Market movers today

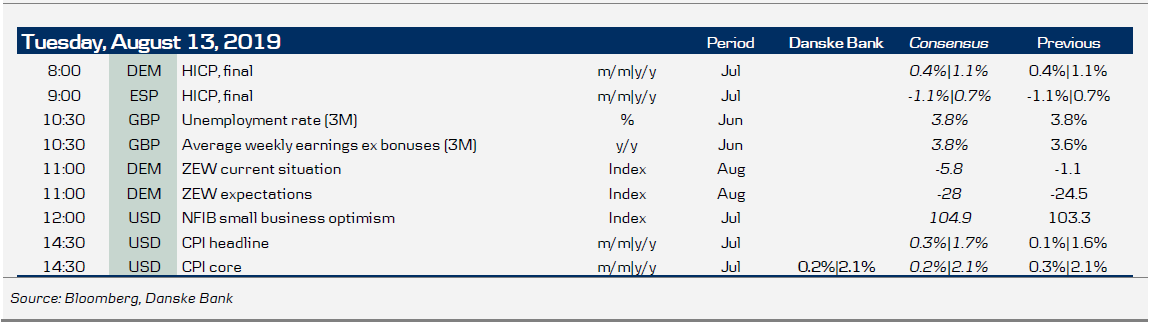

- In the euro area, the main focus is on the German Zew. We expect the Zew to decline further and hence continue to point to a gloomy outlook in the uncertain global environment and the escalation of trade war.

- In the UK, the labour market report for June is due out. The growth rates in wages and employment have been fairly high despite rather weak economic momentum. The question is whether this can continue or the labour market will start to show signs of moderation.

- In the US, CPI core is being released. We expect it rose +0.2% m/m in July, which translates into an unchanged annual inflation rate at 2.1% y/y.

- Overnight in China we get a batch of releases including industrial production, retail sales and fixed asset investments. In line with consensus, we expect the data still to paint a soft picture of the Chinese economy, but not a hard landing. Retail sales growth moved sharply higher but we expect it to have fallen back to around 8-8½% in July.

Selected market news

Political uncertainty in Europe, Asia and Latin America clouded financial markets yesterday and overnight. Negative risk sentiment is prevailing, with equity markets in the US and Asia down over 1%, bond yields trading close to record low levels and the yen continuing to appreciate.

The Argentinian market made headlines yesterday as its asset prices and currency collapsed following President Mauricio Macri's defeat in the weekend's primary elections. Even though the market has corrected some, the Argentinian peso is still down some 16% compared to Friday's close, while its stock market lost close to 40% of its value yesterday.

In Italy, the Senate has yet to agree on the date for a no confidence vote on Prime Minister Conte's government. The latest reports suggest that a decision is likely to be made tonight and that the vote could take place on Tuesday next week. The Italian CDS has risen closer to the high level seen last May, but is still trading at some distance from the levels seen last year.

At a regular press conference overnight, Hong Kong's Chief Executive Carrie Lam, when faced with questions about the recent development in protests and demonstrations, said: "It would take a very long time to restore Hong Kong." She further urged everyone to set aside prejudice. In the Chinese state media, speculation has begun about whether China would intervene if the situation in Hong Kong does not improve.

Fixed income markets

Risk appetite remains under pressure as markets focus not only on the ongoing trade war, but also developments in Italy, Hong Kong and the looming problems in Argentina, where the CDS is spiking after the primary elections showed low support for market-friendly Prime Minister Macri. 10Y US treasury yields dropped as low as 1.64% and 30Y yields dropped to 2.12% - a year low and close to the all-time low of 2.08%. We can expect 10Y Germany to break firmly below -0.60% today.

That said, BTPs saw some support yesterday after Fitch confirmed the rating on Friday and as the higher yields, especially in the short end of the curve, attracted investors. We like the 1Y BOTs, which are still trading above zero.

FX markets

If Norges Bank comes out slightly on the hawkish side compared with market pricing on Thursday, we could see some temporary support for the NOK. However, the market would be likely to fade such a move, as Norwegian economic fundamentals and monetary policy matter less in the current weak global risk environment. Until we see further clarity on the outlook for the global economy, trade war, etc, we prefer to stay on the sidelines in EUR/NOK. See more in Norges Bank Preview Global turmoil calls for vaguer rhetoric.

Due to a previously overlooked measurement technicality, we have decided to revise our inflation forecast downwards. We now see CPIF at 1.5% (previously 1.6%). Our new lower call limits the potential downside in EUR/SEK, as we are now only slightly above consensus at 1.4%, albeit we could still see the SEK strengthening somewhat should we get it right.

In the majors, on a news-less Monday, USD/JPY reached new lows yesterday close to the 105.00 level. Even though the past couple of days have been relatively uneventful for the majors, the market still seems to have a bias for adding to ‘risk-off’ trades. This sentiment in FX markets is also visible in the latest IMM positioning data, which shows that the market has added speculative long JPY positions. Note further that pressure is increasing on the Bank of Japan to respond to the recent slide in 10Y yields below the lower bound of its target range of minus 0.20%. We are close to our 3M (NYSE:MMM) and 6M forecast for USD/JPY of 105, but stress that there is room for an undershooting of these levels if risk sentiment deteriorates further, e.g. on the back of weaker data or a further escalation of the trade war.

The Argentinian peso tumbled yesterday following the severe loss by the market-friendly president Mauricio Macri to the leftish opposition candidate Alberto Fernandez in the primary elections on Sunday, which comes ahead of the presidential elections in October.

The USD/ARS increased by 16% as investors fear the commitment of Mr Fernandez to the ongoing IMF programme would be significantly weaker, raising the prospect of a default on Argentinian debt if he becomes president in October. Near term, the central bank is likely to step in and support the ARS. Mr Fernandez has stressed that he supports the broad parameters of the IMF programme, but uncertainty has increased, which will keep the pressure on the ARS.

Key figures and events