Market movers today

In the UK, key focus is on the Conservative Party's response to the results of the European parliamentary elections today. The Conservative Party is likely to suffer a heavy defeat and Nigel Farage's new Brexit Party may be the biggest party of all. It is highly likely that the defeat would cause Prime Minister Theresa May to resign (see our Brexit Monitor - End of May )

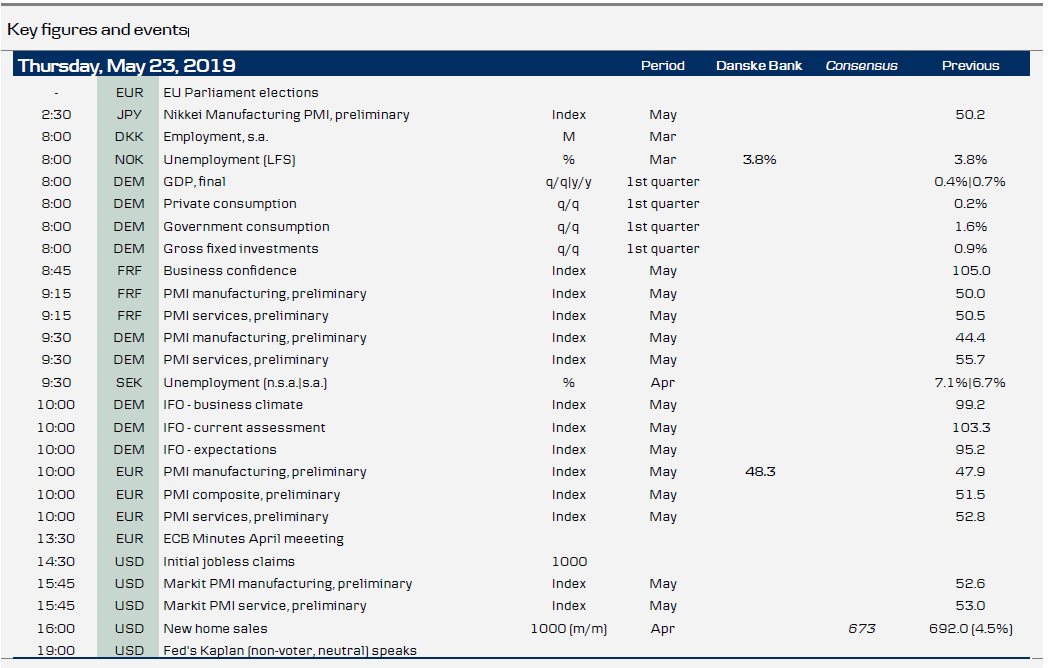

In the euro area, we will get both the flash PMIs and German ifo for May, as well as the ECB minutes form the April meeting. We see scope for a very limited rebound in the manufacturing PMI to 48.3 on the back of the improving order situation in the April survey. However, the latest negative developments in the trade negotiations between the US and China will weigh on the PMIs going forward and a dent in business expectations might already be visible in today's German ifo print

The ECB minutes from the April meeting may prove uneventful for the market. While we are interested in the discussions on inflation and the growth outlook, we doubt there will be any new colour on this, or on the potential 'tiering system' and the upcoming TLTRO3 modalities.

In the US, we also get the Markit preliminary PMIs for May, which should give us a clue to how growth has performed in Q2. Recently, manufacturing PMIs have added to the signs that the economy is set to slow and that the manufacturing sector is not immune to what happens in the rest of the world.

In the Scandi countries, labour market data is in focus in Sweden, Norway and Denmark (see next page).

Selected market news

Yesterday, pressure mounted on Theresa May to step down on the back of her renewed bid to find a majority for her Withdrawal Agreement. A senior Cabinet member, Andrea Leadsom, resigned, saying she no longer believed the government's approach will honour the result of the 2016 referendum. Later in the day, the powerful, so-called 1922 Committee of rank-and-file Conservatives, which oversees leadership elections, decided not to change the rules, but Committee chairman Graham Brady said after the meeting that he will meet with Theresa May tomorrow after the European elections. If Theresa May decides to step down, it opens the opportunity for a more pro-Brexit conservative leader, although such a process may only be completed in autumn. Hence an extension of the 31 October deadline with the EU may be needed, although uncertainty remains high about the potential different scenarios at the moment (see our Brexit Monitor - End of May ).

