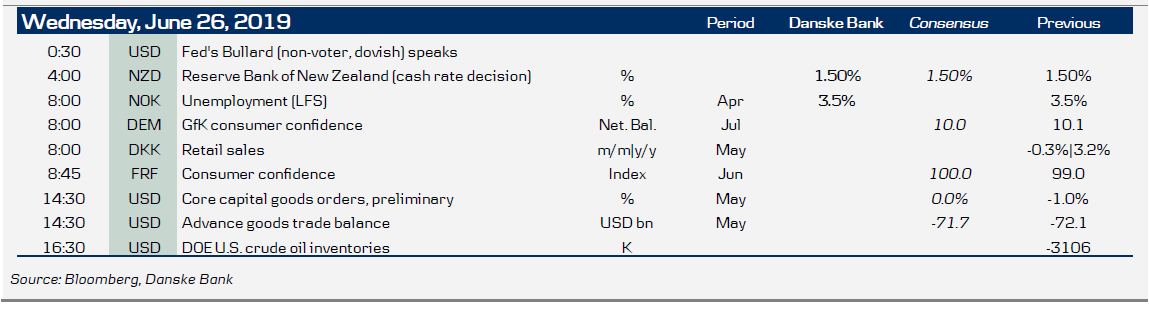

Market movers today

In the US, it will be interesting to see whether core capex orders for May show the same signs of weakness as PMIs as of late.

We also get a first glimpse of how German consumer sentiment has started into Q3 on an otherwise quiet day on the European data front ahead of tomorrow's and Friday's inflation figures.

A range of Bank of England MPC members, including Governor Carney, will testify before the UK Parliament Treasury Committee.

The EIA will publish its weekly oil inventories report today. The market will likely be on the lookout for at large drop in crude stocks after API yesterday reported a 7.6mb drop in crude stocks last week.

In Scandinavia, Norwegian unemployment data and Danish retail sales will be in focus.

Selected market news

The range of Fed speeches yesterday resulted in slightly higher short-term USD rates and a stronger USD. In particular, the market took note of comments from St. Louis Fed's Bullard, who argued for an insurance cut, but that 50bp would be overdone. Fed Chair Powell reiterated his message from the previous FOMC meeting, while adding that it is important not to overreact in the short term.

According to a Senior US administration official, US President Trump and Chinese President Xi Jinping could agree to restart trade talks when they likely meet this weekend at the G20 meeting in Japan.

In Denmark, the Social Democrats have reached an agreement with their three coalition parties to form a one-party government.

The Reserve Bank of New Zealand kept rates unchanged yesterday, but signalled that a further reduction in interest rates may be needed due to both slowing global and domestic growth.

Oil prices rose late yesterday, with Brent crude jumping above USD66/bbl. The market reacted to the news that API reported a 7.6mb drop in crude stocks last week. Oil inventories also dropped in May, when the market took it as a signal of weaker demand. However, the market reaction to these numbers suggests the market may now be more concerned about tighter supply.

Scandi markets

In Scandinavia, we have Norwegian unemployment data and Danish retail sale. A majority in parliament has agreed to support a Social Democratic minority government after the election three weeks ago. There are no major changes to economic policy in the agreement.

Fixed income markets

FOMC Chairman Powell reiterated the need for rate cuts yesterday and confirmed the statements from last week’s FOMC meeting. Other members of the Federal Reserve were more precise in their views, as one was calling for a 50bp cut this year and another thought a safety cut of 25bp was enough. The comments were made in interviews yesterday. However, the comments had limited impact on US equities and US Treasuries. 10Y Treasuries closed below 2% in yesterday’s trade.

Today, we have only some less important key figures released in the Eurozone, with the main focus on German consumer sentiment. Hence, the market is likely to remain rangebound with 10Y Bunds range-trading around -030bp to –35bp. The risk is skewed to the downside.

In Scandinavia, we have Norwegian unemployment data as the main data release, but the impact on the Norwegian market is likely to be limited. The Norwegian krone has lost momentum after the hike from Norges Bank last week, but the 10Y NGB-Bund spread is close to 180bp, which has been the peak this year.

FX markets

EUR/USD faced a reality check of Fed pricing yesterday when the Fed’s Bullard argued that a 50bp rate cut would be overdone and Powell failed to commit to easing. Comments from the two sent EUR/USD temporarily lower as USD rates shot higher. There is still some time to go before the 31 July FOMC meeting and more data and speeches to come, which means the market will likely continue to be in a limbo over whether to price a 50bp cut or not at the July meeting. In turn, EUR/USD should stay range-bound close to 1.14 near term before eventually rising to 1.15 in 3M (NYSE:MMM) as the Fed starts easing. Notably, there is still room for further reversal of short EUR/USD positions. Technically, the market will keep an eye on the 1.1448 top from 20 March.

In the Scandies, the external environment weighed on the NOK yesterday. Further, significant NOK/SEK selling weighed on the cross in a move difficult to explain from fundamentals or the news flow. In FX Trading Portfolio – Update on NOK FX trades we argue that the strategic outlook still favours more NOK strength but that the near-term outlook is more tricky via notably the loss in momentum and next week’s improvement in structural liquidity. This suggests a more cautious EUR/NOK stance near term.

EUR/SEK broke below 10.60 yesterday on the back of the hawkish move by Norges Bank. We would be cautious in jumping on the bandwagon for that particular reason though: for the Riksbank, next week a hawkish Norges Bank is of less importance than the dovish shifts from the Fed and ECB. Meanwhile, the SEK may also be supported by transitory monthend rebalancing needs. On a more global front, USD/SEK is heavy too amid broad-based USD weakness (this is arguably carry-related) and the upcoming G20 meeting should be pivotal.

Key figures and events