Market movers today

The US-China trade war will continue to be the key theme in markets, see more below.

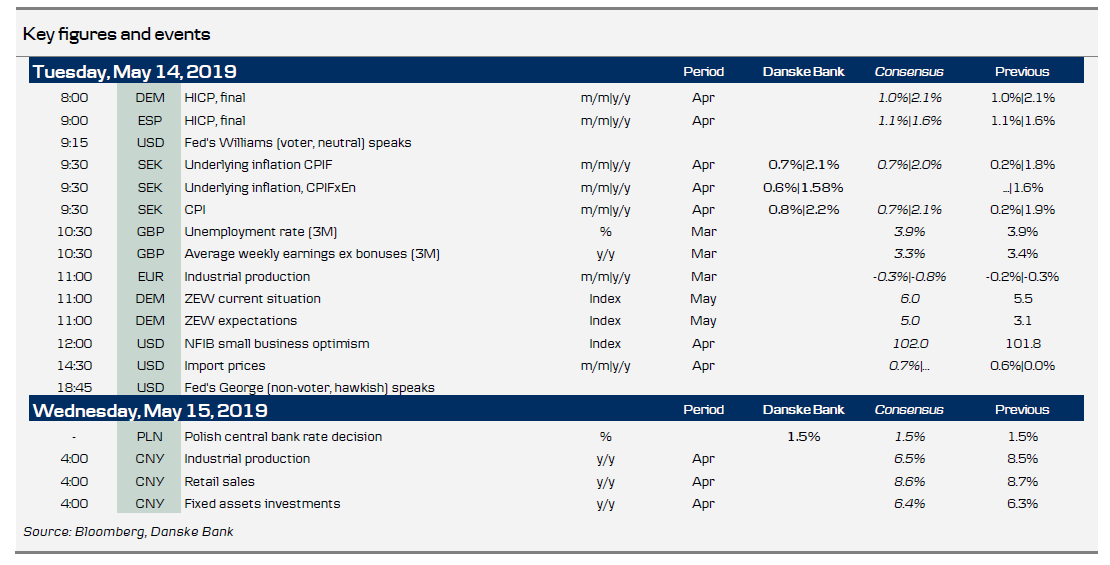

On the data front we expect Swedish CPIF inflation for April to be 2.1% y/y (consensus 2.0% y/y), see more next page.

In Germany, the ZEW survey is due to be released. It has ticked higher in recent months, pointing to higher expectations. The NFIB small business optimism index in the US is expected to show a small increase for April from 101.8 to 102.0.

Overnight (to Wednesday), we get, among others, Chinese industrial production.

Selected market news

It was a terrible day for risk sentiment globally yesterday with major US equity indices down 2.4%. European equity indices recorded only around 1.2% losses. The government bond markets reacted with a strong rally (lower yields), where the US recorded the biggest decline of 6.6bp to 2.40%. European government bond yields declined 2.6bp to -0.07%, just a whisker higher than the multi-year lows reached in late March. Noteworthy, the Fed fund futures took a took 6bp out of the Fed pricing until the end of the year, which means the markets are now fully pricing a rate cut by the end of the year.

The catalyst for the dreadful day for risk is attributed to the US-China trade war escalation as Trump continued to lash out at China in a string of tweets and China came with a retaliation response, see US-China Trade: Back in the tit-for-tat spiral . We are increasingly concerned that the two sides are too far from each other to reach a deal in Q2. The trust between the two sides has been damaged and they both seem to dig in on issues that are important for both countries. For example, on the issue of the need to change Chinese laws. On Friday, China's chief negotiator Liu He said China will not back down on matters of principle. The next key thing to look for is whether Xi and Trump talk on the phone at some point and try to get talks back on track. However, our concern is that it will require financial stress to create the necessary pressure to get the deal done.

Overnight, the sour risk sentiment continued in Asia, despite Trump saying that he will meet Xi at the G20 summit in June.

