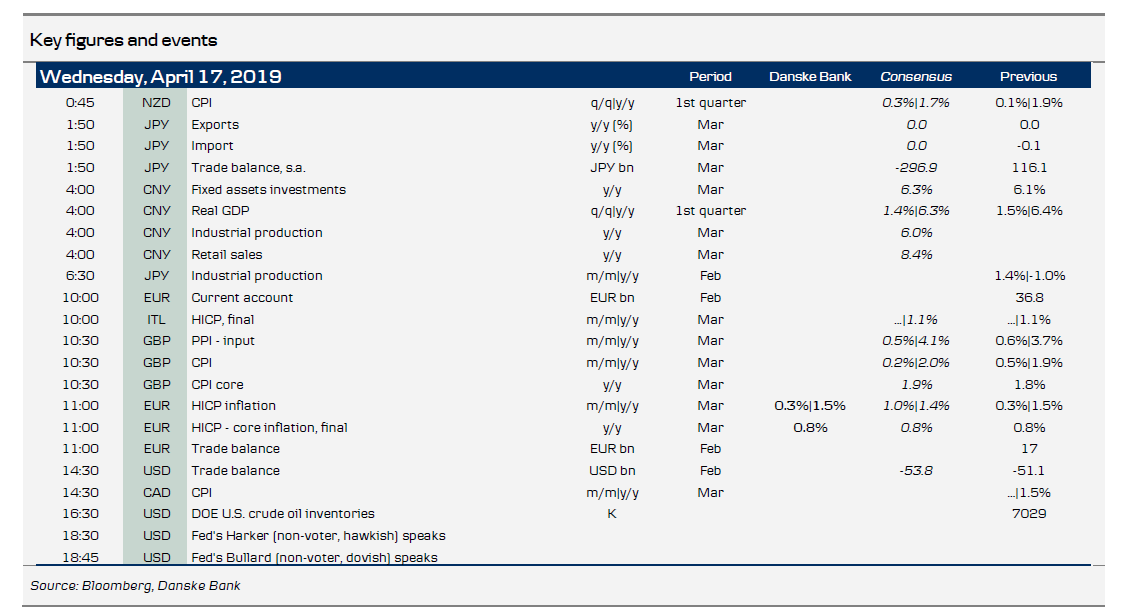

Market movers today

In the euro area, focus today is on the final March HICP figures, which will reveal how much of the fall in core inflation to 0.8% was driven by seasonal effects related to the timing of Easter and which will likely reverse in April.

Markets will also keep an eye on Italy today, where Finance Minister Tria will speak about the outlook before Parliament's Budget Committee. Yesterday, we already saw Italian yields coming under pressure on the back of negative headlines on the budget outlook.

In the UK, data will likely show inflation remaining close to 2% in March amid a continued strong labour market, as yesterday's figures showed. Both Bank of England Governor Carney and Bank of France Governor Villeroy de Galhau are due to speak in Paris.

Selected market news

The Chinese economy fared a lot better in Q1 than recently thought. Overnight, Q1 GDP growth was reported at 6.4% y/y, beating the consensus expectation of 6.6% y/y. In addition, industrial production expanded 8.5% y/y in March, which was significantly higher than the consensus expectation of 5.9% y/y. In contrast to the stronger data from China, data out of the rest of the region disappointed. Japanese and Singapore exports contracted and CPI inflation fell in New Zealand.

The price of Brent crude briefly tested the USD72/bbl level overnight. Oil prices rose on the weekly inventory numbers from the American Petroleum Institute, which was said to report that US crude stocks dropped 3.1mb last week. In addition, the forthcoming expiry of Iran sanctions waivers continues to attract attention in the oil market, with reports of countries looking for other sources for crude oil imports.

A number of ECB headlines hit the wires yesterday, suggesting among other things that a significant minority doubts the forecast for a growth recovery in H2, that the ECB has not discussed a rate cut and that members lack enthusiasm regarding a tiered deposit system.

German ZEW expectations surprised on the upside and registered a second consecutive increase from -3.6 to 3.1 in April, in a sign that investors expect the dark clouds over Germany's economy to lift in the coming months. The current situation assessment remains lacklustre, however, amid many lingering headwinds. For the euro area, the ZEW expectations-current conditions spread has turned even more positive with the April print, which historically has pre-signalled turning points in the manufacturing PMI with a 2-5M lead.

Fixed income markets

The global fixed income sell-off continued yesterday and 10Y US Treasury yields rose to their highest level since the 20 March FOMC meeting. Also, Bunds remained under pressure. The higher yields came as Novotny underlined that there are no official plans for tiered rates and as the German ZEW (expectations part) surprised on the upside. It might be a first sign that investors expect the dark clouds over Germany’s economy to lift in the coming months.

The current situation assessment remains lacklustre, however, amid many lingering headwinds and we still see scope for further downside for tomorrow’s PMI manufacturing, see FX Strategy Another PMI disappointment to send EUR/USD back down. Note also the Reuters story that some ECB policy makers doubt the assumption that growth will recover in H2. We share the concern and hold on to the view that the current FI sell-off will be contained and short-lived. Today, the German Finanzagentur is set to sell EUR1bn in the Jul-44 Bund.

FX markets

Over the past day, EUR/USD has bounced around in the range of 1.1282-1.1313, where stronger data releases, first the better-than-expected ZEW reading yesterday, where the higher expectations component does provide some ray of light for the euro zone economy, and later the stronger Q1 growth data out of China, pushed the pair higher. Those gains were balanced by the relatively downbeat and dovish ECB headlines. For EUR/USD, the big test will be tomorrow, when April’s flash PMIs are released. We look for another disappointment tomorrow, which could send EUR/USD down some 50-70 pips on the day – see FX Strategy Another PMI disappointment to send EUR/USD back down.