Market movers today

- After a very hectic day yesterday with key central bank meetings and releases, we are looking for a quieter day on the data release front.

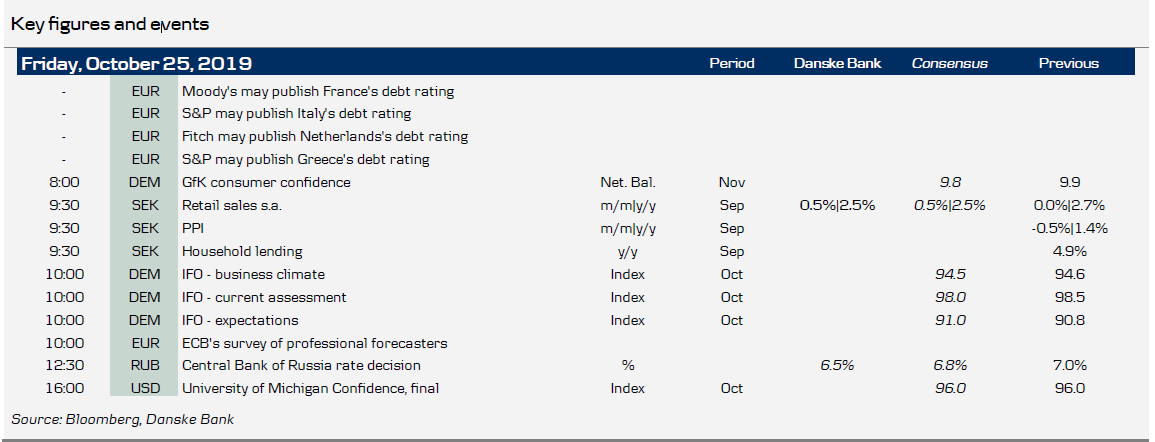

- In the euro area, we get the German Ifo print today. We are looking out for whether the latest stabilisation in the current business climate has continued and if the expectation component has fallen further.

- On the Brexit saga, the EU ambassadors are expected to grant the UK a three-month extension of Article 50, making room for the UK to likely hold parliamentary elections on 12 December if two-thirds of the UK parliament support the Johnson government's motion on Monday.

- Today Bank of Russia (CBR) will hold its monetary policy meeting. We expect a 50bp cut to the key rate, while Bloomberg and Reuters consensus expect a 25bp cut. This time all major factors support a firm cut and a further 25bp cut in December 2019: the RUB has stabilised on comfortable oil price levels, which has put Russia's headline inflation back to the 4% CBR target.

Selected market news

Yesterday the Riksbank took us, and the clear majority of forecasters, by surprise by not only keeping the short end of the rate path unchanged but also clearly indicating that rates will be hiked to zero in December, regardless of the MPR highlighting the weaker growth outlook and the global uncertainty. It turned out that ending negative rates is a goal in itself for the Riksbank, in a sense switching from inflation to rate targeting, for more discussion see our take here . The rate path was lowered after the December hike. It now points to a policy rate at zero for an extended period of time. Meanwhile, not much news to report from the small Norges Bank meeting. We stick to the view that the policy rate will be lifted once again in March next year.

Yesterday, the ECB meeting did not provide many new signals. The most important piece of news was Draghi indicating that ISIN limits are self-imposed, implicitly suggesting that they can be eased if there is a need to expand the eligible pool of securities that can be bought under the QE programme, for more details see our review here .

The US Markit PMI manufacturing rose slightly to 51.5 in October from 51.1 the month before, while the service part was more or less unchanged. However, the employment index dropped further and now signals job growth of just 50,000 next week. Overall the PMI points to relatively subdued GDP growth in early Q4 and supports our call that the Fed will cut rates at its weekend next week, see FOMC preview -Divided Fed is likely to cut again without pre-commitment , published this morning.