The Asian markets declined on hardening rhetoric from the Chinese side, with the state media sharply criticising the US's decision to curb Chinese companies. Meanwhile, Fed Minutes released yesterday showed little support for the market view that the Fed will cut rates later in the year.

Scandi markets

For Sweden, today’s focus is on the Swedish labour market, where unemployment figures for the month of April are due for release. The last reading (March) yielded a surprisingly large uptick in unemployment (6.7%, s.a.), which is expected to be reversed to some extent. We expect a decline to 6.2% (consensus: 6.5%). Nevertheless, the trend in vacancies indicates that we might have seen unemployment bottoming out for this cycle.

In Norway, recent months have again seen divergence between the jobless figures in the LFS and NAV’s figures for registered unemployment. We expect the LFS and NAV jobless measures to converge gradually as LFS unemployment starts to fall again. In March, however, we expect the LFS to show an unchanged jobless rate of 3.8% but with the risk to the downside.

Statistics Denmark is set to publish wage earner employment data for March today. Given that the February figures were static, it will be interesting to see whether that was a warning the labour market is slowing or just a natural consequence of unusually strong January numbers.

Fixed income markets

Global fixed income markets rallied yesterday, led by Gilts, as Brexit concerns continued to grow after Cabinet minister Andrea Leadsom resigned and as the likelihood of May resigning and being replaced by a hardline Brexit supporter continues to rise. Today, the UK holds its EU Parliamentary elections, with Nigel Farage and his new party taking the spotlight.

The rally continued in the US session despite Fed Minutes showing little support to the market view that the Fed will cut rates later in the year. The Fed is still in wait-and-see mode and said that the recent softening in inflation is transitory and that growth would pick up further. However, the Minutes are from before Trump escalated the trade conflict by raising Chinese import tariffs. Hence, we should not over-interpret the Minutes. Today, the market will keep its eyes on European PMI releases and any Brexit news. We expect that yesterday’s move lower in yields will extend today with Asian equity markets under pressure.

FX markets

Yesterday, EUR/GBP traded as elevated as 0.884 but the GBP reversed most of the day’s losses in late hours. We view this spot level as warranted if one sees a high probability of either (1) a new election and/or (2) a no-deal Brexit realisation in the next one to two months. There are many potential quirks before this could happen and we hence we view the pricing as stretched for now. Put another way, we do not view the political situation (yet) with the same severity as late last year, when the GBP was only slightly weaker than seen today. On this side of summer, we do not expect a convergence towards one of the (pound-negative) Brexit outcomes and hence expect very limited further weakness in the GBP. Rather, from the current level, small changes in the perception of the possibility of a softer Brexit could cause a non-linear reaction in favour of GBP strength. A more pro- Brexit Conservative leader would probably increase the chances of a no deal scenario but the small majority in the House of Commons will likely continue to do as much as it can to avoid this, limiting a strong sell-off beyond knee-jerk reactions. Our base case is that a further Brexit extension beyond 31 October is likely. See more in our Brexit Monitor - End of May.

There are grounds for a short-lived bounce in EUR/USD today if we are right that Eurozone flash manufacturing PMI will surprise consensus. We stress that a rally in EUR/USD would be temporary, as one better data point is not enough to justify a higher EUR/USD. Rather, we need to see policy action on the trade war and/or monetary policy trigger an upward trend in EUR/USD - see FX Strategy Policy inaction keeping a lid on EUR/USD, 21 May.

In the Scandies, focus turns to labour market data in both Norway and Sweden – neither of which we expect to trigger large market moves. That said, given that Riksbank Governor Ingves recently stated that unemployment has likely bottomed out for this cycle, it is still worth following. For Norway, we still prefer the NAV release to the LFS print – and so does Norges Bank.