Market movers today

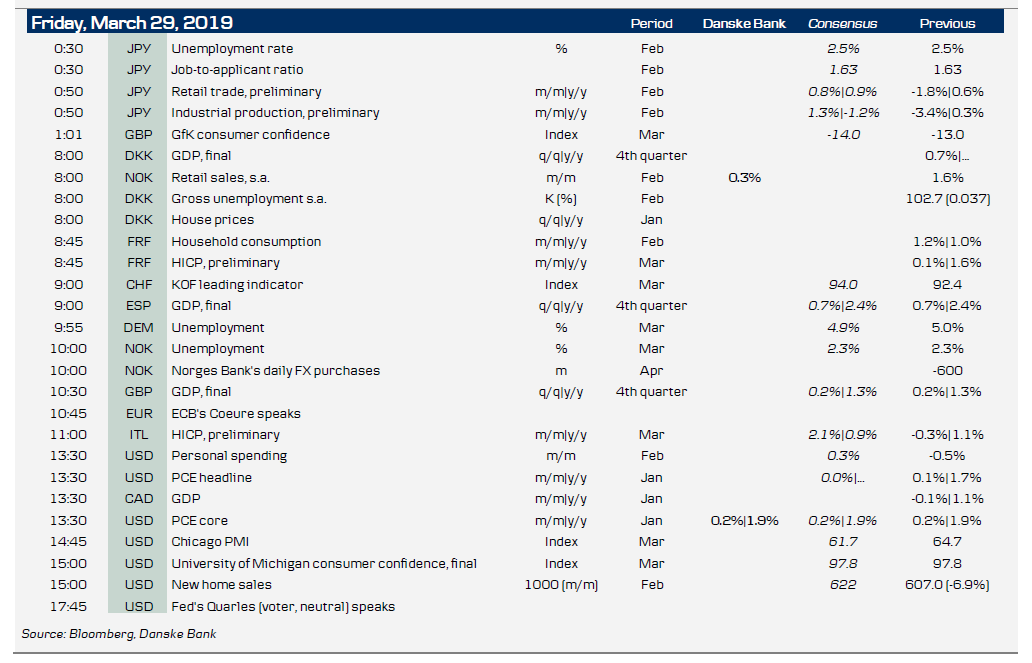

Today we get a lot of important numbers in Scandi, the US and Japan. Brexit will also draw attention with today's vote at 15:30 CET on the withdrawal agreement without the political declaration. We expect the withdrawal agreement to be voted down again and the question remains; how does the EU react to this?

The US PCE headline and core inflation numbers for January are due today and we expect the core print at 0.2% m/m and unchanged at 1.9% y/y, just below the Fed's 2% target.

In Norway, we also get labour market figures and we expect (seasonally adjusted) NAV unemployment for March to be unchanged at 2.3%. This report is more important than the LFS measure that disappointed on Wednesday. The day also brings Norwegian retail sales figures where we anticipate cautious growth of 0.3% m/m in February (see page 2 for more details).

Selected market news

Risk sentiment recovered somewhat overnight with Asian stocks trading up after a tough week. The US equity indices also gained yesterday, while the rally in fixed income markets halted. Yesterday, several Fed speakers sounded cautiously optimistic about the outlook, with St. Louis Fed President James Bullard, saying 'it's premature to consider a rate cut', adding -much in line with our view - that he expects growth to pick up in the second quarter. In addition, New York Fed Chief John Williams (NYSE:WMB) was also modestly optimistic, saying that while growth is slowing, 'right now the US economy overall is in a very good place'.

Trade talks between the US and China resumed yesterday. The US delegation led by finance minister Mnuchin and trade representative Lighthizer had a 'productive' dinner with the Chinese delegation ahead of a full day of talks today between the two sides. Meanwhile, Larry Kudlow, Trumps economic advisor, tempered expectations, saying the US is willing to extend the process for weeks or months in order to get the right deal for the US. We think that discussions are proceeding well, but that we may see hiccups on the final stretch of talks given the difficulties in finding an adequate enforcement mechanism in a potential deal. However, we expect the discussions to be completed before the end of Q2 ahead of the beginning of the US electoral campaign.

