Market movers today

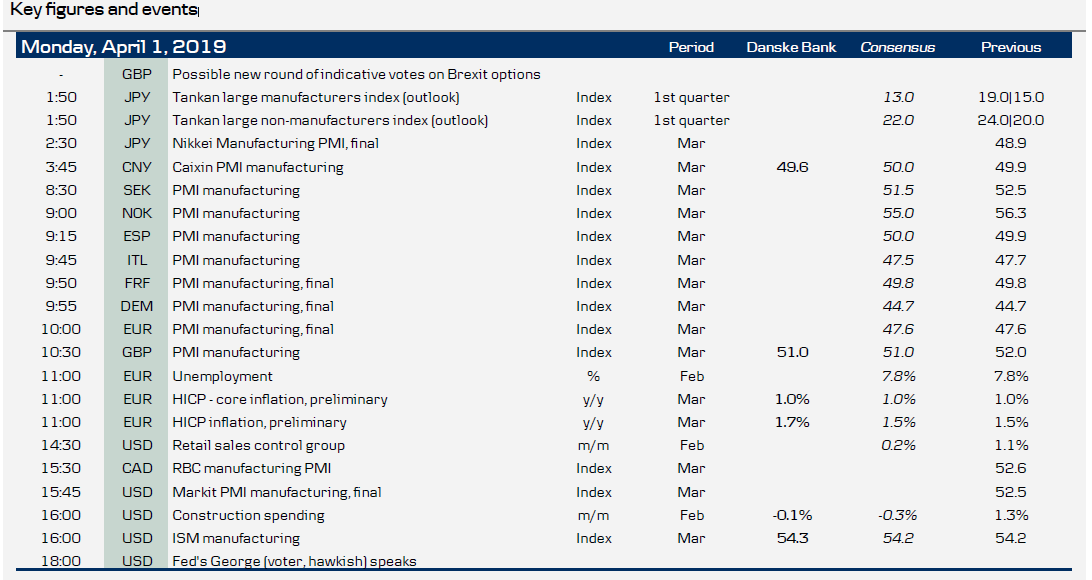

Today is a very busy day in terms of economic data releases. This morning, PMI manufacturing indices for many European countries, including Norway and Sweden (see overleaf), are due out.

In the euro area, we get unemployment data for February and preliminary HICP inflation at 11:00 CEST. Although we still expect core inflation to climb higher in 2019, we expect the March core inflation print to remain at 1.0% y/y, as the Easter effect will exert downward pressure on service price inflation, which might be even more pronounced following the methodological changes to German package tours. For headline inflation we see scope for a rise to 1.7% y/y, driven by increasing energy prices.

In the US, there are plenty of data releases as well. At 14:30 CEST, retail sales are due out, which will be interesting given the weakness in recent months. We expect core retail sales rose +0.5% m/m in February. At 16:00, ISM manufacturing for March is due out, which, given the regional PMIs, may increase marginally. US manufacturing is not immune to what happens in the rest of the world and we expect it to move lower over the next 3M (NYSE:MMM).

In the UK, there will be another round of indicative Brexit votes today. Last week, a permanent customs union or a second EU referendum were closest to getting a majority.

Selected market news

Over the weekend and this morning, China published its official PMI and the Caixin PMI. Both indices surprised on the upside, with the official PMI rising to 50.5 from 49.2 last month, and the Caixin PMI rising from 49.9 to 50.8. It was the biggest increase since 2012 in the official PMI. Both new orders and new export orders rose to a six-month high though new export orders are still below 50. We believe we will continue see a rebound in Q2 data, that tends to correlate with commodity prices, and we have seen higher prices for both metals and oil this year. Hence, the PMIs are encouraging. We also expect further monetary easing to add to the stimulus and thus support activity in Q2. The better PMI data came after positive news stories last week that the Chinese-US trade talks are moving forward. We published our China Weekly Letter on Friday, where we argued that we could see a 'signing meeting' between Xi and Trump in late April.

