Market movers today

We have another important week on Brexit coming up with the EU Summit on Wednesday, ahead of the Brexit deadline on Friday. Focus this week will also be on the ECB meeting on Wednesday, US inflation, Chinese exports and US-China trade talks.

We are unlikely to get new signals from the ECB at the meeting on Wednesday - global indicators have improved but European indicators have not, see ECB Preview .

The US-China trade talks continue this week Xinhua reports, with Trump's economic advisor Kudlow saying the sides are moving "closer and closer" to a deal. While progress is being made, Trump said Thursday that it would probably take another four weeks to close the deal, see China Weekly Letter .

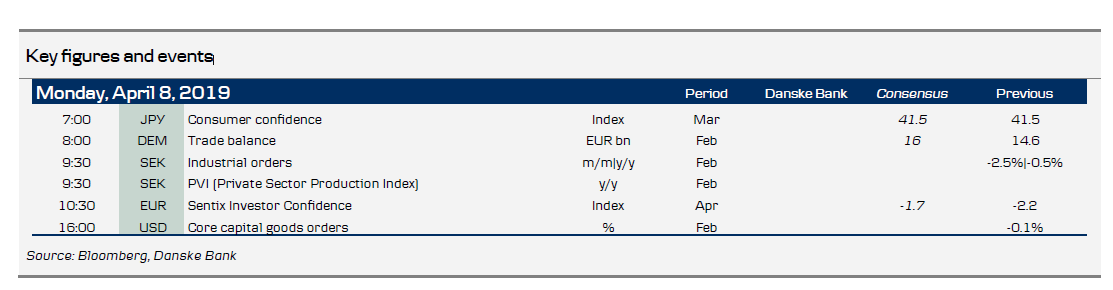

Today, the only scheduled data release of interest is the Euro Sentix survey for April. It increased for the first time in six months in March.

In Scandi markets, focus this week turns to inflation data in both Norway (Wednesday) and Sweden (Thursday).

Selected market news

Most Asian indices are trading modestly in green this morning following another set of encouraging comments on the ongoing trade talks and Fridays nonfarm payrolls release that showed healthy headline job growth but weaker-than-expected wage pressures. This morning, the S&P500 futures and EUR/USD are little changed, the 10Y US Treasury yield has moved below the 2.50% threshold and Brent oil is up roughly 0.5% (see next page).

Following a late-session rally Friday, the Brent crude oil price closed above USD70/bbl for the first time since mid-November. The move came after a week that brought news of OPEC+ output cuts both in terms of compliance and optimism regarding an extension. In addition, over the weekend, Libya's UN-recognised government announced a counterattack ("volcano of anger") on rebel leader Khalifa Haftar and his self-styled Libyan National Army (LNA) that has recently pushed towards Tripoli - the capital and the key city for the oil infrastructure. The escalation in the conflict marks another risk to Libyan supplies (that did rise in March), which could yield more support to the oil price in a week that might also bring further progress in trade talks.

Unless PM Theresa May and Labour leader Jeremy Corbyn make a breakthrough very soon in the attempt to find a common way forward on Brexit , it seems likely we are heading for a long extension (at least to year-end). Theresa May has asked for one to 30 June, which the EU leaders will probably reject by proposing a longer one, at least to year-end, when the EU summit takes place on Wednesday (meeting starts 18:00 CEST). For an update on our probabilities, see this morning's Brexit Monitor -Long extension despite Brexit fatigue .

On Friday, the Norwegian government published a white paper on the oil fund, which included a range of changes. For markets, the most noteworthy change was the inclusion of investments in unlisted renewable energy infrastructure and the exclusion of all emerging market currencies in the bond portfolio. For an overview of the actual currency allocations for the bond portfolio, see this table .

Fixed income markets

This week, there is an estimated EUR15bn in supply from Italy, Germany, the Netherlands, Austria and Finland. Net supply, however, is close to EUR0bn (neutral) given redemptions and coupons from Germany. We expect to see good demand at the small tap auctions from Austria (Tuesday), the Netherlands (Tuesday) and Finland (Wednesday), as fresh supply is modest now that the syndicated deals have been done and the tap auctions are few. Note also that in two weeks’ time, we will have very supportive net cash flows. For more, see Government Bonds Weekly (GBW).

In GBW, we also look at Seasonality in France. We argue that most of the impact from the French redemptions and coupons in April usually happens in March or May, and that there is limited effect in April. Hence, we recommend going long 3Y Ireland versus BGB/OAT given the steep Irish curve between 1Y and 3Y relative to the BGB and OAT curves. Otherwise, the market will focus on the ECB meeting on Wednesday. The ECB is likely to confirm its downside assessment on growth and the market will likely conclude that the ECB is still on an easing bias and that any monetary tightening is very far away. See our ECB preview.

FX markets

The US jobs report on Friday failed to move EUR/USD despite a weak wage growth figure initially sending the pair higher. As for this week’s potential movers, we stress the following: signals of rate cuts or QE needed at Wednesday’s ECB meeting (which we do not expect) to move EUR/USD lower, hence, EUR/USD should remain steady around the ECB meeting; further progress in US-China trade talks would be EUR/USD-positive; and finally, a long extension of Brexit is unlikely to be significant for EUR/USD.

EUR/GBP has traded in the 0.85-0.87 range for some time now and we expect it will continue to do so until we get some clarification over the coming days. Our base case with a long extension would probably be slightly GBP-positive and we could see EUR/GBP trade in the 0.84-0.86 range. In the event of a no deal Brexit, we still expect EUR/GBP to move towards parity. We continue to expect EUR/GBP to move down to 0.83 if the Withdrawal Agreement passes.

After a couple of rather uneventful weeks, at least from a Swedish standpoint, we are in for slightly more action in the coming days. The main events are Prospera’s inflation survey (Wednesday) and the March inflation print (Thursday), but before that the week kickstarts with industrial production and orders due today. Both Ohlsson (Tuesday and Wednesday) and Flodén (Monday and Friday) are set to deliver speeches this week as well. Having traded sideways for quite some time, the SEK is likely to take direction from this week’s events, where the inflation numbers due on Thursday remain key.

In terms of the NOK, the near-term focus will be the oil price rally. Meanwhile, as argued many times before, a rise in the oil price driven by geopolitical drivers/supply-side issues – as is happening now – has historically had much less of an impact on the NOK than when the oil price is driven by global demand. On the data front, the big event of the week is Wednesday’s inflation print. Our call on the core measure is 2.4% y/y, but like other houses and Norges Bank, we acknowledge a high uncertainty on timing given last month’s surprise rise in imported goods inflation in particular. Irrespective, core-core inflation remains supported above Norges Bank’s inflation target until imported inflation falls lower on a stronger NOK. If the NOK does not strengthen, as we pencil in, that would challenge Norges Bank’s inflation target, as the current weak level of the NOK is not consistent with core inflation at 2.0%.