Market movers today

We have a number of important events this week, with most prominently a potential Brexit vote tomorrow or Wednesday, as well as several central bank speeches potentially addressing the recent dovishness from policymakers. US trade negotiators are heading to Beijing for another round of talks later this week and Chinese vice PM Liu He is set to go to DC on 3 April.

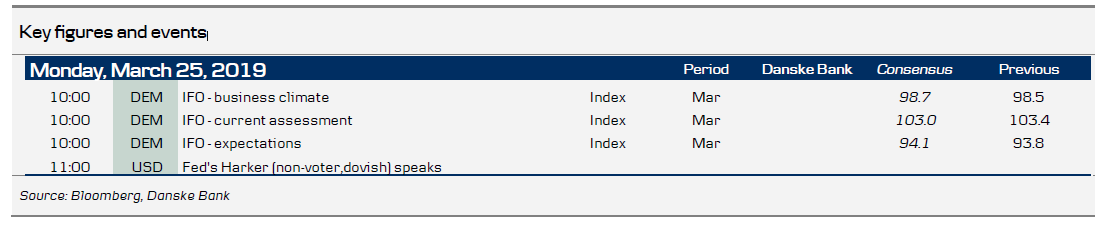

Today's highlight on the data front is the German Ifo for March. After last week's uptick in ZEW expectations investors are becoming on balance a bit less pessimistic on the Eurozone/Germany outlook. However, with the disappointing PMI manufacturing figures on Friday it is clear that the Germany is not out of the woods yet and challenges for the euro area recovery still lie ahead (see Flash Comment: Growing manufacturing abyss challenges Eurozone outlook ).

Selected market news

The global manufacturing cycle continues to shift into lower gear, as both Eurozone and US manufacturing PMIs eased further in March. In Europe, weaker external demand continues to drive the deterioration in companies' order books, which are back at the worst levels since 2012. Especially Germany remains at the epicentre of the Eurozone manufacturing slowdown, leading us to revise down our forecast for German Q1 GDP growth to 0.2% q/q (from 0.3% q/q previously), see Flash Comment: Growing manufacturing abyss challenges Eurozone outlook .

Following disappointing data releases on both sides of the Atlantic markets are getting increasingly worried about the global cyclical stance. Both the EUR and the Scandi currencies were sold off and rates markets headed south. 10Y Bund yields moved below zero and in the US the yield curve has started to invert, with the 10Y Treasury yield falling below the 3M (NYSE:MMM) rate for the first time since 2007 - which historically has coincided with recession hitting within the next 12 months. However, the yield spread itself does not trigger an economic downturn and although the US industrial sector seems to have hit a rough patch - not being immune to global developments - we still think the US economy overall is in good shape and remains supported by fiscal stimulus this year. That said, we currently have a very strong combination of rapidly deteriorating global data combined with surprisingly soft rhetoric from the four major central banks, notable the Fed and the ECB. Hence, we see room for further fixed income performance and curve flattening this week. We continue to see 10Y Bund yields in a -10 to +15bp range the next couple of months and expect that we will soon move towards the lower end of that range.

This morning the sour risk sentiment seems to continue with Asian benchmarks in the red, while Brexit uncertainty remains elevated after reports that PM Theresa May is again facing pressure from her cabinet to resign. In the US risk sentiment might get a boost from news that US justice department special counsel Robert Mueller concluded that Donald Trump and his presidential campaign did not collude with Russia in an attempt to influence the 2016 election result, see here .

Scandi markets

No releases in the Scandi markets today.

Fixed income markets

This week the fixed income market will take its direction from numerous central bank speeches, the German Ifo (today) and the ongoing Brexit votes.

Especially, we see room for further curve flattening 5s10s in core, semi-core and periphery, as the pivotal point on the curve in our view has moved from the 5Y point to the 10Y point given the strong carry/hunt-for-yield environment created by global central banks. In Government Bonds Weekly we recommend to position for a flatter 5s10s curve in Ireland and Portugal. We recommend it on an outright basis rather than in a box versus Germany.

Often periphery and semi-core cannot follow Germany higher in strong rallies. However, we do recommend to buy 10Y Belgium versus Bunds, as we have EUR13.7bn coming to the market in redemptions and coupons in Belgium this week, which also implies supportive ECB reinvestment flows in Belgium in Q2. Note we have closed our long 10Y Finland versus the Netherlands as we have reached our profit target.

This week there will be an estimated EUR18bn in supply from Germany and Italy, but with redemptions and coupons from Belgium, the net cash flow is only modestly negative. Germany will tap EUR4bn in the Mar-21 Schatz and EUR3bn in the Feb-29 Bund, while Italy taps in zero-coupon bonds, linkers and nominals.

Sweden and Norway are also coming to the market with small tap auctions in the long end of the curve (we expect a tap in the 10Y NGB – announcement today at 12:00 CET). We expect no less than two more hikes this year. Hence, we expect the Norwegian 2s10s-curve to flatten significantly in 2019, both outright and relative to peers - a development similar to what we saw in the US when the Fed started to hike a few years ago.

FX markets

With a US-China trade deal postponed, focus for majors is clearly on where the global and the European cycle are heading and focus today will be on the German Ifo numbers. EUR/USD has been supported in recent weeks by rate spreads moving in its favour, but towards the end of last week sentiment clearly shifted despite - or rather due to - a dovish Fed. Recession fears have clearly come back with a vengeance with the inversion of the US curve on Friday and to the extent that markets are grabbed near term by fears of a wider and deeper global slowdown. The scope for this to hit the EUR negatively is tangible in our view: the Fed is already priced for cuts, whereas the ECB is one of the few central banks that is effectively open for repricing in a softer direction given its option of restarting QE. We continue to see risks in EUR/USD tilted to the downside short term and the plethora of Fed and ECB speakers this week could prove instrumental in this respect.

The Brexit saga continues: last week the EU gave the UK one more chance to pass May’s deal (vote likely Tuesday or Wednesday) but a long extension of the Brexit deadline seems more likely than the deal passing. A long extension should be mildly positive for GBP, as the chance of a second referendum would increase.

Meanwhile, even though the six-figure rally in EUR/SEK seems overdone, the fundamental link is that a sharp slowdown in Europe will bring down Sweden too. This week brings lots of Swedish macro data, e.g., the Riksbank business survey (Tuesday) and NIER data (Wednesday). We see EUR/SEK at 10.50 and 10.40 in 1-3M. For the NOK, we continue to emphasise that mainland Norwegian exports are much less sensitive to a slowdown in Europe than one may think. Indeed, that was one of the reasons behind the hawkish NorgesBank message last week. If global sentiment stabilises, this further underpins a rebound in the NOK.