EUR/USD - European Session EUR/USD" title="EUR/USD" width="1233" height="616">

EUR/USD" title="EUR/USD" width="1233" height="616">

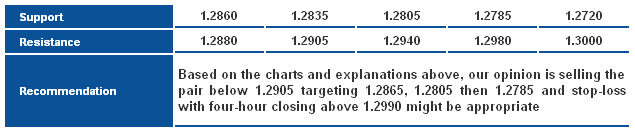

The EUR/USD dropped sharply yesterday, returning below Linear Regression Indicators and is trading now below 1.2905 levels keeping the negative pressure on the pair. The downside move is likely to extend to test 1.2805 levels which is a critical barrier -127.2% correction of the CD Leg of the AB=CD bearish harmonic Pattern- as it will either extend the downside move or trigger the upside correction.

The trading range for today is among the key support at 1.2720 and key resistance at 1.3035.

The general trend over short term basis is to the upside targeting 1.2560 as far as areas of 1.3270 remains intact. EUR/USD_S&R" title="EUR/USD_S&R" width="635" height="135">

EUR/USD_S&R" title="EUR/USD_S&R" width="635" height="135">

GBP/USD GBP/USD" title="GBP/USD" width="1233" height="616">

GBP/USD" title="GBP/USD" width="1233" height="616">

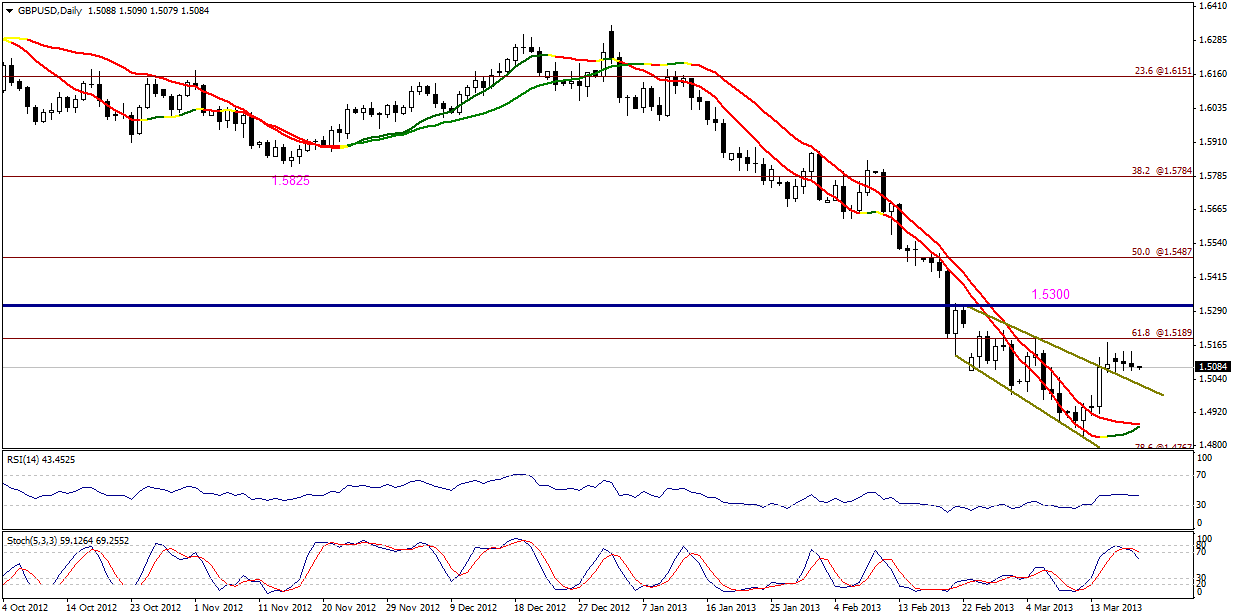

The GBP/USD pair is biased to the downside, but remains limited above key resistance level of the downside move since breaking 1.5300 levels. The current bearish move might benefit the pair by unloading negativity on momentum indicators, then move back to the upside benefiting from possible positive crossover on Linear Regression Indicators. The possible positivity depends intraday on 1.4990 holding steady.

