EUR/USD" width="1596" height="746">

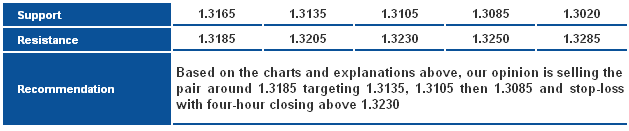

EUR/USD" width="1596" height="746">The pair dropped, and is currently attempting to break a 38.2% correction at 1.3185, as breaking it might extend the downside move. The Linear Regression Indicators tend to be negative and the drop is a response to breaking the key support level of the ascending channel. Trading below the 1.3185 levels forces us to ignore the oversold signals showing on momentum indicators.

The trading range for today is among the key support at 1.3020 and key resistance at 1.3290.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

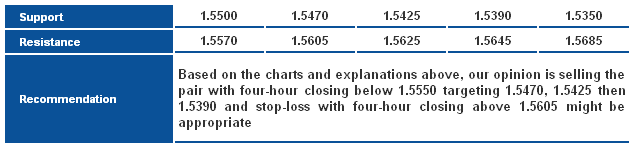

The pair is attempting to trade below a 78.6% correction at the 1.5550 levels, as stability below it might bring back the downside move. The RSI is still showing a negative bias, but the pair has to stabilize below the 1.5550 levels to support the negative outlook.

The trading range for today is among the key support at 1.5390 and key resistance at 1.5645.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

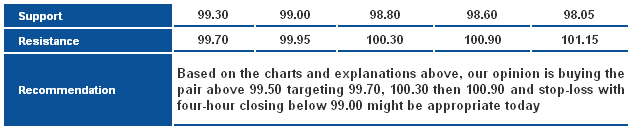

The pair moved sharply to the upside due to breaching 98.60 levels, and is trading above 61.8% correction at 99.35 shown on the graph. Stability above this level extends the upside move, but the pair has to breach key resistance level of the minor ascending channel shown on graph to trigger another bullish wave reaching 78.6% correction and perhaps 88.6% correction at 100.30 and 100.90 gradually.

The trading range for today is among key support at 98.65 and key resistance at 100.90.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

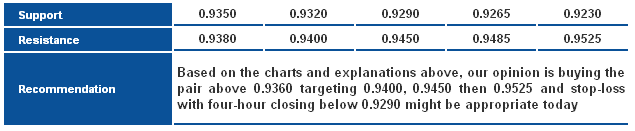

The pair continued moving to the upside until approaching 38.2% correction at 0.9380 as shown on graph. The upside move might extend, but the pair has to breach the referred to level and stabilize above it to increase this possibility. The Linear Regression Indicators are positive and RSI tends to the upside supporting our positive outlook. Breaking the 0.9290 levels and stabilizing below it could fail our intraday expectations.

The trading range for today is among key support at 0.9290 and key resistance at 0.9525.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

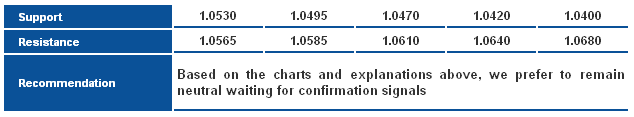

The pair has stabilized again above the Linear Regression Indicators, but is stable also below the top D of the bearish harmonic Bat Pattern at 1.0565. Stability between 1.0495 and 1.0565 requires us to be neutral, whereas we need to make sure that the Bat Pattern will continue affecting the pair, or determine if the affect ended by touching 23.6% correction and levels around it earlier.

The trading range for today is between the key support at 1.0450 and the key resistance at 1.0640.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

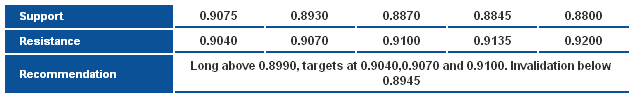

The pair extended the rebound breaking above 0.9000 level, and approaching the key resistance area among 0.9070-0.9100. Further, the upside is still favored, however, breaking this area would give further confirmation to a bullish scenario.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

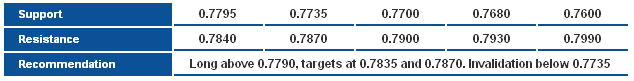

The price is pushing gradually higher, it broke above the resistance of the minor falling wedge, thus challenging the 0.7840 previous swing high(resistance) . The recent strong bearish bias has neutralized, and holding above the broken wedge may push for further gains today, eying the 50-days SMA.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI