Market movers today

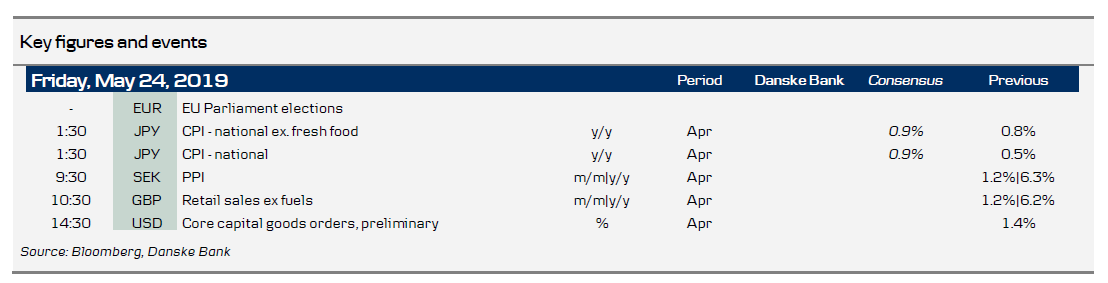

After 'Super Thursday' yesterday brought another set of subdued PMI data on both sides of the Atlantic, markets are in for a more quiet day on the data front today.

EU parliament elections continue to take place today in Ireland and Czech Republic. Results will however only be announced when voting in all EU countries has closed on Sunday evening. For more on our expectations regarding the EU election outcome, see 2019 EU Parliament elections: Setting the scene for the 'European Game of Thrones' .

In the UK, Theresa May is today expected to announce timetable for her resignation as U.K. Conservative Party leader and prime minister after the backlash over her Brexit plans, for more details on the situation, please see Brexit Monitor - End of May .

In the US, preliminary core capex for April is due out. Core capex has softened recently but remains at a high level and we expect investments to continue to increase over this year.

Selected market news

Yesterday, PMI releases in advanced economies cast doubt about the outlook for the global economy . Most severe was the slump in the US, where both the manufacturing and service PMIs dropped sharply. While it is not a big surprise that US manufacturing is not immune to the weakening global economic environment (global value chains), the service sector slowdown is more surprising given the strength of the US labour market. The Japanese and German PMIs also surprised on the downside while the French PMI was a rare light of hope. The weakening of the PMIs comes amid the significant uncertainty about trade relations between China and US triggered by the renewed trade dispute between the two countries over the past month.

The weak signs from the leading global economies led to a sizeable sell-off in global equity markets . The European and US equity markets finished sharply lower while US yields plummeted fuelled partly by further expectations of rate cuts by the Federal Reserve. Asian equity markets this morning, however, are paring losses after indications from US President Trump following the close on Wall Street that Huawei Technologies Co., which was put on a U.S. blacklist earlier this month, could be part of a trade pact with the country.

In the UK, Prime Minister Theresa May is expected to set a timetable for her resignation as U.K. Conservative Party leader and prime minister following the backlash over her latest Brexit proposal (see Brexit Monitor - End of May ). According to Bloomberg news, May intends to quit as Tory leader on June 10 so an election to choose her replacement can begin after President Donald Trump's state visit to Britain. The timetable is expected to be set today. The current favourite to replace her is pro-Leave campaigner Boris Johnson, who is in favour of a cleaner exit from the EU. The GBP saw further decline yesterday.

Scandi markets

Cecilia Skingsley speaks about ”The economic situation and current monetary policy” at 12:00 CET. At this point she will probably stick to the main plan as it was communicated at the April meeting. In addition we have PPI and housing data at 09:30.

Fixed income markets

Global bond yields decline on the back of weaker PMIs, the trade dispute between US and China as well as the possible resignation by UK prime minister May today.

Today, Spain is up for review by Moody’s and Portugal is up for review by Fitch. We expect Spain will receive a positive outlook on the back of the fundamentals as well as lower funding cost as shown by the low yield at the auction on Thursday. There is a possibility that Portugal will also receive a positive outlook. A change in the rating or the outlook is a positive factor for both Spanish and Portuguese bond yield.

FX markets

Horrific flash PMIs in both the Euro Area and the US triggered a strong risk-off move yesterday and sent US rates and yields sharply lower. However, for once the market did not buy the green back. As we argued earlier in the week a break with recent policy inaction on the trade war and/or monetary policy would be needed for our medium-term view of a higher EUR/USD to start materialising, for more please see FX Strategy - Policy inaction keeping a lid on EUR/USD. There is not much in the forward looking indicators of the PMIs to suggest a near-term turnaround for the better. Hence, we might be approaching the tipping point where data and market sentiment are bad enough to force central banks’ hand.

In particular, we will follow Fed speakers in coming weeks for hints as to whether they are ready to move towards the increasingly dovish market pricing. In turn, this could be the market’s cue to start reversing short positions in EUR/USD.

In the Scandies, both SEK and NOK sold off in late trading amid the global risk-off. Especially the NOK took a beating on oil falling below USD 70/bbl. Paradoxically, the move came on a day where the LFS report confirmed that the labour market clearly is in better shape than what Norges Bank expected in March. At this stage we would need a significant negative shock for Norges Bank not to hike next month – yet for the currency the global environment remains the clear driver. We still think it makes sense to be positioned for a higher NOK/SEK and a lower AUD/NOK as the two crosses are better shielded against the global environment.