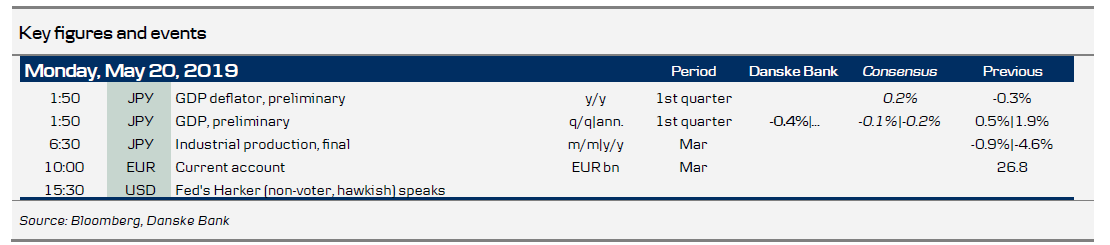

Market movers today

We start the week in a quiet fashion on the data front and even the US-China trade war might be entering a quiet phase after the recent round of escalation. The next thing to look for is any news on more Chinese stimulus and more specific information regarding when the next round of talks in Beijing will take place. While things may have calmed down for now, we still see a risk of another flare-up later as the two sides seem far from each other on the last critical bits of the deal. More financial stress is needed, in our view, to get enough pressure to reach a deal. For more on this, see also China Weekly Letter - China strikes defiant tone, recovery postponed , 16 May 2019.

Later this week, markets will keep an eye on the PMI readings out on both sides of the Atlantic to gauge what is next for the global economy after the new trade spat. In the UK, the EU elections, which start on Thursday, could inflict a heavy defeat on the Conservative Party and increase pressure on Prime Minister Theresa May to resign.

Selected market news

Asian stocks are up this morning, helped by election wins for incumbents in India and Australia and better-than-expected Japanese GDP figures. Defying gloomy survey readings that had pointed to a slowdown, the Japanese economy expanded by an annualised 2.1% in Q1. However the details suggest that consumer demand has remained soft and in light of slowing demand from China and ASEAN countries due to the trade war, we remain cautious on the outlook for Japan.

Elsewhere, politics continues to dominate the news flow. After cross-party talks with Labour collapsed last week, the GBP hit its weakest level since February. Over the weekend, embattled PM Theresa May promised to make a "bold offer" and set out a "new and improved" Brexit deal as she tries to pass her EU withdrawal treaty at the fourth attempt in early June. Although the new offer is said to include improvements on workers' rights, Labour leader Jeremy Corbyn is widely quoted as being sceptical of any deal passing and hence a June agreement is already facing headwinds. On previous occasions the GBP would rally mildly on the news of a change in the impasse and this could very well happen again in the coming week. However, overall, we remain sceptical, as we see only a slim likelihood of the bill passing, after pressure on politicians to find a way forward has eased following the Brexit deadline extension.

Austria is heading for new elections after vice-chancellor Strache from the far-right FPÖ party resigned over a corruption scandal on Saturday, plunging the country into a government crisis just days ahead of the European elections, see here .

Amid rising tensions in the Middle East - not least due to more sabre-rattling between the US and Iran - and signs from OPEC producers of continuing output cuts, oil prices surged past USD73/bbl.

Scandi markets

No releases in the Scandi countries today.

Fixed income markets

There are limited key economic data releases today. This morning, Japanese GDP data for Q1 was released, which surprised on the upside, as the economy grew 2.1% rather than contracted 0.2% q/q (annualised). This was a surprise and may ease the pressure on the BoJ and the upcoming introduction of another sales tax. The reaction to 10Y Japanese government bonds was modest, as yields rose only 1bp this morning. We have seen a modest rise in government bond yields this morning in the Asian region, as governments in Australia and India won, or are expected to win, general elections and thus ease some of the geopolitical pressure.

However, the market will continue to focus on the trade dispute between the US and China, where negative sentiment has pushed yields lower, and with the 2y2y EUR inflation swap rate moving towards 1%, there is room for a further decline in yields.

In the European government bond market, there is a positive net cash flow that needs to be reinvested, as shown in our GBW: new 20Y Dutch green bond. See more here Government Bonds Weekly - We recommend paying 9m3m EONIA and a new 20Y Dutch green bond, we also discuss ECB pricing and argue that the pricing is too benign given the stability of the Eonia fixing. We doubt that the ECB will cut rates and recommend paying Eonia 9M3M forward. We are also still cautious in buying Italy even though the 2Y-5Y curve is quite steep and 5Y looks attractive. In terms of issuance, the focus is on the new 20Y Green bond from the Netherlands. We expect it to be priced in line with non-green Dutch government bonds. Investors in the French, Belgian and Irish green government bonds have so far been unwilling to pay up for the Green label.

FX markets

EUR/USD will look ahead to Thursday’s release of May’s flash PMIs. We look for a slightly bigger rebound in the Eurozone manufacturing PMI than consensus, which should break the negative trend seen since last summer of EUR/USD plummeting on disappointing flash Eurozone PMIs. In the bigger picture, a US-China trade deal is not in the cards before late Q3 and a recovery in Chinese PMIs not due before Q4. These are important prerequisites for a sustained uptick in EUR/USD. We forecast EUR/USD at 1.12 in 1M, 1.13 in 3M (NYSE:MMM) and then rising to 1.15 in 6M.

Also for the Scandies, risk sentiment derived from the cocktail of Eurozone data, trade negotiations and central bank communication will prove pivotal in a relatively thin week on the domestic data front. Highlights of the week will be Norwegian LFS data and a couple of Riksbank speeches that will likely be scrutinised for new information. That said, we have just learned that the Riksbank has reverted to its old habit of poor verbal guidance between meetings. Ironically, transparency is the theme of a speech by Mr Ingves on Thursday.

In Australia, PM Scott Morrison won re-election, although the incumbent Labor Party had been widely expected to win. With his election, the focus of economic policy turns to helping the housing market, prospects of tax cuts and infrastructure investment. Given a struggling economy, an expansive policy would be helpful but the timeline remains uncertain. We expect the AUD to struggle in the coming months.