Yesterday, China signalled that it is willing to purchase USD20bn of US farm goods in a year if the two sides sign a partial trade deal (phase one) over the next month. Furthermore, it signalled that additional purchases could be considered in the case of future (phase two), see here .

Scandi markets

We get retail sales number for September, which we expect to have grown2.5% y/y.

Fixed income markets

As discussed on the first page, we had to look carefully to find anything new from Draghi at his last public appearance as head of ECB. His message that ISIN limits are self-imposed also suggests that the limits could be changed at its discretion. The ECB does not see any restrictions arising on bond purchases for 'quite a bit of time' (there are 'reasonable assumptions' behind the calculations, Draghi underlined). All things equal, this supports our view of further spread compression in semi-core and periphery versus core. Today we get the ECB inflation survey of professional forecasters. Especially the latter is interesting in light of the market inflation expectation still being much muted with 5y5y at 1.20%. We see a risk that the report shows lower inflation expectations.

On the back of the Riksbank meeting yesterday, especially, the front-end of the curve sold off and a December hike is now priced with a relatively high probability. However, also the long end underperformed adding to the underperformance from Wednesday, when SGB supply in 2020 was lifted by the Debt Office. Still, the curve clearly bear flattened 2s5s and 2s10s.

Italian bonds performed yesterday as Draghi underlined flexibility in respect of ISIN limits (more buying in periphery) and as the head of the Italian Debt Office said that bond supply next year would be in line with this year. He also stressed the good demand at the 8Y BTP Italia sold this week. Italy is up for rating review by Standard & Poor’s tonight. We expect (1) lower political uncertainty after Salvini is gone, (2) a low risk of a budget stand-off with the EU Commission as also Moody’s pointed out this week and (3) significant lower funding rates for Italy to trigger a change of the current ‘negative outlook’ to ‘neutral outlook’ by Standard & Poor’s. We even see a small chance of a positive outlook tonight. We remain long 10-Y BTP versus Bunds for a 120bp target.

FX markets

On the back of the Riksbank meeting discussed on page 1, the SEK strengthened initially on the news, rightfully so. However, the clear indication of an upcoming December hike was accompanied by a veritable slash of the path further out, which now consists of a horizontal line out until end 2022. Thus, even though a hike is pencilled in, further out policy is now actually more accommodative than previously indicated. This might be at least part of the explanation as to why EUR/SEK rebounded after the initial sell-off and actually closed unchanged on the day. Given this longer-term policy guidance, our still rather downbeat view of Swedish fundamentals, and lingering global political and economic uncertainty, we believe it is too early to call for a turnaround in the SEK. Hence, we are still comfortable with our general forecast profile for EUR/SEK, even though this setback to our Riksbank call could possibly entail a level shift in the trajectory.

After the Norges Bank came with a practically unchanged policy message, EUR/NOK did not react much compared with the sell-off after the Riksbank. Fundamentally, we believe the latest NOK weakness has gone too far but we acknowledge that there are few imminent triggers for a turnaround and stay side-lined in NOK FX for now.

ECB did not rock the EUR boat much, but crucially for majors UK political uncertainty flared up again yesterday after UK PM Johnson called for the opposition to support a general election, and both GBP and to some extent EUR crosses suffered as a result. Tail risk for a no-deal event remains substantially smaller than just a few weeks back but prolonged uncertainty about a final Brexit date is likely to (continue to) weigh on the economy, on rates and possibly on GBP in turn. We hold a forecast of 0.875 in EUR/GBP and thus see some downside for sterling from here.

Yesterday, the Turkish central bank cut its policy rate by 250bp, a far bigger cut than expected by us and Bloomberg consensus of a 100bp. We think that the bigger cut was made possible by the end of military operation in Syrita, which caused Trump to revoke anti-Turkish sanctions, supporting the TRY. The TRY weakened a touch after the cut, but that is not a fundamental factor—the carry appeal is still there and rate cut will help economy further. We see another cut in December 2019 as highly likely given that further disinflation is expected.