The Asian markets have reacted positively to the growth news and the major equity indices are in green. USD/JPY is also higher, trading above 111, and 10Y US treasury yields opened some 3bp higher at 2.43%. In Turkey, Erdogan and his AK party lost several key cities in Sunday's election, and the lira remains under pressure after last week's turmoil.

Finally, on Brexit, EU's Junker warned over the weekend that the EU's patience will not last forever. The voting continues this week in the UK parliament. The government must now make a request to the EU at the extraordinary summit on 10 April or leave with a hard Brexit on 12 April.

Scandi markets

Swedish manufacturing PMI is due for release at 08:30 CEST. New orders bounced back in February after a dip close to the ‘standstill’ 50 level in January. However, Swedish manufacturing is closely correlated with German manufacturing and hence the significant drop seen in German orders over the past couple of months implies a sharp downside risk for Swedish PMI.

In Norway, the global slowdown in manufacturing shows no sign of infecting the manufacturing sector so far. This is of course due to the strong impulses coming from oil investments, and as they are set to grow strongly in 2019, we expect an increase in industrial activity over the year. Hence, we expect the PMI to stay at elevated levels, even though we expect a slight fall to 55.0 in March.

Fixed income markets

This week, there is an estimated EUR13.5bn in supply from Spain and France coming to the market. There are only small coupons, so there is an estimated total negative cash flow of EUR12.9bn. There are minor positive cash flows for the next two weeks, while large redemptions in Italy, Spain and not least of all France will generate major positive cash flow in the second part of April. On Thursday, France will tap in the 10Y, 15Y and the new 30Y OAT (5/2050). Spain has decided to only tap two nominals also on Thursday. These will be the 3Y and the 10Y benchmark bond. Market discussion goes on whether Spain could introduce a new 5Y bond relatively soon. Spain will also tap the 8Y linker. For more, see the Government Bonds Weekly, which we published on Friday.

In our Government Bonds Weekly we also have a special theme on a possible ECB tiering system. In the end we do not expect that the ECB will opt for a tiered system. But the important thing to notice from a strategic point of view is the clear message the ECB is sending to the market. When the ECB acknowledges that it is once again considering tiered rates to shield banks after the idea was abandoned in 2016, it underlines that the ECB now sees it as likely that rates will stay negative for an extended period of time, and it even opens the door for new rate cuts.

We continue to favour carry trades and see more downside for Bunds’ 10Y yields. However, today, Bunds might open on the weak side after the stronger-than-expected Chinese PMI data.

This week, focus will once again be on Brexit and then we have the labour market report on Friday. Today, Euro zone CPI will be in focus. We expect core inflation to remain at just 1.0%.

FX markets

On Friday, the NOK benefitted from a rally in oil prices, equities and also a strong NAV labour market report, which confirmed that the labour market remains strong despite Wednesday’s disappointing LFS data. Also, the strong Chinese PMI data over the weekend is very encouraging as it should support global commodity FX including the NOK. Going forward, we still expect a stronger NOK, as explained in Reading the Markets Norway to be published later this morning. In this edition, we also take a look at the Norwegian dividend season, which peaks from mid-April to mid-May. Under even rough assumptions, we estimate a very moderate net exchange need of NOK7.5bn worth of net NOK selling from now until early June. Historically, the NOK has even tended to strengthen during the dividend season and we think this pattern could be repeated.

On the SEK, Swedish PMI is likely to edge lower this morning and a break of 50 cannot be ruled out. If so, the SEK should take a hit and push EUR/SEK firmly back into the higher end of the 10.40-10.50 range.

DKK liquidity conditions are set to ease further in April, where government purchases of mortgage bonds and tax returns will push the net position above DKK250bn and keep downward pressure on EUR/DKK FX forwards (see DKK Edge - EUR/DKK rises as the dividend season peaks). This week, we will monitor closely whether mortgage bond redemptions will temporarily exacerbate this effect (see FX Strategy - Bond flow in April could weigh on EUR/DKK FX forwards).