Market movers today

- Focus is again on Brexit with the UK House of Commons returning to session. It looks like we are heading for a snap election sooner than expected. Today there will be an emergency debate on a bill trying to force PM Johnson to ask and accept another Brexit extension until 31 January in case no deal is reached no later than at the EU summit 17-18 October. A government official has said PM Johnson will start the process for 14 October general election if he loses the vote (needs two-third majority). PM Johnson will make a public statement at 19:00 CEST.

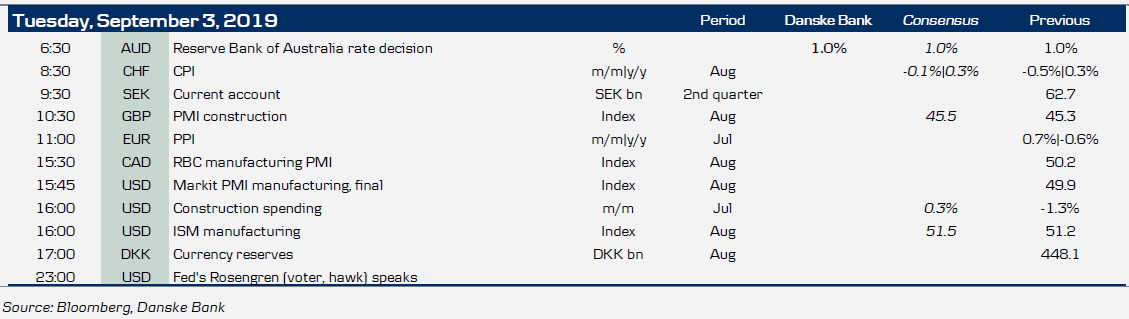

- A key economic release today is the US ISM manufacturing survey for August. Weighted regional PMIs suggest that ISM manufacturing is set to come in stronger, but Markit PMI suggests a decline. We expect ISM manufacturing to fall slightly to 50.8 but given the mixed signals it is not a high conviction call.

- The ISM survey is one out of a few important gauges for Fed policy makers ahead of the crucial September meeting in two weeks. Tonight we will hear Fed's Rosengren's (voter, hawk, dissented first cut) views on the US economy and Fed policy.

Selected market news

Developments in the UK will likely set the agenda in markets today . In our view, the most likely scenario is an election soon. EUR/GBP remains fairly stable for now, though, trading below 91, still some way from the peak in early August above 93.

The biggest move in markets this week has been the USD. The trade weighed USD keeps pushing higher to the strongest level in two and a half years. Bond and stock markets are mostly treading water awaiting new developments in the US-China trade war and more signals on the state of the global economy and the extent of policy stimulus. The ISM manufacturing this afternoon will shed light on the state of the US economy after PMIs worldwide yesterday continued to paint a fairly bleak picture of the global economy, see CNBC .

According to Bloomberg , the US and China struggle to get a face-to-face meeting in place in September , as the new round of tariffs imposed on Sunday is hurting trust between the two sides. Washington did not meet a Chinese request to delay the tariff hike on 1 September. The fact that the two sides struggle to agree even on the conditions for a new meeting is in our view indicative of how far the two sides are from each other despite US President Donald Trump's frequent messages that the talks are going fine. Trust may have been hampered further by Trump referring to a call from Beijing negotiators that apparently never took place. For now the correspondence is in our view more a matter of damage control and avoiding further escalation than getting any closer to a deal.

In Hong Kong the protests have become more violent again lately . The police is now taking a harsher stance on the most radical protesters using mass arrests, see SCMP . So far there is no sign that Beijing is set to move in forces and we believe it will only happen if things get completely out of control.

Scandi markets

No big events in Scandi today. For comments on SEK and NOK see FX markets below.

Fixed income markets

We saw some upward pressure on yields/rates yesterday, but it was difficult for the market to maintain a bearish pressure and we ended the day more or less unchanged for the 10Y German government bond yield. Italy continued to perform in the long end of the curve. A new government between PD and the 5SM seems more and more likely on the back of opinion polls among PD voters and 5SM voters.

