.80. EUR/USD was expected to rise to 1.139 from 1.132, but instead it dropped to 1.12285. Morten Lertrø (WW Holding ASA) had the best forecast at 1.1235. Congratulations to all of you – well done.