The trading range for today is among key support at 1.4910 and key resistance at 1.5250.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 remains intact. GBP/USD_S&R" title="GBP/USD_S&R" width="632" height="131">

GBP/USD_S&R" title="GBP/USD_S&R" width="632" height="131">

USD/JPY USD/JPY" title="USD/JPY" width="1233" height="616">

USD/JPY" title="USD/JPY" width="1233" height="616">

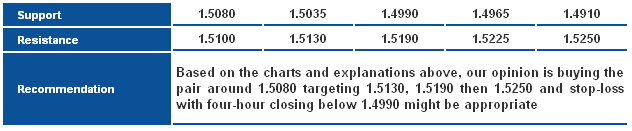

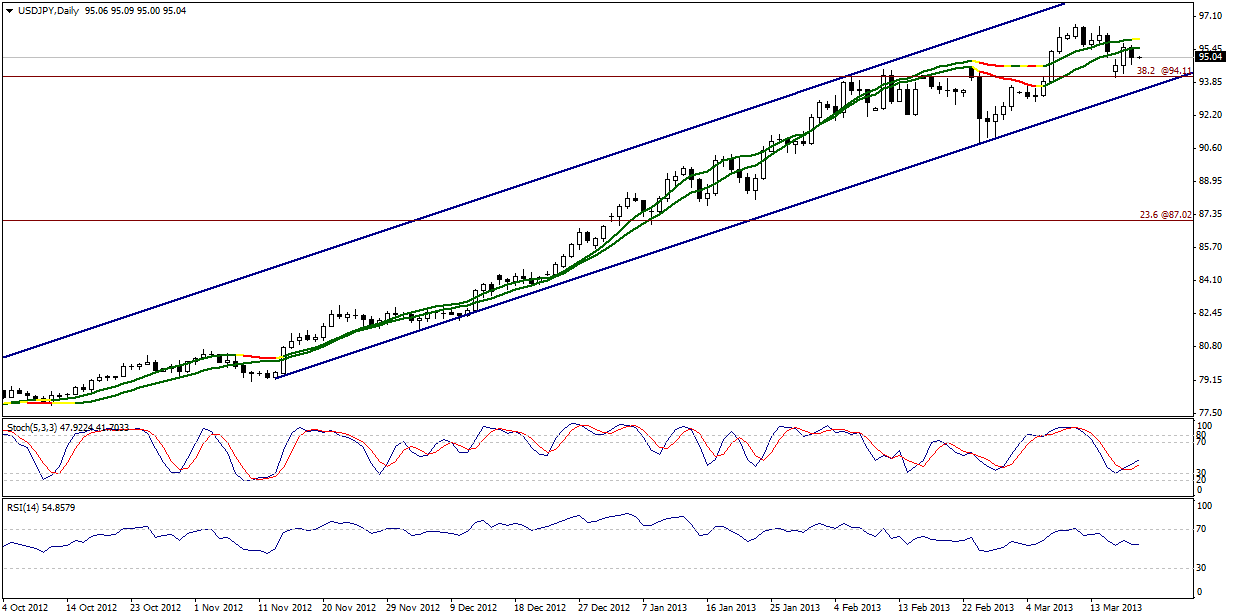

We are worried that the USD/JPY pair failed to hold above 95.50 levels and above Linear Regression Indicators supported by negativity shown on RSI. Meanwhile, we cannot bet on a downside move while the pair is stable above 94.10 levels. Stability above this level might extend the effect of the ascending channel and positive signals on Stochastic. We prefer to remain neutral in our report today.

The trading range for today is among key support at 93.80 and key resistance at 97.10.

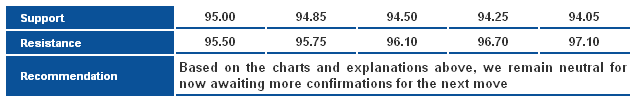

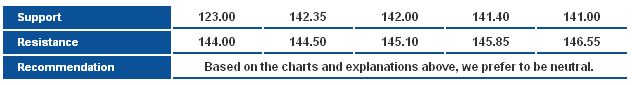

The general trend over short term basis is to the upside targeting 100.00 as far as areas of 84.00 remain intact. USD/JPY_S&R" title="USD/JPY_S&R" width="635" height="102">