In Europe, financial markets yesterday digested the indications from the ECB that a tiered deposit system is under consideration. We provide a detailed discussions of the possible facility in our piece published yesterday: ECB Research - ECB Watchers conference: is a tiering system really the answer? Yesterday, German HICP inflation fell to 1.3% in March from 1.5% in February), driven by lower food and core inflation. In our view the numbers do not bode well for next week's euro area core inflation release.

Scandi markets

In Norway we get retail sales for February and unemployment for March today. Retail sales have been weak since last spring despite strong growth in January. The main reason for this is probably high power prices eroding consumers’ purchasing power and this effect will probably not disappear completely until we get to the April figures. We therefore anticipate only cautious growth of 0.3% m/m in February. Employment continues to grow strongly and although the supply of labour is expanding, unemployment is still falling, albeit at a more moderate tempo. We therefore expect (seasonally adjusted) NAV unemployment for March to be unchanged at 2.3%.

Today, we also get February’s Danish unemployment figures and final Q4 GDP estimate. Unemployment has been steadily falling since mid-2017 and we would have to go all the way back to the start of the financial crisis to find the same low level as now.

Fixed income markets

The global fixed income rally ran out of steam yesterday. Even a 0.2pp lower than expected German CPI was not able to fuel a further rally and both core and periphery yields edged a few basis points higher. The market continues to discuss a possible ECB tiering system. The impact on the economy is probably limited, but the signal is important, as it underlines that the ECB acknowledges that negative deposit rates are here for an extended period of time and that rate cuts could potentially be back on the agenda, see ECB Research - ECB Watchers conference: is a tiering system really the answer?

In the US especially the policy-sensitive 5Y point on the curve was under pressure, 5Y Treasury yields have moved 6bp higher over the past 24 hours and the 5s10s curve has flattened.

We published our overview of foreign holdings in DKK bonds yesterday. It showed that foreign investors now own 52% in the 2’ 50io bond. Foreigners own 45% in the regular 2’50 and 30.6% of all callable bonds.

FX markets

EUR trading heavy still post ECB’s tiered deposit talk earlier this week with notably EUR/CHF continuing to fall to new 2017 lows even though risk sentiment has stabilised a bit. SNB’s Maechler yesterday reiterated that the franc is ‘highly valued’ and again mentioned the importance of the intervention pledge. We have previously stressed that it would require EUR/CHF to fall towards 1.10 before the latter would be seen but it is worth keeping an eye on the weekly sight deposit figures near term to see whether the SNB starts to step in. Meanwhile, the GBP is set for another volatile day as PM May is set to bring the withdrawal agreement (but not the political declaration on future relations required to go through with Brexit) to a vote in parliament today in order to meet the formal requirements for an extension (most likely it will be voted down). EUR/GBP stuck in the range 0.85- 0.87 for now.

In the Scandies, EUR/NOK closed in the 9.60s after a volatile session that saw the cross reach an intraday high of 9.7472. Today’s data calendar brings three important releases in retail sales, NAV labour market report and Norges Bank NOK purchase announcement for April. Our base case is all three of these releases will continue to underpin a domestic case for a stronger NOK. Separately, we expect EUR/SEK to stay within the 10.40-50 range, even as the dividend season continues with relatively large pay-outs.

Meanwhile, the TRY remained under pressure yesterday with the USD/TRY climbing

3.5%. One of the reasons for investor caution is the increasing tensions between Turkey and US. A Turkish employee of the US consulate in Istanbul went on trial on Tuesday on charges of espionage, terrorism and playing a role in an attempted overthrow of the government in a case that has strained Turkey’s ties with the US. We remain bearish on the TRY.