Market movers today

Markets are still awaiting the two key events this week: the ECB meeting tomorrow and the US employment report on Friday.

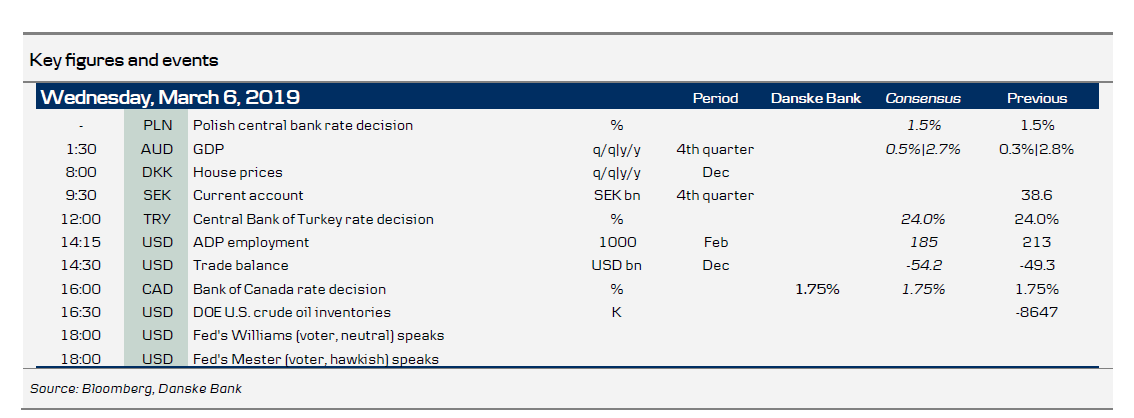

Today, we get the US ADP (NASDAQ:ADP) employment report, which offers some input on the job situation in the US. However, note that the correlation with non-farm payrolls on a month-to-month basis is not very high.

Further, US trade data is due; while normally it does not receive a lot of market attention, the chance that it might show that the US trade deficit has grown by more than USD100bn due Trump's presidency could mean it gets some focus amid the final rounds of trade negotiations between the US and China.

The Bank of Canada is widely expected to leave policy rates unchanged at today's interim policy meeting. At the last meeting (9 January), Poloz and co signalled that the next policy move is still expected to be a hike. Meanwhile, as in the US, markets have fully priced out any hike probability over the next 12M. Given our constructive view on the global economy and our call on Fed and oil, we think this is too dovish. However, we doubt we will see any significant re-pricing post today's announcement.

Tonight, the Fed's Beige Book is released and we will have speeches by the two Fed members Williams (NYSE:WMB) (voter, neutral) and Mester (voter, hawk).

Selected market news

Mixed sentiment overnight with Asian equities struggling after small losses in the US session. Notably, weaker-than-expected Australian GDP data showing growth decelerated to 2.3% (previous 2.8%, consensus 2.6%) helped dent risk appetite in Asia. This came after a relatively strong US non-manufacturing ISM report on Tuesday afternoon, which saw the overall index rebound to 59.7 in February (previous 56.7), driven by a decent increase in both business activity and new orders, albeit the employment component actually fell somewhat. At least this underlines that a US recession is not imminent and we should be on track for a healthy level of Q1 growth with 3% q/q (ar) in sight. However, the Fed's Rosengren helped dampen any attempts to reprice the Fed on this, as he was out stating it may take 'several meetings' before the Fed is ready to move on rates again. US Treasuries ended the day mixed but the 10Y yield declined a tad to 2.72%. USD crosses continued to edge higher as the ISM report helped add to the sense of a possible bottom in the US cycle.

Separately, the GBP was supported yesterday by noteworthy comments from Bank of England (BoE) governor Carney that the current market path for the Bank rate 'may not be high enough'. Meanwhile, May's talks with the EU were reportedly unsuccessful yesterday (but are set to continue today) and preparations for a no-deal outcome continue. The BoE announced that it has set up a EUR swap line with the ECB to ensure UK banks can have access to euro funding. And according to Sky News , the UK may cut tariffs down to zero for 80-90% of all goods (excluding cars and some food products) in case of a no deal Brexit.

Scandi markets

No significant calendar events scheduled in Scandinavia today.

Fixed income markets

The new 10Y Greek bond launched yesterday saw orders in excess of EUR11.8bn and the debt office sold EUR2.5bn, up from an initial EUR2.0bn target with a yield of 3.90%. Hence, the hunt for yield and carry is intact in the EGB market. BTPs also got a boost yesterday as the Italian service PMI rebounded into expansionary territory.

Today, Denmark will tap the markets today with a tap in the 5y and 10Y benchmark bonds of an estimated DKK2.5bn. The lack of duration in the Danish mortgage bond market bodes well for demand and we expect that DGBs will continue to tighten vs Germany in March.

Furthermore, we forecast a new rise in banks’ net position (excess liquidity) in the Danish market. It will further add support to the short-end of the DGB-curve. For more, see https://bit.ly/2VEwUY3. The EGB issuance calendar is empty today ahead of supply from Spain and France tomorrow.

FX markets

Among the majors, EUR/USD continued its slide yesterday and dipped below 1.13 on muted moves in US yields but helped by the strong US PMI report. We are still awaiting a likely repricing of the Fed in a more hawkish direction, which could deliver pockets of USD strength ahead but we do not envisage a trend move as such. Watch out for the Fed speakers today in this respect. Ahead of the ECB meeting tomorrow, focus for majors will be on the Bank of Canada today: while widely expected to be on hold, the statement will be scrutinised for hints of whether central banks are about to turn (1) more dovish amid global growth challenges, or (2) more hawkish as the skies may clear with the prospects growing for a trade deal and a decent Brexit.

In the Scandies, after a brief visit above 10.60, EUR/SEK turned lower on comments by Riksbank vice governor Cecilia Skingsley. She said SEK weakness was unjustified based on macro, that she is comfortable with the bank’s repo rate path and stressed that it has become more forward-looking and thus less inclined to respond to spot inflation. The latter can be seen as a response to the substantial January inflation miss. We think the Riksbank’s tolerance to such misses will be tested again next week when the February numbers are due out. Separately, Norwegian house prices fell a little short of expectations yesterday, but as the release followed two strong months and given how activity remains high in the housing market, the print is no game changer for the NOK. Indeed the tone for the NOK yesterday was set by the recovering SEK, and in recent days EUR/NOK has generally lagged EUR/SEK price action somewhat but as EUR/SEK recovered yesterday, NOK/SEK fell towards the 1.0750 level. We note that there is a big option expiry in NOK/SEK this week close to current spot levels, which could tie EUR/SEK and EUR/NOK price action together more than usual. That said, we still see a case for a lower EUR/NOK over the coming months.