EUR/USD" width="1596" height="746">

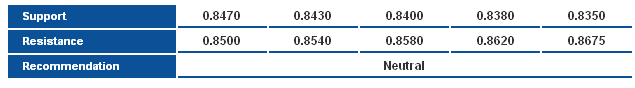

EUR/USD" width="1596" height="746">The pair touched a 38.2% correction at the 1.3185 level, shown on graph, which took the pair slightly to the upside. Some bullish correction is likely, but the downside move remains favored as long as the pair is stable below 1.3315. The pair is also trading again within a sideways range, as shown on graph, and Linear Regression Indicators are trading negatively supporting further bearishness.

The trading range for this week is among the key support at 1.3020 and key resistance at 1.3385.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

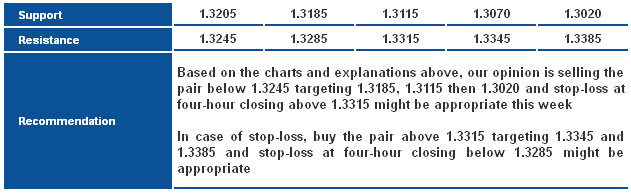

The pair kick started trading this week with a bullish gap. Stability above 1.5550 weakens the downside move without cancelling it, as trading below 1.5645 is still negative and we will count on it this week. We will wait for the pair to trade again below 1.5645 represented in 78.6% correction to better favor the downside move.

The trading range for today is among the key support at 1.5280 and key resistance at 1.5750.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

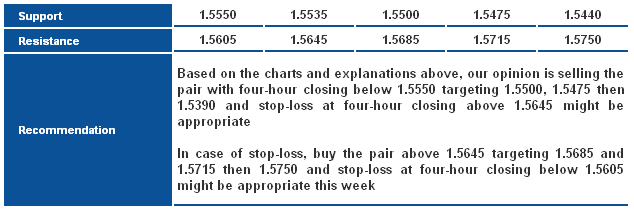

The trading session opening was above key resistance level of the downside move and around 338.2% correction at 98.60 as shown on graph. We cannot count on the breach that occurred, as the bullish price gap needs confirmation. Therefore, we prefer to remain neutral in our weekly report. Trading below 98.05 brings back negativity, while breaching 99.00 might trigger a new bullish wave.

The trading range for this week is among key support at 96.70 and key resistance at 100.70.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

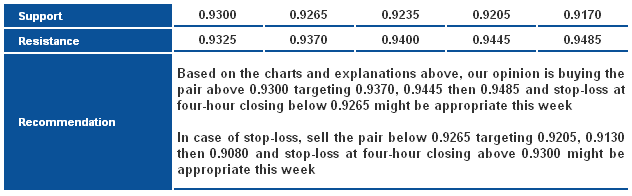

The pair managed to remain stable above 0.9265, represented in 78.6% correction shown on graph and above the Linear Regression Indicators. Stability above the referred to 0.9265 keeps the possibility of extending the upside move, and the first suggested target is 61.8% correction followed by resistance level of the expanding sideways range the 50% correction at 0.9445.

The trading range for this week is among key support at 0.9080 and key resistance at 0.9485.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

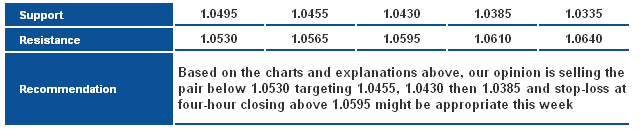

In the bullish attempt we witnessed last week, the pair failed to stabilize above Linear Regression Indicators and above top D of the bearish harmonic Bat Pattern at 1.0565. Therefore, the possibility of the downside move is still valid. Breaking 23.6% correction at 1.0495 will confirm extending bearishness.

The trading range for this week is between the key support at 1.0335 and the key resistance at 1.0640.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

The pair rebounds breaking the short term descending resistance shown on chart, while RSI resolves the bullish divergence. Therefore, the bullish scenario is slightly favored, where a break above 0.8995 may give it further confirmation, and extend to 0.9070 next key resistance.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

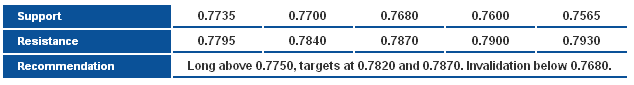

The price rebounds after failing to hold below 0.7735 support, as RSI indicated a strong positive divergence, and price is approaching the resistance of the minor falling wedge shown on chart. Accordingly, the bullish bias is expected to continue further this week. Break and stability below 0.7735 may will extend to 0.7680 key support, while taking 0.7680 will negate any bullish potential.

GBP/JPY GBP/JPY" width="1596" height="762">

GBP/JPY" width="1596" height="762">

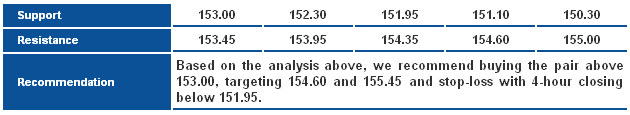

The GBP/JPY pair breached 153.00 and is attempting to settle above it now, clearing the path for potential positive trades in the upcoming days. Targets of the proposed bullishness begins at 154.60 and extend toward 156.75. The Moving Average 50 is supporting that bullishness, which stands intact if the price resides above 152.40.

**Trading range expected this week is between the main support at 151.95 and the main resistance 156.75

**Short-term trend is to the upside, targeting 163.00 if 147.65 remains intact

EUR/JPY EUR/JPY" width="1596" height="762">

EUR/JPY" width="1596" height="762">

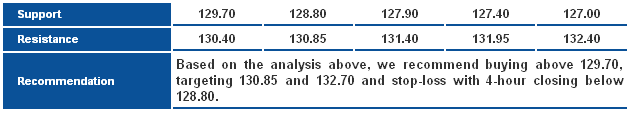

The EUR/JPY pair conducted bearish attempts however was blocked by 129.70, forming a solid support in the face of intraday trades. That makes us expect positive trading ahead, targeting 130.85 that will clear the path toward 132.70 if breached. Note that breaking 129.70 will halt our expectations and lead to bearishness that targets 128.80 then 127.90 if the former is breached.

**Trading range expected today is between the main support at 128.80 and the main resistance at 133.75

**Short-term trend is to the upside, targeting 140.00 if 124.95 remains intact

EUR/GBP EUR/GBP" width="1596" height="746">

EUR/GBP" width="1596" height="746">

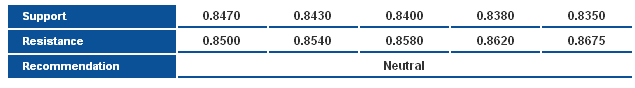

The pair starts the week with a bearish gap, approached our full downside target at the main long term 200-days SMA, and the ascending support for the overall bullish trend. Accordingly, we prefer to move to the sidelines, and monitor how price reacts to this medium term juncture.