Market movers today

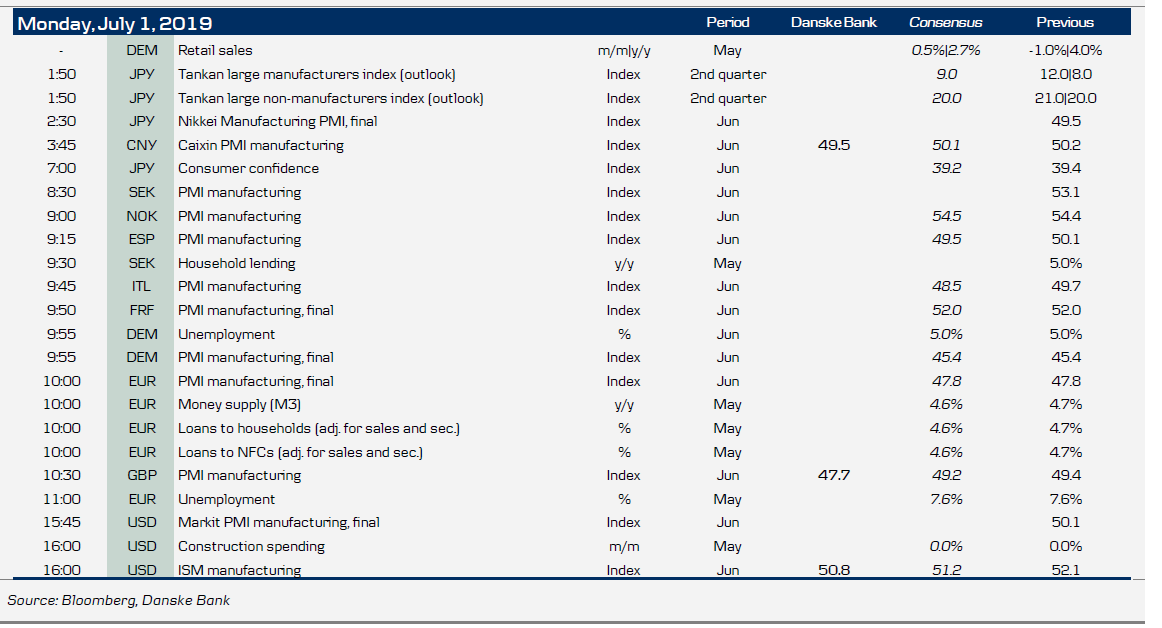

- We are starting the week with a host of PMI manufacturing releases, which will give an indication of where the global manufacturing cycle is heading amid the uncertainty prompted by the trade stand-off between the US and China. Markets will also keep an eye on the aftermath of the trade ceasefire over the weekend.

- In Europe, there will be ongoing discussions on who will head key European institutions after difficulties agreeing on the candidates.

- In the UK , the PMI manufacturing index for June is set to be released today. The index is likely to fall further, as it remains elevated compared with the equivalent euro area index and stockpiling ahead of Brexit.

- In the US , we start the week with ISM manufacturing for June. We expect ISM to decrease and come in at 50.8, down from 52.2. In our view, the US manufacturing sector is not immune to the global slowdown but we think the index will remain just above the important 50 threshold. That said, risk is skewed to the downside.

- Sweden's industrial PMI has done well compared with the German PMI. However, there is still a risk that the Swedish June PMI turns down, as Swedish new orders and German industrial PMI have been negative over the past months. Likewise, we see a risk of a correction in manufacturing production on the back of weak German production.

- In Norway, we expect the PMI to rise moderately to 54.5 in June, given that strong growth in oil-related industries has meant industrial activity has held up well despite the slowdown in global manufacturing. Industrial production increased by 2.2% in April after a relatively weak Q1 and is thus back in line with the underlying trend seen since mid-2017. Given the strong rise in April, we estimate a slight correction for May, with a decrease of 0.4% m/m.

Selected market news

The key event during the weekend was the truce between the US and China. The US and China are set to restart the trade negotiations. Furthermore, the restrictions on Huawei were eased a bit, as US companies are allowed to sell some products to Huawei. However, it is still very uncertain how long this truce is going to last and thus this should only bring a short-term relief to the markets. The JPY has weakened modestly, while commodity currencies have strengthened. 10Y JGBs have risen with some 2bp and most Asian equities are up 0.5%-2% this morning.

In Japan the Tankan survey showed that the sentiment among Japanese manufacturers fell to the lowest level in three years. The survey was conducted before the G20 meeting this weekend. However, domestic-focused companies were more upbeat on the economy.

Scandi markets

In Norway, strong growth in oil-related industries has meant manufacturing activity has held up well despite the slowdown in global manufacturing. The latest oil investment survey suggests spending will be higher than expected this year, so we expect the uptrend in manufacturing to continue barring a much more pronounced international downturn. Therefore, we expect the PMI to rise moderately to 54.5 in June.

This morning we released our weekly on the Norwegian market. We look at why Norges Bank will continue to tighten monetary policy despite international headwinds. See more here.

In Sweden, the main event this week is the Riksbank meeting on Wednesday. Read our preview and thoughts on FI and FX in Reading the Markets Sweden. In short, we think that it will take a step in a more dovish direction, referring to global uncertainties and the significant U-turn among major central banks. Today, manufacturing PMI is due for release. Sweden’s industrial PMI has done well compared with German PMI. However, there is a continuing risk that the Swedish June PMI turns down, as Swedish new orders and German industrial PMI have been dreary over the past months. We also get household lending data today.

Fixed income markets

Straight from agreeing to resume trade talks with China to shaking hands with Kim Jong Un in North Korea, Trump keeps busy. Regarding the trade war, the ceasefire is comforting news. However, as key obstacles remain, a renewed escalation is likely also given the fact that the trade war could become an integral part of Trump’s presidential election campaign. See more on US-China Trade war.

Draghi only managed to ‘reflate’ inflation expectations briefly with 5y5y trading above 1.3% post-Sintra only to close last week near the 1.2% level. The appetite to buy inflation seems to mute quickly as inflation pricing edges slightly higher, whereas the sellers are easily attracted by the ‘elevated’ levels.

On the supply side, Finanzagentur is coming to the market with a EUR4bn introduction of the OBL Oct-24 on Wednesday. On Thursday, the AFT will tap up to 10bn in the May-29, May-34 and May-50 OATs and the Spanish Tesoro will tap the Nov-23 linker and the Apr- 23, Oct-29 and Oct-48 SPGBs. BTPs are likely to take their lead from the political front as the European Commission will decide whether to take further steps in an excessive deficit procedure (EDP) as it reviews the Eurozone countries’ budget situations on Tuesday.

At Wednesday’s Riksbank meeting the focus will be on the rate guidance. Following the April meeting global CB sentiment has shifted increasingly dovish, but Swedish inflation data has been roughly in line with forecasts and Q1 GDP was slightly above expectations at 2.1% y/y. Nevertheless, we think the Riksbank will signal a more cautious approach then previously and change the current guidance to ‘next hike late this year or early 2020’. See more in Reading the Markets Sweden.

Key figures and events