It has been about a month since the last earnings report for Danaher Corporation (NYSE:DHR) . Shares have lost about 2.8% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Danaher Q2 Earnings Beat, Increase Y/Y, Guides Up

Danaher reported adjusted earnings of $0.99 per share in second-quarter 2017, beating the Zacks Consensus Estimate of $0.97 by 2.1%. Moreover, adjusted earnings rose 10.0% on a year-over-year basis.

The bottom line also steered past the company’s guided range of $0.95–$0.98.

The upside in the company’s bottom line can be attributed to its effective Danaher Business System (“DBS”), which provides a set of philosophies, processes and toolsets to drive improvement. Moreover, a decent top-line performance supplemented earnings rise.

Revenues by Segment

Danaher reported total sales of $4,510.1 million, reflecting an increase of 6.3% year over year. In addition, the figure surpassed the Zacks Consensus Estimate of $4,496 million.

Improvement in second-quarter revenues was due to positive contributions from both non-core and core businesses. While acquired businesses contributed 6.0% to overall growth, core businesses contributed 2.0%, both on a year-over-year basis. The company’s recent large acquisitions, Pall and Cepheid, contributed significantly toward the top-line increase.

Life Sciences segment revenues rose 4% year over year to $1,384 million. Operating margin for the quarter expanded 150 basis points (bps) to 16%. The sales growth of this segment was driven by robust market traction of mass spectrometers, microscopy, flow cytometry and genomics products. Impressive rise in the operating margin was driven by higher sales volumes and incremental year-over-year cost savings associated with restructuring actions.

Revenues at the Diagnostics segment increased 14.5% year over year to $1,440 million. Impressive performance of clinical business in China and robust performance of acute care diagnostic and pathology diagnostics business proved conducive to growth of this segment. However, operating margin at the segment contracted 760 bps year over year, to 10.9%. The fall is attributable to higher costs associated with new product development and higher restructuring and impairment charges.

Revenues at Dental came in at $703 million, falling 1.5% on a year-over-year basis. Operating margin rose 30 bps to 15.6%. Lower demand for dental consumable product lines in North America and Western Europe proved to be a drag on the top line of this segment. Also, price decreases impacted this segment negatively. Rise in operating margin is attributable to incremental year-over-year cost savings associated with the restructuring actions.

At the Environmental & Applied Solutions segment, revenues were up 4.5% year over year to $983 million. Solid performance across all the business lines, namely, water quality, analytical instrumentation, chemical treatment solution and ultraviolet water disinfection in end markets drove growth for this segment. Operating margin rose 70 bps to 23.9%. Cost savings associated with restructuring actions benefitted operating margin.

On a year-over-year basis, operating profit margin contracted 150 bps to 15.2%. Gross margins were down 110 bps to 55.0%. Both operating and gross margin decline is attributable to restructuring and impairment charges, which completely offset benefits of higher sales volumes and incremental year-over-year cost savings.

Liquidity

Danaher exited the second quarter of 2017 with free cash flow of $891.9 million compared with the year-ago figure of $835.7 million.

Guidance

Concurrent with the earnings release, Danaher provided its guidance for third-quarter 2017. The company projects adjusted earnings per share in the range of $0.92–$0.96.

Furthermore, Danaher raised its full-year 2017 adjusted earnings guidance. It now expects adjusted net earnings per share to lie in the range of $3.90–$3.97 compared with the earlier guided range of $3.85–$3.95. Overall, the company reported impressive key metrics largely driven by its effective business model, the DBS. The model focuses on three critical areas – quality, delivery, and cost & innovation.

How Have Estimates Been Moving Since Then?

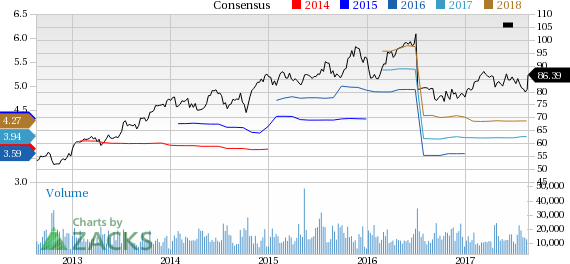

Analysts were quiet during the last one month period as none of them issued any earnings estimate revisions.

Danaher Corporation Price and Consensus

VGM Scores

At this time, Danaher's stock has a subpar Growth Score of D, a grade with the same score on the momentum front. Following the exact same course, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate investors will probably be better served looking elsewhere.

Outlook

The stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Danaher Corporation (DHR): Free Stock Analysis Report

Original post

Zacks Investment Research