Market movers today

- Markets will continue to digest the repercussion of yesterday's eventful ECB meeting. Also focus remains on any headlines about a possible interim trade deal between the U.S. and China.

- EU Finance ministers will meet in Helsinki today. Discussions on the "euro area budgetary instrument for convergence and competitiveness" as well as policy priorities from the new Italian finance minister will both be on the agenda.

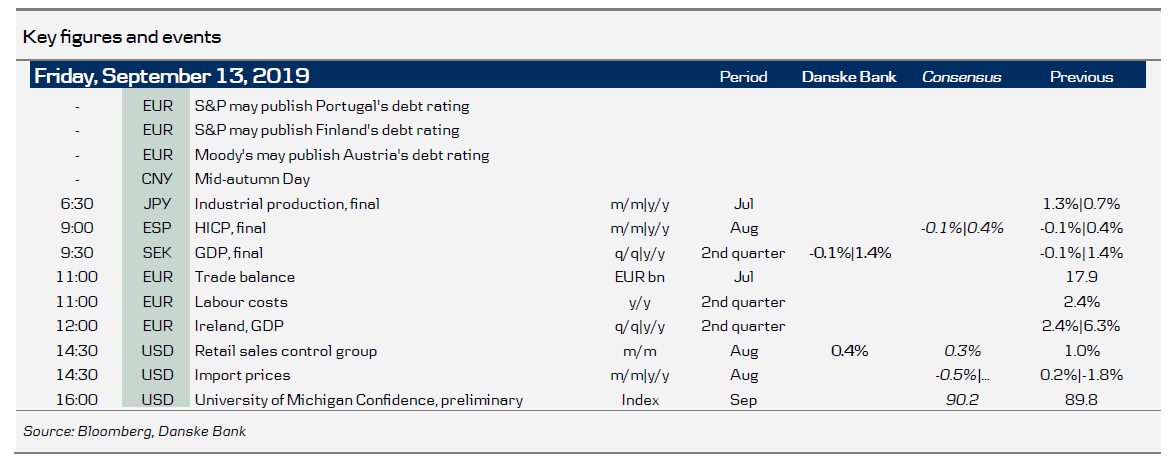

- In the U.S. retail sales figures for August are due out. Last month, the retail sales control group came out much stronger than we expected, indicating strong consumption growth. In light of the recession in the manufacturing sector, we intend to keep an eye on whether private consumption growth can keep up the pace. While a negative surprise is long overdue given the volatility of the time series, fundamentals still look strong and we expect an increase of 0.4% m/m.

- In Sweden we get revisions of second quarter GDP today.

Selected market news

The ECB cut the deposit rate by 10bp to -50bp, leaving the MRO and MLF unchanged, while also linking it to the inflation outlook. In addition, the ECB restarted QE by EUR20bn/month with an open end, which was a strong commitment, but a very vocal call from Draghi indicated a need for fiscal policies to take the stage now. Given the much clouded environment and need to gauge the market impact of the tiered deposit system on money market rates, we do not expect the ECB to change policy rates in our horizon at the current juncture. However, if further monetary easing is needed, it would come via a rate cut and not further QE.

The short-end of the EUR money market curve suffered markedly on the publication of the details of the tiered deposit system, which potentially could mitigate part of the effect of the rate cut, while the longer end of the yield curve is broadly unchanged on the day. EUR/USD initially sold off on the open-ended QE announcement, but bounced back after details of the tiered deposit system was announced.

Following the rate cut from ECB, Danmarks Nationalbank announced a 10bp cut in its key policy rate, the rate of interest on certificates of deposit, to minus 0.75%. It left the current account rate and the lending rate unchanged at 0.00% and 0.05%, respectively. Danmarks Nationalbank also kept banks' current account limit unchanged.

In the midst of the ECB meeting, rumours surfaced that US had discussed offering China an interim trade deal that would delay and roll back some tariffs in return for concessions on the issue of intellectual property rights and purchases of agricultural goods. The White House later denied. OPEC+ announced that it will put more pressure on members not complying with output cuts in response to concerns of a growing supply surplus in the oil market. Finally, US Treasury Secretary Mnuchin dismissed the rumour from earlier in the week that US mulls an easing of sanctions on Iran.

