Market movers today

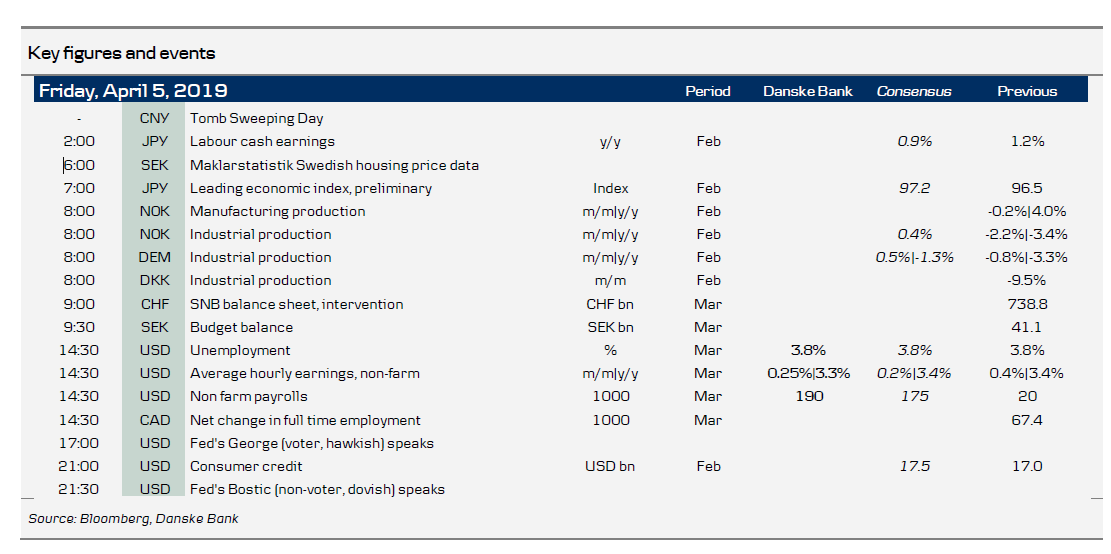

Today, the US jobs report for March is due out. The US labour market looks strong on most parameters and the weak increase in nonfarm payrolls in February was most likely a fluke after the big increase in January. We expect nonfarm payrolls rose 190,000 in March and that average hourly earnings rose +0.25% m/m, implying a fall in the annual growth rate to 3.3% y/y from 3.4% y/y. If we are right, the jobs report should support markets, which have rallied this week based on renewed growth optimism, as the US is not about to fall into recession just yet.

Besides the US jobs report, we get industrial production in February from Denmark , Norway and Germany this morning.

In Norway , at 11.45 CEST, the government will publish a white paper on the investment universe of the Government Pension Fund Global, also known as the "oil fund". Markets are likely to focus in particular on the decision over the bond portfolio, as the fund's proposal in September 2017 included cutting the bond portfolio to three currencies; namely the EUR, USD and GBP. The original proposal also suggested removing all corporate bonds and linkers from the investment universe. The white paper could also include other changes to both the bond and the equity portfolio. As these changes could be far reaching, we expect any changes to be implemented only slowly.

Markets will look out for any breakthroughs in the Brexit negotiations between PM May and Labour leader Corbyn with only a week to Brexit day on 12 April.

This morning, we have published our ECB preview ahead of next week's meeting. In short, we expect Draghi to repeat his 'delayed, not derailed' inflation message, thereby no new policy signals from the ECB. However, we expect Draghi to strike an overall cautious tone and the ECB to keep its downside risks assessment on growth.

Selected market news

Most Asian equity indices as well as the S&P500 futures are trading modestly in green this morning on the back of positive remarks on the ongoing trade negotiations in Washington between the US and China. Trump stated that "a lot of the most difficult points" had been tackled and that he expected a deal to be reached within four weeks. While Chinese President Xi is not present at the negotiations, Vice Premier Liu He has brought his message calling for an early conclusion to the negotiations. A date has yet to be set for the presidents to meet.

In the UK, four and a half hours of negotiations between PM May and Labour leader Corbyn yielded a set of statements that the negotiations had been "productive" and "technical" - yet still short of any concrete results. The negotiations will continue today.

There is talk that the EU may offer a long but flexible extension at next week's extraordinary EU summit, which would include an option to leave earlier if the UK passes the withdrawal agreement. One precondition is for the UK to call for European elections next month. That said, not all EU leaders agree with this approach and while the probability of no deal Brexit is low in our view, it is still not negligible.

Scandi markets

Norway. The global slowdown in manufacturing shows no sign of infecting the manufacturing sector so far. This is of course due to the strong impulses coming from oil investments, and as they are set to grow strongly in 2019 we definitely expect an increase in industrial activity over the year. We therefore also expect that manufacturing production rose 0.4% m/m in February.

Sweden. Today we already got house price data from Svensk Maklarstatistik which showed unchanged yearly growth rates for both apartments and houses (not a market mover). Later we get the budget balance.

Fixed income markets

Sentiment in the global bond markets reversed a bit on Thursday on the back of a solid auction in France as well as in Spain. The 10y spread between France and Germany tightened a few bp, and there was some modest spread compression between the core-EU and the periphery. We believe that the spread compression will continue given that the global central banks will continue to flood the markets with cash as well as keeping an easing bias towards policy rates.

Today, the Norwegian government will announce details regarding the changes to portfolio composition of the Norwegian “oil fund”. There could be some potential large portfolio shifts as they may potentially hold no corporate bonds as well as scaling down on a number of currencies and focus solely on EUR-, USD- and GBP-denominated debt. Furthermore, that the debt should be primarily in nominal government bonds as well as covered bonds. The implementation of such changes will be gradual. The announcement is expected at 11.45 CET.

Belgium (Fitch) and France (S&P) is up for review by the rating agencies. However, both countries are on stable outlook and we do not expect any change to the outlook or the rating. This morning we published our our ECB preview - No new policy actions expected as ‘inflation is delayed, not derailed’ for the meeting next week. We expect an uneventful meeting with no new announcements on neither TLTROs nor tiering of the ECB deposits.

FX markets

EUR/USD has traded in a tight range of around 1.1200-1.1250 this week, as the bout of global data releases and news has not offered much argument of a change in either direction. On the one hand, better data out of China and hints of a trade deal has supported EUR/USD; on the other hand, news that Italy’s budget deficit will be higher this year along with a pickup in short-term US rates has countered this effect. If we are right in our call for another solid US labour market report today, the market will likely be inclined to further price out Fed cuts, which should give some short-term support to USD.

Elsewise FX markets should keep an eye out for the Norwegian government announcement on the petroleum fund (see front page). While any potential change is likely to be phased in over a long time period a change in the bond portfolio setup could involve the potential of more than NOK 500bn worth of GBP and especially USD and EUR buying at the expense of especially JPY, AUD, CAD and a range of EM currencies. Importantly, a potential change of the bond portfolio setup does not involve any NOK exchange as the oil fund invests in foreign denominated assets.