In Norway, mainland GDP was at first sight slightly weaker than expected, growing 0.3% q/q in Q1 (Danske: 0.4 %, consensus: 0.4 %).The figures were partly affected by negative supply-side effects in power production and fisheries. Importantly, Norges Bank will probably consider the weakness as temporarily (as stated after last week's rate meeting). The monetary policy report from March assumed +0.6 %, However, the details revealed a better result than the headline would suggest due to a revision of Q4 18 DP (to 1.1% from 0.9%) and strong employment growth of 0.48% q/q, which is noteworthily higher than Norges bank's projections. We see Norges Bank on track to hike rates in June, see more Reading the Markets Norway - On track for June hike .

Scandi markets

In Sweden, April inflation will be closely monitored today. It should not be a blockbuster, however, as our forecasts for all three inflation measures (CPI, CPIF and CPIF excluding Energy) are all spot on the Riksbank’s. Taking the starting point in the latter, the monthly print has not been higher than 0.6 % m/m, which is our forecast now, since the turn of the millennium. That should give some comfort that the upside risk is limited. The forecasts for energy and rates are normally quite accurate; hence, any miss is likely to be in that core measure. The main drivers this month are international airline tickets and charter package prices, assumed together to add 0.4 percentage points m/m to inflation. Fuel will add 0.15 percentage points and mortgage rates just below a tenth.

Fixed income markets

US Treasuries rallied strongly yesterday night as trade concerns dominated. The curve 2s10s steepened as the market added to cut expectations. The market is now pricing a full cut this year and close to two more in 2020. Soft comments from the Fed’s Kaplan and Clarida also added to the rally.

Today, the market will once again trade on risk appetite and we get a test of the appetite when Italy is in the markets selling 3y, 7y and 30y bonds. The 10Y IT-DE spread has widened more than 20bp since the start of the month. BTPs are suffering not only due to the weak risk appetite, but also as political uncertainty is on the rise in Italy and as the EU Commission last week said that the budget deficit will be 3.5% in 2020. We recommend to buy 1Y BOTs after the recent underperformance, but stay away from BTPs. See Government Bonds Weekly, 10 May 2019.

Note we published Reading the Markets Norway yesterday. We recommend to buy NOK FRA Dec-19 outright as Norges Bank has clearly guided for a June rate hike and as very little prices in the curve beyond that.

FX markets

When it comes to data, Swedish inflation is normally the most prominent market mover of all. If it surprises. Our forecast (see Scandi section) is in line with the Riksbank’s and broadly in line with consensus, too. Hence, we do not expect much reaction in the SEK. If anything, an outcome in line with the Riksbank could be seen as a slight relief, as compared to the last couple of months, and as such weigh marginally on EUR/SEK.

For the NOK, Swedish inflation will set the tone in early trading. However, we still think the global environment, including the oil price, will remain the key driver today. Overall, we think it is difficult to turn near-term bullish on the NOK. However, we think the topside in EUR/NOK remains capped by Norges Bank and our fundamental predisposition remains to buy NOK as the currency simply has become too weak for Norges Bank to reach its inflation target (as long as the global economy does not fall out of bed).

EUR/DKK rose to as high as 7.4680 yesterday and, hence, back to the level Danmarks Nationalbank (DN) sold EUR/DKK in FX intervention in January. Weak equity markets, a lower USD and a large discount in FX forwards is likely part of the explanation for the move higher. In our view, it is (still) premature to speculate on independent rate hikes in Denmark. DN has about DKK40bn in FX reserves to draw on before we get to that point.

EUR/USD found some temporary support up to around 1.1260 from a further repricing by the Fed yesterday. The market now expects a full 25bp rate cut at the December meeting. The move lower in US rates also took USD/JPY down close to 109 and implied volatility back up again. The setback in trade talks and weak risk sentiment further mean that we were stopped out on our long commodity basket (AUD, NZD, CAD) vs JPY trade recommendation from 8 April with a resulting loss of 3% (including carry). Finally, EUR/CHF came under pressure from a combination of trade woes and Italian government tensions and the cross briefly dipped below 1.13. Risks are tilted towards more CHF strength near term as the ECB putting ‘normalisation’ on hold leaves the SNB vulnerable. However, it will probably require a dip towards 1.10 before the SNB looks to intervention.