Fixed income markets

A very dramatic day in the European fixed income markets on the back of the ECB meeting. Looking beyond the near future, ECB and Draghi are sending strong message that rates are “low for a very long” time as well as an open-ended QE, such that the ECB could be stuck with a QE programme “for infinity” as market participants describe it. This is very dovish. However, the market reaction to the tiering was very hawkish with plenty of speculation of banks expected to close “the carry trade”, where they had borrowed money from ECB and bought short-dated bonds.

Furthermore, the discussion on whether it would be the “average rate of the deposits”, which is some -26bp or the marginal rate of the deposit, which is -50bp, that would determine the front end, it was clearly the “average rate”. Hence, yesterday’s move from ECB is actually working more like a rate hike. Hence, the combination of an expected closing of the “carry trade” and the “average rate” turned the bullish flattener into a bearish flattener in core- and semi-core EU government bonds.

What do we believe in? We think that the ECB was very dovish, and we stick with our long positions in the periphery versus core and semi-core (long Italy versus Germany/France, long Spain vs. France). We still like being long Buxl spreads even though the size of the QE is not as big as expected.

If inflation expectations do not continue to rise there is risk of more flattening from the long end. However, we do not really believe that “the carry trade” argument for the rise in the front end yields as Italian and Spanish banks holdings of Italian and Spanish government bonds has not increased, and in Spain has actually decreased. Furthermore, looking at the “free flow” in German government bonds based on ECB data it does not seem that German bank treasuries have stocked up on German government bonds either. In Denmark the rise in yields/rates takes some of the prepayment risk in 2% bonds, as the price of 0.5% 30Y callables declined yesterday. However, the decline was modest relative to e.g. the decline in the Bund future. If we enter into a period where 0.5% 30Y callables are NOT the preferred alternative for the borrowers, then the prepayment risk is declining, and solid carry will be supportive for the callable mortgages.

FX markets

The ECB meeting proved a roller coaster ride for EUR/USD – as it usually is when the ECB changes interest rates. The pair initially jumped as the ECB cut only 10bp, but sold off immediately afterwards on the open-ended QE programme and strong forward guidance. During the press conference, the market got cold feet as ECB President Draghi sidestepped questions about QE details and addressed negative side effects. Finally, when tiering details were published EUR/USD rallied back above the levels from before the meeting. In the short term, the combination of the rate cut and tiering could cause volatility in the short-term EUR money market, which could spill over to EUR/USD. Over the medium-term, we think that the ECB regained some credibility today with its strong forward guidance, which makes EUR a more two-sided bet. We keep our forecast on 1-3M of 1.10. The Fed meets next week, where we look for a 25bp cut in line with market expectations, but likely no strong pre-commitment to further easing, which will could weigh on EUR/USD.

The decision by Danmarks Nationalbank (DN) to cut its key policy rate 10bp (see front page) could start to put renewed upward pressure on EUR/DKK. When the dust settles, there is a good chance that the rate cut by DN will have bigger impact on DKK rates than the rate cut by ECB will have on EUR rates, due to the introduction of a tiered deposit system in the euro area. That in turn would lead to a wider discount on EUR/DKK in FX forwards, which could push EUR/DKK higher. There could be scope for a return to the levels seen in Q2 where a 3M (NYSE:MMM) EUR/DKK FX forward traded close to minus 0.25% and EUR/DKK spot close to 7.4700.

In Scandies, despite no releases in Norway, yesterday marked a very eventful day for NOK with the ECB announcement, tiering details revelation, rumours of a trade deal and subsequent denial and an oil price mirroring USD. Overall, the day weakened our call for a tactically lower EUR/NOK over the coming week as higher EUR-rates lifted the broad EUR. We do, however, still pencil in a Norges Bank rate hike next Thursday to add support to the heavily tested NOK. There was relatively small gyrations in EUR/SEK on the ECB meeting. Pressure on the Riksbank to respond to global central banks and in particular the ECB is one of the headwinds for the SEK going forward. Today’s second Q2 GDP release is a potential market mover if we see significant revisions. In our quarterly FX survey, Danske’s FX Thermometer, it is notable that the Nordic client base, for the first time, has turned bearish on the SEK. A majority expect Norges Bank will raise rates this year while the average forecaster stays bullish on the NOK.

The sell-off in US Treasuries yesterday along with positive news on the trade war front (see front page) weighed on JPY. In turn, we were stopped out of our short SEK/JPY trade recommendation (stop of 11.20).