EUR/USD" width="1596" height="746">

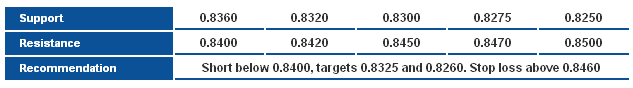

EUR/USD" width="1596" height="746">The pair kick-started trading this week with a strong bullish price gap, carrying the pair above Linear Regression Indicator 34 and 55 signaled by more bullishness ahead. A slight drop is likely to cover the price gap especially that Stochastic offers intraday overbought signals. Trading above 1.3215 this week will trigger further upside rallies.

The trading range for this week is among the key support at 1.3115 and key resistance at 1.3605.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

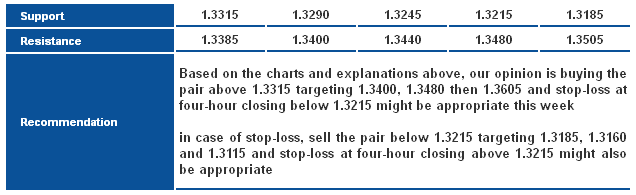

The pair managed to move sharply to the upside at the beginning of this week and stabilized above 113% correction at 1.5875 shown on graph. Stability above this level could push the pair further to the upside to test 1.6005, and perhaps further towards the significant resistances around 1.6055. The referred to resistances are considered very important intervals, we cannot expect breaching these levels especially that momentum indicators are offering overbought signals. Therefore, despite expecting further bullishness, Risk/Reward ratio is inappropriate at these levels forcing us to prefer to remain neutral in our weekly report.

The trading range for this week is among the key support at 1.5685 and key resistance at 1.5875.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

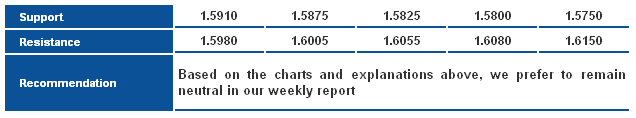

The pair dropped sharply with the beginning of this week providing a bearish opening gap that pushed the pair to stabilize below 99.35. Stability below the referred to level is negative and might be able to push the pair further to the downside towards 38.2% correction at 98.00, and key support level around 97.85. We should point out that breaking 97.85 might trigger a stronger downside wave. Stabilizing below 100.30 keeps the bearish possibility, but we will count on consolidating below 99.95 levels this week to keep these intraday expectations.

The trading range for this week is among key support at 96.25 and key resistance at 100.90.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

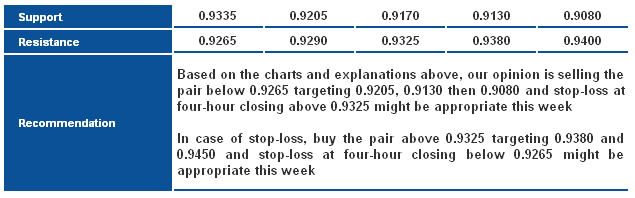

The pair dropped below 0.9290 which is negative and might extend the downside move. The pair has to break 0.9149 levels represented in a previous bottom shown on graph to prove extending the bearish wave. Anyhow, we hold on to our negative expectations this week unless we see a breakout above 0.9380. The pair traded below Linear Regression Indicators and Linear Regression Indicator 34 moved to the downside supporting these expectations.

The trading range for this week is among key support at 0.9010 and key resistance at 0.9450.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

The pair extended the downside move affected by the bearish harmonic Bat Pattern. The downside move might extend to test 113% correction at 1.0235 shown on graph. Breaking the referred to level means breaking the medium-term ascending channel and might push the pair further to the downside, as it needs to break this level to confirm extending the bearish Bat Pattern’s affect of ending it to trade again within the ascending channel shown on graph. Therefore, we expect a downside move that depends on breaking 1.0235 to prove it's extension.

The trading range for this week is between the key support at 1.0090 and the key resistance at 1.0420.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

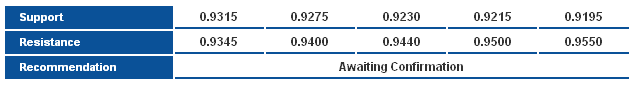

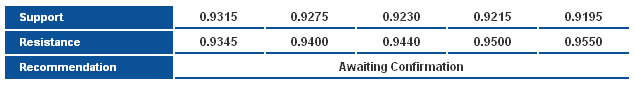

The pair starts the week with a major bullish gap, challenging the main resistance level and top of the recent sideway range at 0.9345 area. Accordingly, stability above this resistance is necessary to confirm the extension of the bullish rebound for the week.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

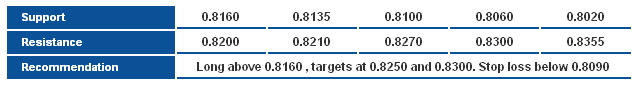

The pair gaps above 0.8160 resistance level and the 200-days SMA, further stability above this resistance should confirm the breakout of the previous sideways market, and suggests a further gains within the upcoming sessions, where 0.8100-0.8090 support level should limit any downside attempt.

GBP/JPY GBP/JPY" width="1596" height="762">

GBP/JPY" width="1596" height="762">

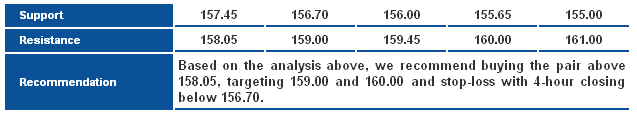

The GBP/JPY pair is stuck in zones between 156.70 and the bullish channel's resistance at 158.05, and we're expecting the latter to be breached in order to confirm the continuation of the bullish trend. In general, the Moving Average 50 is keeping the potential uptrend valid so far. Expected targets begin at 159.00 and extend toward 161.75, and confirming them requires the price to stabilize above 156.70.

**Trading range expected this week is between the main support at 156.00 and the main resistance 161.00

**Short-term trend is to the upside, targeting 163.00 if 147.65 remains intact

EUR/JPY EUR/JPY" width="1596" height="762">

EUR/JPY" width="1596" height="762">

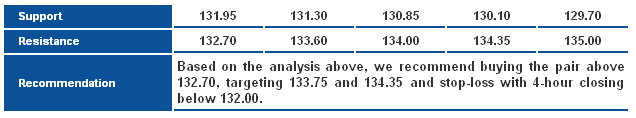

The EUR/JPY pair is adhering to consolidation above the Moving Average 50, making us favor positive trading this week. Breaching 132.70 will clear the path for targets extending all the way to 133.60. Stochastic is offering profound support to positive expectations, provided the price resides above 131.95, more importantly above 130.85.

**Trading range expected this week is between the main support at 130.85 and the main resistance at 135.00

**Short-term trend is to the upside, targeting 140.00 if 124.95 remains intact

EUR/GBP EUR/GBP" width="1596" height="746">

EUR/GBP" width="1596" height="746">

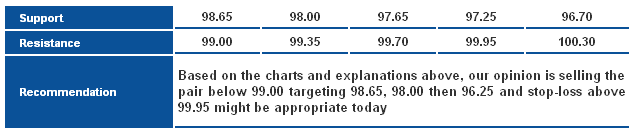

EURGBP has broken the key support and neckline of a major double top pattern, which turns now into a resistance around 0.8400, and should limit any bullish attempts. The bearish scenario has targets initial targets at 0.8320 and 0.8260.