Market movers today

After a week of thin Easter trading, focus will be on the uptrend in oil prices (more below) and on news from the ongoing US-China trade talks; for more on our expectations of what a trade deal could bring market-wise, see Global Research - What a US-China trade deal will bring to the markets . The start of Japan's Golden Week will likely keep volumes thin in that region this week.

The oil market will stay in focus after the comments by President Trump yesterday that the US plans to end Iran sanction waivers by 2 May. Notably, attention will centre on whether other OPEC members will ensure adequate oil supplies after a further fall in Iran oil exports, as indeed suggested by Saudi Arabia yesterday.

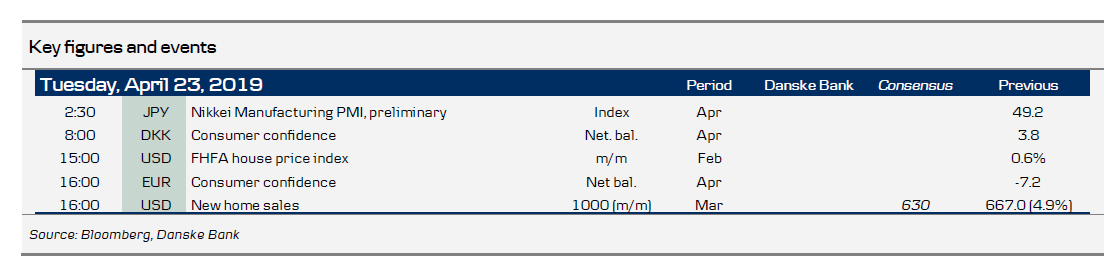

On the data front, we have a rather quiet day with the only notable release being the euro-area consumer confidence for April. Later this week the Riksbank meets (Thursday) and next week brings Chinese PMI, a Fed meeting and the US jobs report.

Danish consumer confidence data is due today; see Scandi section p. 2 for details.

Selected market news

A continued uptick in global oil prices is setting the scene for markets following a week of thin Easter trading. Notably, over the weekend, the US administration announced that it would not renew waivers on sanctions on Iranian oil exports. This effectively means that a range of countries that have been allowed to take up oil from Iran, despite the US withdrawing from the Iranian nuclear deal in May last year, will no longer be allowed to do so starting from 2 May this year. While Saudi Arabia and the UAE reportedly aim to make up for a good deal of the 1.9 mb/d that Iran currently supplies, Brent crude oil rallied past USD74/bbl yesterday. Indeed, the US removal of waivers is just one of a string of recent supply concerns hitting the oil market. Adding to strains, Iran has threatened to close the Strait of Hormuz - a key gateway for Middle East oil to the rest of the world.

Risk sentiment has held up reasonably well so far in the wake of the sustained oil uptick, with major equity indices little changed over the Easter period. Trading has been mixed overnight in both the US and Asian sessions. Over the past few trading days, US 10Y yields have settled just above 2.55% while the German 10Y bund again fell below 0.025% after PMIs came out on the weak side of expectations in the euro zone (and the US) ahead of the Easter period; EUR/USD dropped below 1.13 as a result. We stress, however, that some key signs of stabilisation are visible in the euro-zone figures, as notably, the PMI 'new orders' rose for the first time since December 2017. Hence, we still hold the view that the euro-zone economy is bottoming out in Q2 and will regain some momentum in H2 19, with annual growth of 1.3% for 2019.

Scandi markets

In Denmark, new consumer confidence data is due today. We have become accustomed to lower levels of consumer confidence at around 3 on the index, meaning Danes are generally less positive compared with the summer, when consumer confidence was around 10. Hence, there has been a marked drop in optimism, though we expect slightly more cheer in April and forecast consumer confidence at 4.7.

Fixed income markets

Bunds rallied last week on the back of weaker-than-expected euro PMIs – if the IFO indicator surprises on the downside this week, it will likely confirm the weak sentiment in Germany and send core-EU yields lower again. There are some EUR43bn in redemptions and coupons from France, and thus a big reinvestment need from the more passive investors such as ETFs. However, much of the seasonality in French government bonds has already been priced in given a 10Y spread around 33-34bp. Hence, we expect to see only a modest tightening in France versus Germany on the back of the redemption flow.

Italy and Greece are up for review by S&P. The rating agency already has Italy on negative outlook, and the risk is that Italy is downgraded one notch to BBB- given that the deficit for 2019 has been revised up and growth down. The risk of a downgrade is not really priced in the 10Y Italian-German yield spread, but we stay neutral on Italy. Indeed, we still prefer Spain despite a tight spread to core-EU. The upcoming elections on 28 April indicated that the current left-wing government will win but still needs the support from e.g. Podemos. This could provide some short-term ‘noise’, but we expect limited impact on Spanish government bonds in the long run.

FX markets

Towards the end of last week, EUR/USD dropped back below 1.13 following another disappointing PMI reading out of the euro zone; US figures, however, also came out on the weak side. Continued upward pressure on oil and continued support for equities helped to stabilise the cross though. We look for EUR/USD to stay close to 1.13 on 3M (NYSE:MMM). Calendarwise, the next big movers are not until next week. Elsewhere in the majors, EUR/GBP has remained steady above 0.8650 and USD/JPY close to 112. EUR/CHF remains in an uptrend though, as demand for safe havens is waning amid more upbeat global sentiment and underpinned by comments ahead of Easter from the SNB’s Jordan that rate cuts (from the current -0.75%) are a viable option. We note, however, that positioning looks ever more stretched on CHF – but also JPY – shorts, see IMM Positioning Update.

In the Scandies, the NOK continues to benefit from the rise in oil prices with EUR/NOK now settling in the 9.50s. With domestic data keeping up, diminished global geopolitical risks, higher oil prices and improving global economic data, we still think markets are underestimating the likelihood of a June rate hike. Indeed, under a reasonable set of assumptions, Norges Bank’s rate path implies a roughly two-thirds probability of an early summer hike. Also, despite the latest NOK rise, the import-weighted NOK (I44) actually remains weaker than the central bank projection. Hence, we think the NOK rally has further legs to go. EUR/SEK is back above 10.45 ahead of Thursday’s Riksbank meeting.

As noted in Reading the Markets Sweden - 12 April 2019, our base case is that the Riksbank will revise down its inflation forecast but keep the repo rate path intact this month. The market will likely take this a bit hawkishly and EUR/SEK could drop more than 10 figures, towards 10.30. On the other hand, should the Riksbank lower the rate path after all, EUR/SEK could once again challenge the 10.60 highs. In any case, we do not underestimate the volatility of the cross in response to the Riksbank’s actions.