UK government yields continue to decline as the risk of a hard Brexit increases. Now there is also the risk of a general election mid-October given yesterday’s comments from PM Johnson. Hence, the political uncertainty continues to increase and bond yields decline. Short term it is difficult to see this change much. Hence, the downward pressure on UK Gilt yields is likely to persist in the coming weeks.

Today, Austria will be doing a small tap in the 5Y and 10Y segment. The Austrian debt office plans to sell EUR1.15bn. The auction should go smoothly despite the very negative rates on Austrian government bonds. However, the 5Y benchmark (RAGB 0% 07/24) trades almost 20bp higher than a matching German government bond (OBL 0% 10/24). The 5Y bond is a bit cheap as the spread to Germany has widened from 11bp to 18bp since early August.

The main key economic event today is the release of US PMI data for August. The consensus call is for a modest increase relative to July. However, soft data will support the downward pressure on global yields.

FX markets

The trade war continues, with the latest headlines discussing when/if trade talks are to be resumed after the latest round of tariffs. In addition, Latin American and Asian PMIs continued to send signals of weakness in the global manufacturing sector. In light of this, USD/CNH moved nearly 0.5% yesterday, to just shy of 7.20. It would appear the CNH leg of USD/CNH is once again absorbing negative news and we believe this will continue to be the case. Conversely, we expect broad dollar to continue appreciating against EM.

Notably, USD/JPY looks quite poised to take a leg lower towards and likely below 105, if commodities start slipping on the back of a global deterioration.

EUR/USD trended lower yesterday as broad USD continued to see support. The strong USD could be challenged the coming days. We look for ISM manufacturing to drop today and disappoint consensus expectation. That should weigh on USD and halt the recent bearish momentum in EUR/USD. Tonight Boston Fed’s Rosengreen will kick off a series of Fed speeches this week before the blackout period begins on Saturday, ahead of the FOMC meeting. Rosengreen’s relatively hawkish views are well known though and we doubt he will move the market. Rather we are looking forward to NY Fed’s Williams’ speech tomorrow and Fed Chair Powell on Friday.

EUR/GBP remains incredibly stable, hovering just below 0.91. Tomorrow, the MPs will request an emergency debate on a motion forcing PM Johnson to ask (and accept) an extension to Brexit. The debate will likely be scheduled for Wednesday (vote soon after). We continue to hold the view that the current uncertainty will not in itself be sufficient to move EUR/GBP substantially. As of the current pricing, the volatility will likely come after we have converged on some sort of outcome (deal, no-deal, election and extension or so).

Yesterday the SEK strengthened on the back of the stronger-than-expected Swedish manufacturing PMI. However, we believe this respite to be temporary and as such EUR/SEK remains a buy-on-dips in our view. The Riksbank rate decision looms and the event itself should prove rather binary: a lowered rate path (our base case) should weigh on the SEK while a stubborn Riksbank (i.e. unchanged rate path) could make the cross eye 10.70 once again. Regardless of the outcome, the long-term trend in EUR/SEK remains upwards sloping towards 11.00 (our 12M forecast).

Last week’s data releases out of Norway have been comforting (oil investment survey, labour market reports, GDP, retail sales) and yesterday’s manufacturing PMI was no exception. As expected the print rebounded strongly above the fifty-threshold to 53.8 with strong underlying details. The NOK gained upon the release as it presumably raised the probability of a September Norges Bank rate hike. To be fair, however, the volatility in the manufacturing PMI has made the release less important to most Scandinavian-based analysts; especially during summer. Ultimately, we think the Norges Bank decision will boil down to the Regional Network Survey (10 September). We expect this to be strong and hence as long as we do not see a selloff in global equity markets we could be in for some relative rates-induced NOK strength in the coming weeks.

Key figures and events