Market movers today

In the US focus today is on the US Michigan consumer sentiment indicator, which will give us more details about the activity in the US service sector and private consumption growth on the back of the mixed signals we received from the strong ISM non-manufacturing and weak PMI services print, respectively.

The day will also give us details about how hard the Chinese export sector has been hit by the trade war with the US and the global slowdown from the trade balance figures for October. We expect exports to still look soft but not as weak as in the beginning of 2019. Markets will also keep a close eye on any trade headlines.

In Sweden, the September consumption indicator is due out, giving us more clues about where Q3 GDP growth is going to print.

Selected market news

Risk appetite amid 'good news' regarding trade talks has infused optimism to stock markets and was the key driver for both FX and fixed income markets yesterday.

There was a significant sell-off in the European and US fixed income markets and 10Y German government bond yields have now risen almost 50bp from the low levels seen in August, while the 2Y German government bond has risen some 30bp since August. This is despite the ECB cutting rates and introducing QE between August and now.

In the FX-markets the SEK, CAD, AUD and NZD have been winners over the past month in the equity rally amid market hopes of a cyclical turn but over the last week strong Norwegian data alongside higher gas and oil prices have brought the NOK into the good company. On the other hand, the JPY and CHF have underperformed.

Scandi markets

In Sweden, focus is on the meeting of the general council of the Riksbank at 1pm, where they might announce who will be Jochninck's successor.

In Denmark, we have received the final details regarding the upcoming non-callable mortgage auction in late November as Realkredit Danmark yesterday published its auction supply for the upcoming refinancing auctions of non-callable bullets starting 20 November.

The final amount sees a total supply of DKK27.1bn in 1y bonds, DKK4.5bn in 3y bonds and finally DKK5.6bn in 5y bonds. The relatively low supply of 5y bonds is due to in part low refinancing rates from borrowers moving further out the curve due to the historically low cost of doing so and remortgaging of subsidized social housing loans, which will continue to be a supporting factor for the segment for the upcoming three years. Apart from the DKK supply the mortgage banks will auction EUR900m in 1y-5y EUR-denominated bonds and Nykredit will auction DKK20bn in 4-5y floaters. The total liquidity surplus (maturing amount relative to auctioned) is at DKK30bn and as such we expect good demand at the auctions, not at least following the recent steepening 2s5s. For more see: Strategy Denmark: Low supply at the November auction of non-callables, 7 November.

Fixed income markets

Significant sell-off in the European and US fixed income markets on the back of an expected trade deal between China and the US. 10-Y German government bond yields have now risen almost 50bp from the low levels seen in August, while the 2-Y German government bond has risen some 30bp since August. The trade deal does bring optimism back to the risk asset as e.g. 10Y Italy has only risen some 35bp. Furthermore, the 10Y spread between Greece and Italy is now close to being flat and Greece is still not investment grade.

The rise in yields does bring back some memories of the sell-off in spring 2015, when Bund yields rose some 100bp within a month without any strong fundamental explanation.

However, this time we do have an ‘explanation’ given the possible trade deal between China and the US as well as some form of Brexit deal. Furthermore, even though both the ECB and the Federal Reserve have cut rates, both of them seem to be on hold for now. However, the macroeconomic data are still gloomy for the European economy and not that solid for the US economy, so the stimulus from expansive monetary policy is still needed.

Hence, we still need to see rates remain low for a long time.

FX markets

Risk appetite amid ‘good news’ regarding trade talks has infused optimism to stock markets and was indeed the key driver in FX markets yesterday. USD took its cue from an uptick in notably 2Y rates in a sign that the dominating effect from a possible tariff roll-back is mainly the unwinding of the negative effect this has had on the US economy and on Fed policy (rate cuts). As such, the possible USD negatives stemming from a risk rally (i.e. move away from the safe havens) and/or unwinding of the ‘dollar shield’ that tariffs have provided have not been able to overshadow the upward move in US rates. Over the past month, not least SEK, CAD, AUD and NZD have been winners in the equity rally amid market hopes of a cyclical turn but over the last week strong Norwegian data alongside higher gas and oil prices have brought the NOK into the good company. On the other hand, JPY and CHF have underperformed.

If the latest trade optimism prevails, both the NOK and the SEK could strengthen further. The SEK has also been supported in anticipation of a Riksbank December hike, which would take the repo rate away from negative territory. Yesterday, we saw a break of 200D moving average in EUR/SEK, which may open for further SEK gains in the near term with 10.60 being the next immediate support. If the cross breaks below that level, the multi-year trend of higher and higher lows is broken and the market may then aim for 10.50. That said, in our view, the cyclical outlook in Sweden and globally and monetary policy beyond December, remain important strategic headwinds for the krona. In Reading the Markets Sweden we discuss the outlook for the krona in more detail. On the NOK, we still pencil in more upside as the domestic economy remains strong, Norges Bank seems underpriced in rates markets and as the recent improvement in Norway’s terms of trade supports Norwegian equities.

EUR/DKK rose to new 2019 high yesterday and thus above the level which triggered FX intervention by Danmark’s Nationalbank (DN) in October. The pair gained support from the rise in EUR bond yields and a still wide discount in FX forwards. Overall, we look for the pair to continue to trade at elevated level, since DN seems in no hurry to reverse the weakening trend. Near-term, we will monitor equity market performance. An extended rally after today’s positive trade news could provide some much needed DKK support.

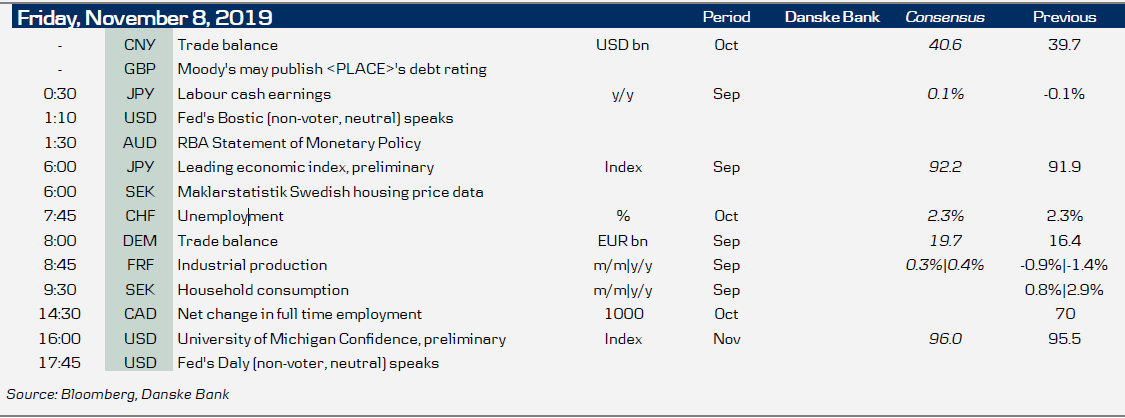

Key figures and events