Risk sentiment takes a hit from renewed trade uncertainty

Market movers today

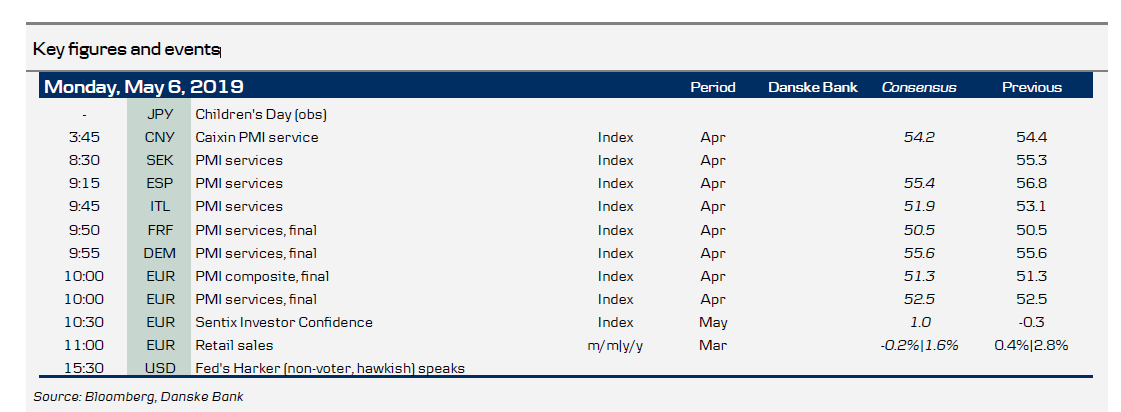

We have a very interesting week ahead of us although today is quiet in terms of economic data releases. We thought that the US and China were about to strike a trade deal this week, but Trump’s latest tweet questions that (see more below). This is likely to dominate markets today.

In terms of economic data releases, European PMI services, retail sales and investor confidence are due out today. We also get unemployment data for Norway.

In the UK, we will follow the cross-party negotiations between Theresa May and Jeremy Corbyn that May’s team wants to wrap up this week after both parties suffered in the UK elections last week. According to media reports, Theresa May is preparing to offer Corbyn to make a customs arrangement with the EU.

Otherwise this week, German industrial production, US inflation and China inflation are due out. The EU Commission is also publishing its new economic forecasts for the EU countries.

In Scandi, we get Riksbank minutes tomorrow and Norges Bank decides on monetary policy on Thursday.

Selected market news

Over the weekend, US President Trump threatened to impose new tariffs on all of US imports from China, see tweet. It is a huge turn of events that adds renewed uncertainty to the outcome of this week’s talks. It may be that it is just a bluff and an attempt to squeeze out more of China but bullying rarely works on China and Trump’s threat could backfire.

If talks this week fail, we could face a new escalation of the trade war, which would give a big hit to risk sentiment and could derail the brewing signs of recovery in the global economy. This morning stocks are flashing red in Asia with Chinese stock indices more than 5% down. Futures on S&P500 are down nearly 2%. Yuan plunged the most in three years.

However, with Trump going into election campaign, we still do not think he would risk a no-deal outcome that would most likely derail the stock market rally and cause a dive in economic sentiment. So our baseline is still a deal by the end of Q2. But uncertainty has clearly gone up.

For more on the renewed trade uncertainty see US-China Trade - New uncertainty as Trump threatens of new tariffs.

In euro area, we believe the risk of a recession has subsided recently, see Euro Area Macro Monitor.

Scandi markets

Today, Norwegian unemployment data is due out, where we expect a fall from 2.4% to 2.3%.

Fixed income markets

Today we could get some safe-haven buying of Bunds and Treasuries on the back of renewed trade uncertainty.

The more positive economic news for also Italy has led to a solid tightening of the spread between Italy and core-EU, where the 10Y spread is testing the 250bp-level. If the EU commission makes an upward revision to the economic forecast also for Italy later this week, then this is positive for Italian government bonds. However, if the EU commission discusses a possible breach of the 3%-limit for the budget deficit, then it will be negative for Italy.

ECB will release numbers for April for the reinvestments on the QE programme. It will be interesting to see whether the German portfolio continues to shrink, while smaller countries such as Ireland and Portugal are still being purchased well above the numbers seen in Q4, 2018.

There was no change to the outlook for France. Moody’s maintained a positive outlook on the French government bonds. Given the softer fiscal policy and higher budget deficit, we see a risk that Moody’s will remove the positive outlook. Our trade recommendation has been to be long 5Y Spain versus France with a target of 30bp. The spread is currently 34bp, and we keep the trade on.

Today, the final prepayments data for Danish callable bonds are released. We expect an increase of 35% from last week’s numbers and a total of DKK 90-105bn in prepayments for the July term. Our focus is on the prepayments in 30Y 3% and 2.5% bonds, where we expect significant prepayments, which in our view are not fully priced.

FX markets

NOK benefitted on Friday from rising global inflation expectations and a much strongerthan- expected NAV labour market report, see chart. This report is very important to Norges Bank, our call for a June rate hike and our strategic expectation for a stronger NOK. Our fundamental predisposition remains to add NOK longs on spot dips. Yet today we see downside risk for the house price release on the back of Thursday’s OBOS data.

EUR/SEK was on the verge of taking out the August 2018 high of 10.73 last week as the cross continued to climb in the aftermath of the surprisingly dovish Riksbank decision.

The Minutes from that meeting is this week’s most important event for the SEK, with clear market moving potential. While there were many components to the dovishness, the most important thing for EUR/SEK was, in our view, the rate path signalling a hike no earlier than around year-end. The Minutes will shed more light on how board members reasoned. Both the RBA and RBNZ hold policy meetings during the week and we expect them to be dovish. Renewed uncertainty on US-China relations makes the risk increasingly skewed to the downside for NZD and AUD. Depending on how trade talks play out over the week, pressure is also on for JPY to move below 110.

Finally, Fed speakers on Friday managed to soften Powell’s tone at last week’s FOMC meeting somewhat; this may have placed a near-term cap on USD strength, leaving some relief for not least EM for now. A key question for the FX market, which largely shares the laid-back attitude to risks prevailing across asset classes amid the pricing of a Fed cut within 12M, remains: will a Fed that’s on hold – no more, no less as we look for – be enough to keep USD strength at bay?