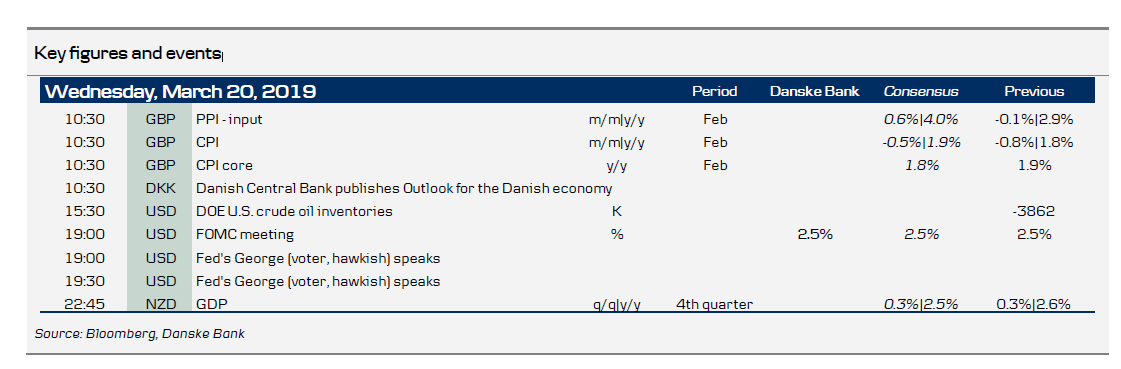

Market movers today

Today's highlight is the Fed meeting tonight. We expect the target rate will remain unchanged at 2.25-2.50% and no major changes to the statement. The big question is what the Fed will signal about being 'patient'. We expect the Fed to lower its 'dot' signal to one rate hike in 2019 (down from two). We expect them also to be revised lower for 2020 and 2021 and would not be surprised if the Fed signals 'one and done'. That said, the Fed has begun downplaying the importance of the dots, so we would be careful putting too much weight on them going forward. Our current base case is two rate hikes (in June and December) based on our overall positive economic outlook, but if the Fed continues focusing on inflation expectations, a June hike seems less likely, as market-based inflation expectations are well below the historical average.

The Brexit discussion continues to draw market attention and in particular the letter that PM May is likely to send to EU council president Tusk later today (more below). The UK CPI inflation for February is unlikely to drive the GBP.

Selected market news

Yesterday, we found out that today PM Theresa May is likely to send EU council President Tusk a letter explaining why the UK wants an extension. This letter is expected to be received today, where hopefully we will also get to know the content. According to Bloomberg , the EU is likely to say that May has to get the Brexit deal through Parliament by mid-April, otherwise the choices are a long extension into 2020 or leaving without a deal. While May's hope is that Brexiteers and DUP will back her deal in order to get Brexit going, the risk is instead prominent Brexiteers in her Cabinet will quit and Brexiteers will make life difficult for her in Parliament (and perhaps even vote for no confidence in her).

As we outlined yesterday, our base case is a long extension (60% probability versus 30% for a short extension). Yes, Brexit may be annoying and time-consuming for the EU leaders and an extension is not only for the better, but probably still better than adding a no deal Brexit to the current mix of a slower economy and high political uncertainty in other EU countries as well. We attach a 10% probability of the EU leaders not agreeing on the principles of an extension, which would be negative for markets, but we think the probability of a no deal scenario has declined. EU leaders are known to be more hawkish on Brexit than Tusk, Juncker and Barnier. One clear problem is that the EU leaders want an explanation for why to give an extension in the first place. For more details see Brexit Monitor: 60% probability of a long Brexit extension , 19 March.

The road to a ceasefire to the US-China trade war was dented yesterday, but remains on track to a solution. Senior officials were said to have reported that Trump-Xi may only meet in June and not, as recently reported, April. However, talks are still ongoing and the discussions at this final stage are difficult. Next week, the US' Lightizer and Mnuchin are travelling to Beijing and similarly, the following week China's He is going to the US in an attempt to solve the disputes, which are currently said to focus on the intellectual property rights, drug data and patents as well as the enforcement metrics.

Fixed income markets

The periphery lost some ground yesterday relative to the core-EU markets – part of the widening was driven by the forthcoming switch auction in Italy, where the Debt Office will extend the debt profile. The Bund spread continues to grind tighter and traded below 50bp yesterday. Hence, it is outside our expected range for 2019, which is between 50bp and 60bp. The tightening is driven by the solid issuance from financials and corporates that take advantage of tighter spreads as well as the “hunt for yield”. We are recommending buying the Bund Spread at these levels, since the carry is only modestly negative, and if the spread tightens some 2-3bp from here, then there is positive carry being long AAA-rated collateral versus bank credit (single A to BBB).

Part of the move in the Bund spread as well as longer-dated ASW spreads for German government bonds is also attributed to the decline in ECB reinvestments. In a recent study by the ECB, it shows that the ECB has bought some 5% more in Germany relative to the capital key, but less in Finland, Ireland and especially Portugal. See more here https://bit.ly/2CsMXkF The study also shows that they have bought too much in the peripheral covered bonds relative to e.g. France. The “underweight” in e.g. Portugal is very visible in the reinvestments in Portugal, where the ECB in January and February has bought almost as much as it did in the individual months late last year.

Today, the German Debt Agency will tap EUR4bn in the Bobls, while Denmark will tap the 5Y and new 10Y benchmark. We expect to see decent demand in the 5Y bond, but maybe not as high as last time, where it was 1.6. Denmark will tap the 5Y and 10Y for DKK 2.5bn. This should go smoothly –

FX markets Today, the Fed could signal it will be ‘one and done’ with respect to hikes from here, but with very soft pricing already and a lingering ECB easing risk premium, we doubt EUR/USD is in for a large spike. Rather, we would look for Friday’s PMIs for direction from here: we think the cyclical picture favours USD for some time still, which in light of the ECB’s hesitant stance caps upside in the cross for now.

GBP remains in the hands of Brexit. At the moment, EUR/GBP seems stuck in the 0.85- 0.87 range. As an extension is already more or less priced in at this point, we expect any decision on (at least on the principles of) an extension will only be marginally positive for the GBP and EUR/GBP should remain above 0.85, in our view. If EU27 rejects an extension, which we cannot rule out given the more hawkish Brexit stance among EU27 leaders compared to the EU Commission (10% probability, see page 1), we should see EUR/GBP break above 0.87, as markets will start pricing in a higher risk of a no deal Brexit again. It remains our base case that the most likely Brexit outcomes are GBP positive but the next significant move lower in EUR/GBP depends on when we will get clarification.

The SEK was supported by Cecilia Skingsley’s comments yesterday, where her repeat of a higher tolerance toward inflation misses can be interpreted as somewhat hawkish in light of the last two prints that were 0.3-0.4 percentage points below forecast. Her comments may suggest that if the March numbers are not much worse, at least she will support maintaining the H2 rate hike guidance intact at the April meeting. The next trigger for EUR/SEK will be Norges Bank tomorrow, where a hawkish surprise in line with our house view could pull the cross lower.