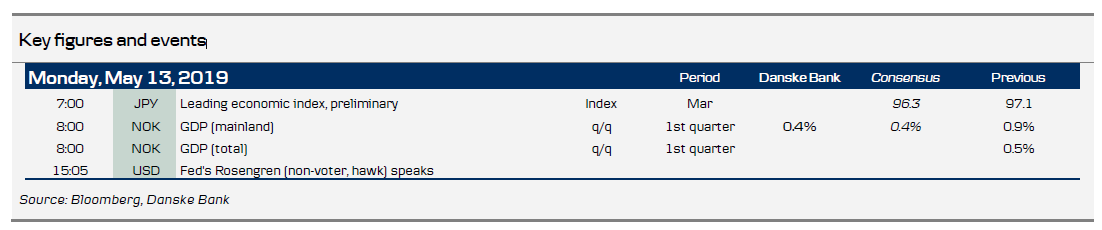

Market movers today

Today's data calendar is quite thin, although the Norwegian GDP number will attract some attention. The number is widely expected to fall short of Norges Bank's March estimate for Q1, but given the temporary nature of the disappointment (even emphasised by NB itself last week), and given the latest strong NAV labour market report, the market impact should be limited.

Naturally, European and US markets will digest the latest on the US-China trade war (more below).

Later this week, we are set to get some information on the solid Q1 euro area GDP growth, with both the March industrial production and May ZEW index. In China, we look out for the April industrial production, retail sales and fixed asset investments. In Sweden, inflation will take centre stage. Our forecast for CPIF excluding energy is in line with the Riksbank's at 1.6% y/y.

Selected market news

Global risk sentiment had a tough week last week with the renewed US-China trade war tensions. By the end of the week, the US-China trade talks in Washington ended in what looked like a deadlock - positions that seem to have been further entrenched. Both sides sent signals of cautious optimism but the underlying development suggests a bigger crisis in the negotiations. The trade teams have agreed to meet again in Beijing, but not when. At the same time, President Trump's economic advisor said there was a 'strong possibility' for Trump and Xi to meet at next month's G20 in Japan. The US has given China a month to make concessions or otherwise face tariffs on all imports. In this case the tariffs could come into force in early August. We see an increasing risk that the trade talks drag out into H2 and that it will get worse before it gets better, see more in US-China trade - Talks in Washington end with signs of deadlock .

Overnight, the Asian markets are trading in classical a risk-off reaction mode, as major equity indices are down, the yen stronger and treasury futures up.

Yesterday, Bloomberg via the Italian news outlet Corriere della Sera, reported that Italian Prime Minister Conte suspected deputy Salvini of bringing down the coalition government in an end to a bad week for the Italian bond market (also after the EC's revision earlier last week). Recall that the Italian government coalition partners (M5S and Lega) are not natural coalition partners, which may raise the risk of renewed pressure on the Italian economic outlook should the political instability rise again.

During the weekend, the final count of Wednesday's election in South Africa gave the ANC 57.5% of the votes (up from of 54.5% in the local elections three years ago). This raises the prospect of a more forceful implementation of the reform agenda in South Africa by Ramaphosa, which is dearly needed to increase the country's lacklustre growth prospects. However, EM currencies may face a challenging period ahead following the US-China trade war.

Scandi markets

We get Norwegian GDP figures (see below in FX section).

Fixed income markets

We see limited chance of a rise in rates in the coming weeks given that (1) the trade talks between the US and China ended in a deadlock again; and (2) global central banks are keeping monetary policy in check with a bias towards easing, as inflation remains low, such as the US CPI data released on Friday and expectations for Swedish inflation to be released this week. See more in weekly on the Swedish market see more here https://bit.ly/30boYAJ. The only central bank expected to raise rates is the Norwegian Central Bank. We take a closer look at the Norwegian bond market in our weekly to be published this morning. This week’s supply in the European government bond market comes from Italy, France and Germany. The Italian auction on Tuesday is the most interesting given the renewed pressure on Italian government bonds on the back of the general risk-off sentiment as well as the EU Commission’s downward revision of the growth forecast for Italy in 2019. We take a cautious stance on Italy and stick to the front end of the curve, as discussed in our Government Bond Weekly. Here, we also look at the ECB’s reinvestment programme. There is no “smoothing” on the aggregate level of reinvestments, but some significant country differences. See more in Government Bonds Weekly, 10 May 2019.

FX markets

In the Scandies, the global environment including global inflation expectations remain the near-term key driver of the NOK. This morning’s GDP release is widely expected to fall short of NB’s March estimate for Q1, but given the temporary nature of the disappointment (even emphasised by NB itselflast week), and given the latest strong NAV labour market report, the market impact should be limited. In this morning’s edition of Reading the Markets Norway (published later this morning), we highlight that as long as the global economy does not fall out of bed, the NOK is currently too weak for Norges Bank to fulfil its inflation target. That suggests a strengthened NOK potential if global developments calm down and the moderate global recovery gets a footing. For the SEK, in terms of data, the inflation numbers (Tuesday) are

the most important, though if our forecast proves correct, there should not be any market impact since it (CPIF 2.1%, CPIF ex energy 1.6%) is in line with both consensus and the Riksbank. We will keep an eye on today’s speech by Henry Ohlsson at 12:30 CEST, acknowledging his hawkish views are not shared by the majority of the Board. For more on our thoughts on the hardbattered SEK, we recommend FX Strategy - Hardships for the SEK, 13 May 2019.

EUR/USD was surprisingly immune to last week’s weak Chinese data and escalation of trade tensions. In fact, the EUR was among the best performing currencies in the G10 sphere last week following the JPY and CHF, supported by a rally in fixed income and lower commodity prices. The next big data point for EUR/USD will be next week’s flash PMI data.

Downwards pressure on USD/JPY eased slightly on Friday as markets went in to the usual mode of thinking the rational thing about trade is to get a deal done but over the weekend, we see each camp as having been further entrenched. As we enter a new week; US/Iran, Italian politics and further (negative) news flow on trade currently look set to help USD/JPY move lower.