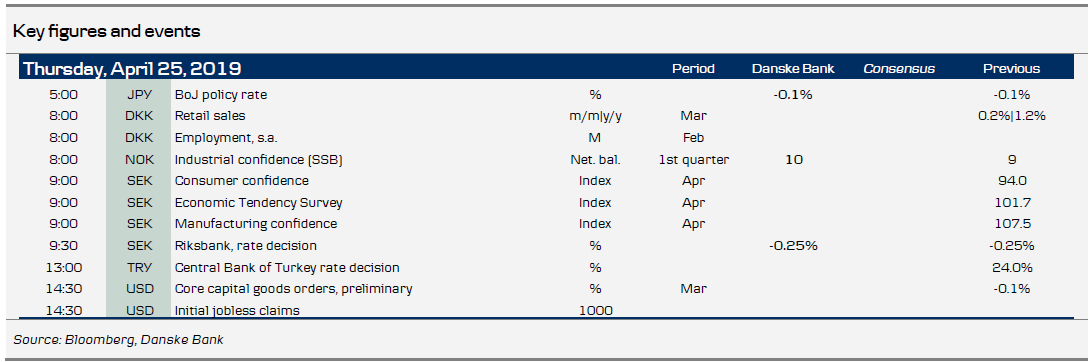

Market movers today

Riksbanken will publish its monetary policy decision following the April meeting. We look for an unchanged rate path and an end to the QE programme. Although not a high conviction call this could see EUR/SEK move towards 10.35 (see more on page 2).

Also today the Turkish central bank (TCMB) will have its monetary policy meeting and make a decision on policy rates. In line with Bloomberg consensus, we expect the one-week repo rate to remain unchanged at 24.00 as inflation deceleration has stopped and the rising oil price risk is seen as a negative factor for both the Turkish economy and the current account balance.

In Norway Q2 manufacturing confidence is released today (see more on page 2).

In Sweden, apart from the Riksbank, we also get NIER's economic tendency survey (see more on page 2).

Selected market news

Following weaker than expected Australian Q1 CPIs, and a disappointing German Ifo survey, which saw bunds rally 5bp and EURUSD at close to 2y lows, the sights were set on the Bank of Canada's rate decision late in the European session. The market interpreted the BoC's decision as dovish as it firmed its 'on-hold' stance (policy rate unchanged at 1.75%) and markets are now pricing in a 50% probability of rate cuts over the coming 6M, despite the monetary policy report containing several upbeat elements on growth, inflation and capital utilisation. In our view, we would have to see a significant negative global growth shock or a Fed funds target cut for the BoC to cut rates, and thus the market reaction seems overdone. The USDCAD strengthened towards the 1.35 mark, but we still see a stronger CAD going forward on relative rates and higher oil. The decision and preceding events laid the foundation for a rally in US treasuries which saw 10y yields down 5bp.

Staying in the focus of central banks the BoJ kept its QQE with yield curve control unchanged at a meeting ending this morning. It tweaked the forward guidance somewhat though, now saying they "will keep very low-interest rates levels for an extended period of time at least through to around spring 2020". Until now there was now specific time frame for how long rates would be kept at low levels. The BoJ cut its GDP forecast for FY2018 ending in March from 0.9% to 0.6%, which is no surprise considering what looks like a weak Q1. In addition, FY2019 and 2020 GDP and inflation forecasts have been cut slightly. Particularly interesting is the new inflation outlook, which now includes FY2021. BoJ expects CPI inflation to hit 1.6% by then (lowest t+2 inflation forecast since 2013). That is, the BoJ does not expect to meet its inflation mandate within a two to three-year horizon.

Oil could not sustain its recent gains as American crude inventories saw a surprisingly big jump of 5.48 million barrels according the EIA. Also yesterday, according to Bloomberg, US government officials stated that Trump backed the recent attack on Tripoli by the Libyan opposition led by strongman Khalifa Haftar. This could potentially be a long term blow to Libya's growing and stabilising oil exports.

Scandi markets

Norway. Statistics Norway will publish the Q2 manufacturing confidence. This never has any great market impact, but will give us important signals about what is currently the economy’s most important growth driver – oil-related activity. Despite the global manufacturing slowdown, it seems that activity in Norway is accelerating, which is of course a result of strong growth in oil investment boosting oil-related industries. The PMI also picked up in Q1 after softening towards the end of last year. We therefore expect the manufacturing confidence indicator to climb from 9 to 10, which would be the highest for more than eight years and help eliminate much of the uncertainty about the growth outlook for 2019.

Sweden. Today’s main event is undoubtedly the Riksbank rate decision. We look for 1) a downward adjustment of the inflation forecast, 2) an unchanged rate path and 3) an end to the QE-programme. Although inflation has widely undershot the Riksbank’s forecasts three months in a row, the communication from board members has remained relatively upbeat. On top of that, recent developments regarding ECB and the FED are clear headwinds for the Riksbank’s hiking ambitions. Thus, from an analytical standpoint, the most prudent policy action would probably be to lower the rate path and postponing the next hike somewhat. However, we believe that the board will opt to buy themselves more time, in hope of an inflation-pickup. Thus, although not a high-conviction call, we end up with a call for an unchanged rate path. Regarding the NIER the indicator dropped sharply last year, to levels just above the neutral 100 level. Confidence in several domestic sectors has dropped below that level i.e. in households (consumer), private services and retail trade, while surprisingly construction still remains above. Manufacturing confidence is now in a steep decline, but still remains at very positive levels. This time the overall direction of confidence may be of more importance than normal.

Fixed income markets

The sentiment in the European rates market changed significantly yesterday on the back of the weaker than expected Ifo indicator and a decent Bund auction where the bid-to-cover was 2 relative to 2.6 in March. Hence, the yield on the 10Y Germany government bond yield was pushed below 0% and the curve flattened, while the Bund spread moved back above 50bp. The spread between the periphery and core-EU widened modestly as peripheral markets could not follow the rally in the core-EU markets.

FX markets

Today’s Riksbank rate decision will set the tone and guide the SEK moving forward, and we look for a more pronounced break of the 10.40-50 range. Our call for today’s decision (see Scandi section) would entail strengthening of the SEK, but we stress that this is not a high-conviction call. If we were to see an unchanged rate path (our base case), coupled with an end to the QE-programme, we look for a move towards 10.35 and maybe even a test of 10.20, which coincidentally are our 1 and 3M (NYSE:MMM) forecasts, respectively. On the other hand, should the rate path be revised down (and perhaps coupled with continuation of QE), we could easily see EUR/SEK above 10.60. Then, of course, there are all the outcomes in between: unchanged rate path coupled with continuation of QE, and the opposite. The effect of these outcomes are harder to predict, but if anything we believe policy actions regarding the rate path to dominate those of the QE programme, at least as far as the SEK is concerned. The Riksbank decision will most likely also set the tone for the NOK even if the SSB industrial confidence data are important for economists (less so for markets). We still pencil in a stronger NOK in the coming months but highlight that USD/NOK volatility has become an attractive hedge against such a view (details here).

NZD, AUD and JPY tumbled further against USD by around 1% and slightly less for JPY. These moves appear to have been broad outflows versus most EM indices to USD and bonds and are joined by a loss of momentum in industrial metals and slightly rising volatility across asset classes. The key theme for week’s ahead seem thus to refocus on the drivers for risk appetite.