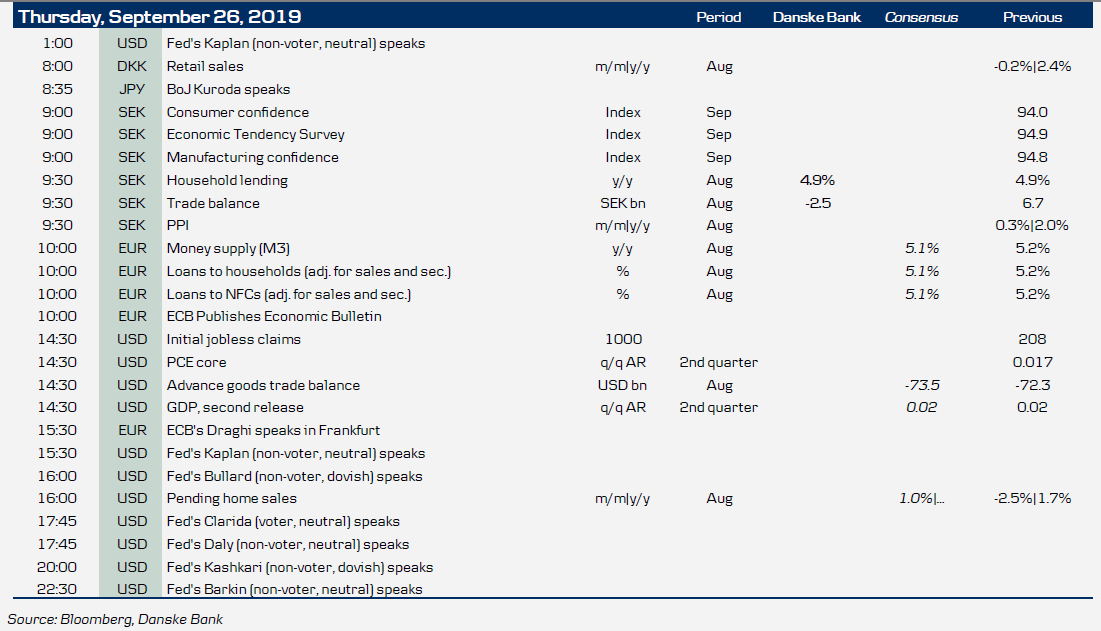

Market movers today

On the data front, we expect that household lending growth in Sweden remained stable at 4.9% y/y in August. Although the outlook for Riksbank action is uncertain, we expect mortgage rates to remain low. To some extent, this may have been mitigated by deteriorating labour market data.Weekly US jobless claims could prove interesting in light of the weak reading of Monday's flash PMI employment index.European money growth data will give the status of monetary policy transmission before the restart of ECB's QE programme. .In central bank speeches, ECB's Draghi (15:30 CEST) and the Fed's Kaplan, Bullard, Clarida, Daly, Kashkari and Barkin will all speak this afternoon.USD funding market will keep a close watch on the results of Fed's repo operations. It has scheduled to roll over its overnight repo operation and increased the limit to USD100bn (from USD75bn) and conduct its second two-week term repo operation this week with a limit of USD60bn (compared to USD30bn on Tuesday).Selected market news

Oil prices dropped sharply yesterday on the back of the combination of negative risk sentiment, a strong USD and news that Saudi Arabia is ahead of schedule in returning oil production to normal following the attack on two production facilities 1½ week ago.

USD75bn was rolled over in the Fed's overnight repo operation yesterday. A total of USD92bn of bids were submitted - up from USD80bn on Tuesday. Hence, the Fed's total liquidity injection via temporary repos still stands at USD105bn. It will likely rise today, where the Fed has increased the limit on its overnight repo to USD100bn and plans to conduct another two-week term repo of up to USD60bn. If fully utilised, the Fed's liquidity provision via temporary repos will rise to USD190bn. The effective Fed Funds rate was unchanged at 1.90% for a fourth straight day.

Last night, ECB board member Sabine Lautenschläger resigned (by 31 October 2019). The press statement does not provide an explanation for her resignation; however, we note that the ECB just launched a stimulus package and given that she was among the most hawkish in the governing council, there may be a connection. The near-term monetary policy implication is that the ECB will have only 5 board members until a replacement is found. Her replacement is likely to be less hawkish than she is. Last time a board member resigned was in 2011 (Jurgen Stark) due to the launch of non-standard measures taken at the time.

A number of Fed officials spoke and made comments yesterday. Chicago Fed's Evans said he did not forecast another rate cut this year as he saw easing as a mid-cycle adjustment. In a Bloomberg Opinion column, Minneapolis Fed's Kashkari said that recent unrest in money markets 'does signal that something's very wrong with the financial system'.

Scandi markets

In Sweden, we are set to get a quite a lot of data today. We expect NIER confidence data for households and business sectors to stabilise around last month’s levels, but the trend is downwards and it would not surprise us if the weak German confidence data will take its toll on the manufacturing sector and export orders. Given the (very) poor labour market data received over the last couple of months, it will also be interesting to see businesses’ views on hiring plans and if it will pull consumer confidence lower. Households have been rather optimistic about their own economic situations, but that may quickly change with a weak labour market. We also get PPI, trade balance and household lending statistics for August. We expect the trade balance at SEK -2.5bn and the household lending growth to have remained steady at 4.9% y/y.

Fixed income markets

The positive sentiment in the US Treasury market turned negative yesterday on the back of a soft 5Y US Treasury auction combined with a rebound in equities and the comments from President Trump on a possible trade deal with China. There was some spill-over effect to the European markets, but the spread between the periphery and core EU continued to tighten across the yield curve.

Today, the Italian Debt Office will be selling up EUR7.5bn in a new 6Y bond as well as tapping in the 6Y floater and an 11Y bond. We expect there will be decent demand at the auction even though spreads have tightened vs EU peers. However, the need for yield is still very strong and with the new Italian government looking for a budget deficit around 2% in 2020, the outlook for Italian debt looks strong. We will get a string of data from Europe and the US as well as a speech from the ECB’s Draghi.

The Danish Debt Office will do a tap in T-bills. These are bought mainly by foreign investors swapping them into USD, GBP, etc.

FX markets

Cyclical currencies were initially weaker on Wednesday but that move reversed late in the day as Trump tweeted that a deal with China might be close, and after an ‘enhanced’ trade deal was signed between the US and Japan. It is further worth noting that the USD has in broad terms been seemingly little moved by the impeachment process gaining traction against the US president. Further, the NZD strengthened overnight after RBNZ governor Orr said in a speech following yesterday’s decision to keep rates unchanged that unconventional monetary policy in New Zealand is unlikely.

For the GBP, the Supreme Court ruling earlier in the week and Labour leader Corbyn’s speech yesterday in which he urged Johnson to step down, sterling is looking more prone to price in political risks again after having moved to levels that we consider somewhat stretched, i.e. too much optimism has been baked in, in our view.

In Sweden, we get a batch of macro numbers this morning, where in particular the NIER confidence data have market-moving potential - in both directions, that is. After a series of poor macro readings, the Swedish surprise index is at historically depressed levels, which suggests it will be more difficult to disappoint - and conversely easier to beat expectations.

However, as long as data continue to challenge the Riksbank’s rather optimistic narrative of the economy, we think there is ample room for re-pricing the money-market curve, which in turn should be bullish EUR/SEK.

Key figures and events