Market movers today

It's time for the long-awaited ECB meeting today. While no changes to interest rates are expected, the growth outlook and new staff projections alongside the discussion about a new liquidity facility will take centre stage. Yesterday, sources close to the ECB revealed that growth and inflation projections would see an extensive downward revision. However, the ECB is still looking for a recovery during the year in line with our expectations and we do not expect new signals at the meeting, or an announcement on a liquidity facility (contrary to market consensus). Watch out for a potential volatile and sharp intraday market reaction, as market expectations for the meeting are more dovish than ours.

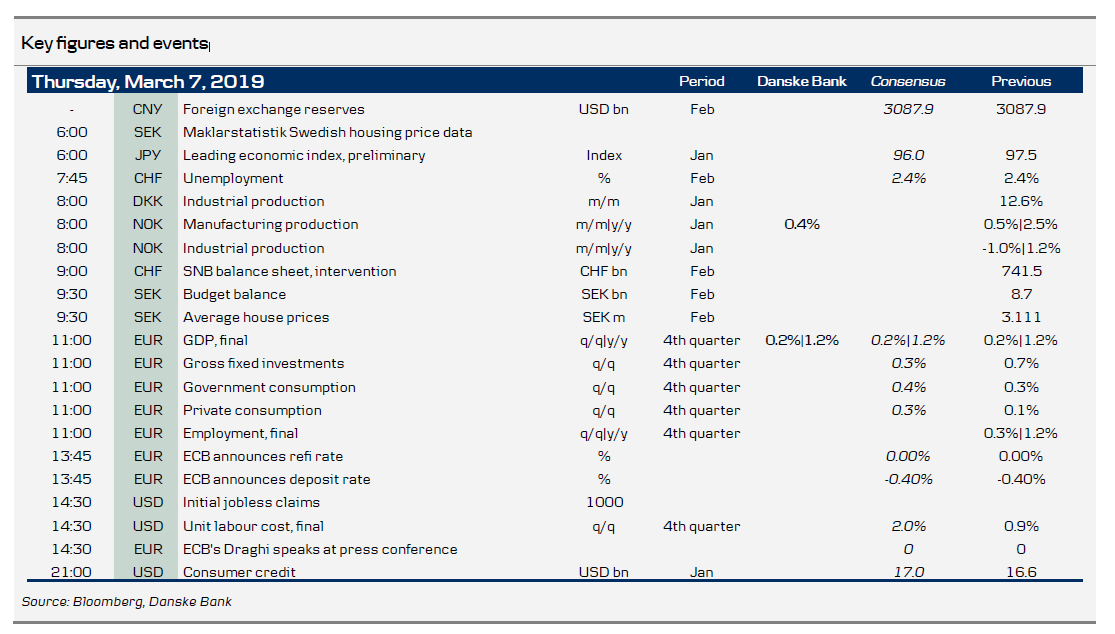

US initial jobless claims will give another signal on the status of the business cycle and labour market in the US. Jobless claims have been hovering around 225k for a while, which is still in line with a robust labour market and decent growth.

In Scandi, Norway is set to release data on manufacturing production and Sweden will publish house price statistics.

Selected market news

Swedish apartment and house prices were unchanged in February, according to the Swedish Maklarstatistik. In the Greater Stockholm area, house prices rose 1%, while apartment prices were unchanged.

Yesterday, a Bloomberg story suggested that the ECB staff projections published later today would justify an announcement of a new liquidity operation. The same story suggested growth projections would point to close to potential growth by the end of the year (thereby implying no major change in the growth narrative). While we do not expect a liquidity operation to be announced later today (see above also), the discussion that takes place will be very important for a potential monetary policy case - and as such, point to confidence about a temporary (or potential) structural growth slowdown in the euro area. The ECB published an opinion with no objection to Philip Lane replacing Peter Praet as ECB chief economist. With the EP and ECB's positive opinion on Philip Lane, the European Council would be the last formal body to give approval before Lane could start at the ECB on 1 June 2019.

US crude oil stocks rose more than 7mb last week, according to EIA data published yesterday. While crude oil inventories can be volatile, the large build does raise some concerns about weak demand in the oil market at a time when key figures for global economic growth have been weak.

Scandi markets

Norway. We expect manufacturing production figures to show a 0.4% m/m increase in January fuelled by stronger growth in oil-related industries. Through monthly volatility, the PMI figures show no sign of a slowdown in the manufacturing sector despite the global turmoil.

Fixed income markets

Global yields rallied yesterday as a number of stories supported sentiment, among them dovish comments from the Fed’s Williams (NYSE:WMB), EU and UK officials saying that a Brexit breakthrough was not near and, not least, the Bloomberg ECB story. It suggested that the ECB staff projections published later today (see front page) would imply an extensive downward revision and justify an announcement of a new liquidity operation.

Before the ECB verdict, the market will have to absorb supply from Spain and France. Given the market optimism yesterday after the ECB Bloomberg story, we look for good demand at both auctions. Spain will tap in the 5Y, 10Y, 30Y nominals and the 10Y linker. We continue to favour the 5Y segment in Spain. France will also add significant duration today, as the debt office will open a new 10Y OAT (0.5% May-29) and tap in the 15Y and 25Y bonds.

We have published Reading the Markets Denmark. We continue to recommend to receive DKK 5Y swaps vs EUR 5Y given the expected jump in banks’ net position (excess liquidity in April). We also look at high coupon callables, where we see the greatest potential for further performance among 20Y callables compared to 30Y callables.

FX markets

Yesterday afternoon, the Riksbank announced that it is reducing its FX reserve by USD8bn due to a change in contingency needs due to (1) shifts in bank balances, such that these now hold larger liquidity reserves, and (2) Nordea’s move to Finland, which leaves it under ECB (rather than Riksbank) supervision. The drop in FX reserve will be effectuated by allowing dollar loans from the Swedish National Debt Office maturing during the course of this year to run off; hence, no FX transaction should take place on the back of this. That said, given that the Riksbank has, as part of its toolbox during the past few years, stressed the possibility of FX intervention, the FX reserve reduction may at first sight have been interpreted as a sign of monetary policy normalisation. Indeed, the announcement sent EUR/SEK briefly below 10.50, but we stress that the Riksbank decision here was done out of financial stability considerations. Hence, we believe we should not read monetary policy signals into this. Today, the Riksbank’s Ingves and Skingsley will participate in an open hearing on current monetary policy at the Swedish committee on finance, and it is an opportunity not least of all to hear about the Riksbank’s take on e.g. the historically weak SEK.

For majors, it is all about the ECB today. The main thing the FX market is waiting for from the ECB is for it to revisit its forward guidance on rates - and, as this is unlikely to be touched this month, we think it remains too early for the ECB to drive the EUR too much. If we are right that no liquidity injection will be announced in March (even if we stress that there are risks to this call after the ECB sources story yesterday), the knee-jerk reaction to the ECB today could offer some limited EUR support as no TLTRO could at first sight be seen as a hawkish signal. We do not expect a move in EUR/USD significantly above the 1.1350 level though (resistance at 1.1353). Finally, we note that IMM positioning data is finally now up-to-date after delays in the aftermath of the US government shutdown.

Overall, JPY shorts have been reduced since New Year whereas EUR, USD and GBP positioning is little changed overall: speculators remain short EUR and GBP and long USD.