EUR/USD" width="1596" height="746">

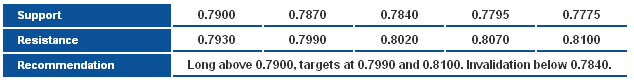

EUR/USD" width="1596" height="746">The pair dropped sharply yesterday and is currently trading close to the 50% correction shown on graph. Whereas this correction residing at 1.3105 levels represents an intraday interval with a possibility of extending bearishness. The bearish possibility is still valid, but the pair has to stabilize intraday below 1.3185, whereas the current bearish correction isn’t over yet and there aren’t enough positive signals indicating the end of the correction.

The trading range for today is among the key support at 1.3020 and key resistance at 1.3230.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

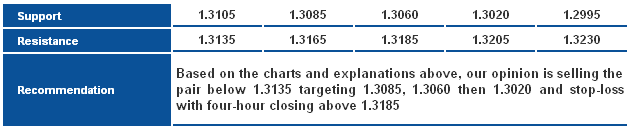

The pair’s attempt to stabilize above 88.6% correction at 1.5645 failed, whereas Linear Regression Indicator 34 failed the bullish attempts. Stochastic is currently showing a negative crossover in levels reflect overbought signals, as RSI is moving in a general bearish bias. Therefore, the possibility of a downside move is valid today.

The trading range for today is among the key support at 1.5425 and key resistance at 1.5770.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

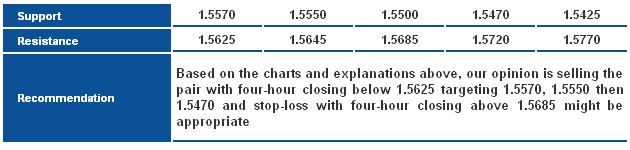

The pair’s upside move remained limited below a 78.6% correction at 100.30 then moved back to the downside, as momentum indicators are showing the weak momentum of the pair. The pair is trading again below key resistance level of the ascending channel which might trigger some bearish correction. Trading below 100.30 will be considered negative if there is a break at the 99.35 level represented in 61.8% correction, as shown on graph.

The trading range for today is among key support at 98.65 and key resistance at 100.90.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

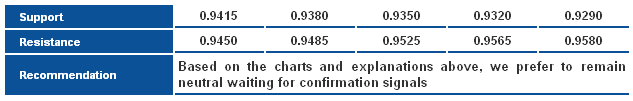

The pair managed to stabilize today around a 50% correction at 0.9450 shown on graph. Linear Regression Indicators support positivity while momentum indicators tend to be negative. We need to see how the pair would react with the referred to correction, so we prefer to remain neutral.

The trading range for today is among key support at 0.9290 and key resistance at 0.9605.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

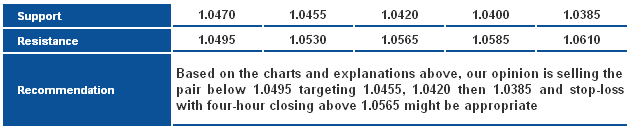

The pair is trading below 23.6% correction of CD Leg of the bearish harmonic Bat Pattern which might extend the downside move affected by the referred to harmonic pattern and might touch the first target of the pattern represented in 38.2% correction at 1.0455; breaking 1.0455 levels increases the possibility of touching the second target at 1.0385 represented in 61.8%. All these negative expectations requires stability below 1.0565, but today the pair has to stabilize below 1.0530 to keep the bearish possibility.

The trading range for today is between the key support at 1.0385 and the key resistance at 1.0565.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting

1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

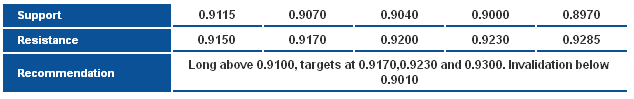

As shown on the daily chart above, the pair settled above the 50-days SMA, but retreated from the main descending resistance for the consolidation phase. A break above this resistance is required now to confirm a potential bullish reversal, or at least a move towards 0.9320-0.9350 area. Overall, we consider the retreat yesterday as a mere correction, ahead of resuming the potential bullish move.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

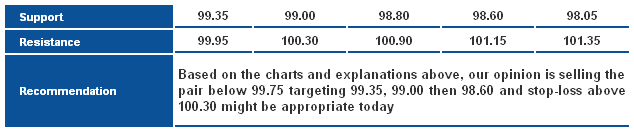

The pair resumes the strong bullish wave after a minor pullback, settling bove the 50-days SMA, and attempting to break 0.7930 resistance level. The bias remains to the upside, supported by momentum indicators. We see further upside especially if price manages to hold above 0.7930 resistance level.