USD/JPY_S&R" title="USD/JPY_S&R" width="635" height="102">

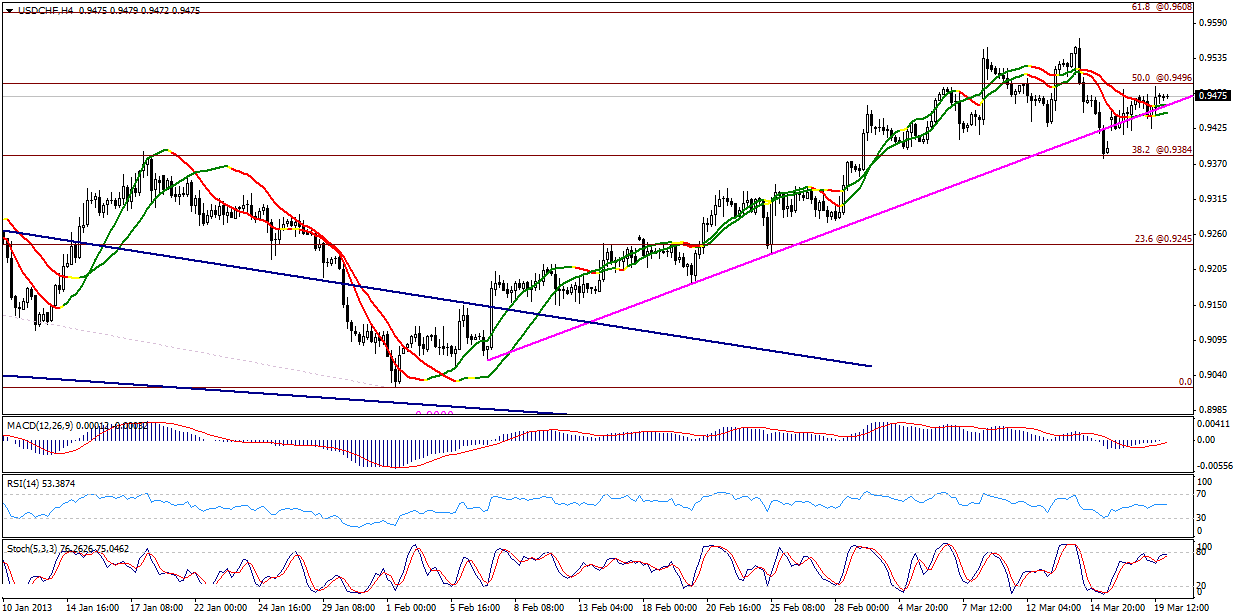

USD/CHF USD/CHF" title="USD/CHF" width="1233" height="616">

USD/CHF" title="USD/CHF" width="1233" height="616">

The USD/CHF consolidated above key support of the bullish wave that helped maintain positive bias, stability above Linear Regression Indicators further supported positivity. Stability above 0.9425 force us to remain neutral today, while stability above 0.9375 levels makes us hold on to positivity on the short term.

The trading range for today is among key support at 0.9375 and key resistance at 0.9655.

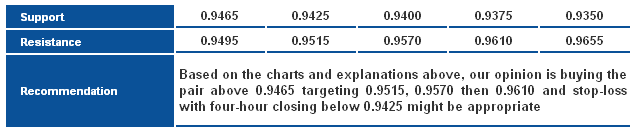

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860. USD/CHF_S&R" title="USD/CHF_S&R" width="632" height="132">

USD/CHF_S&R" title="USD/CHF_S&R" width="632" height="132">

USD/CAD USD/CAD" title="USD/CAD" width="1098" height="718">

USD/CAD" title="USD/CAD" width="1098" height="718">

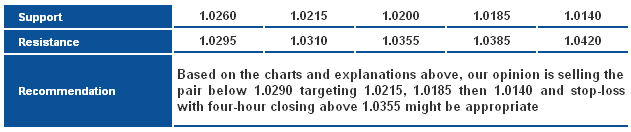

The USD/CAD pair moved to the upside on yesterday's session, and is trading now with some positivity. The upside move is still limited below Potential Reversal Zone (PRZ) of the bearish harmonic Bat Pattern at 1.0355 levels, as trading below it is negative. As for today, trading below 1.0295 levels will be considered negative and stability below it might push the pair again to the downside.

The trading range for today is between the key support at 1.0120 and the key resistance at 1.0355.

The general trend over short term basis is to the upside with steady daily closing above levels 0.9800 targeting 1.0485. USD/CAD_S&R" title="USD/CAD_S&R" width="631" height="132">

USD/CAD_S&R" title="USD/CAD_S&R" width="631" height="132">

AUD/USD AUD/USD" title="AUD/USD" width="1233" height="616">

AUD/USD" title="AUD/USD" width="1233" height="616">

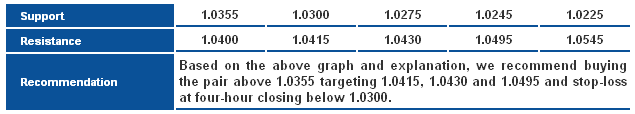

1.0355 prevented the AUD/USD pair's bearish attempts, encouraging us to bet on it to expect an uptrend in today's session. Note that an extension to the uptrend requires a breach to 1.0415; it will restore the pair's position above Linear Regression Indicators. Trading above 1.0300 is generally viewed as positive.

– The trading range expected today is between the key support at 1.0300 and the key resistance at 1.0495

– The short-term trend is downside targeting 0.9400 if 1.0710 remains intact AUD/USD_S&R" title="AUD/USD_S&R" width="635" height="114">

AUD/USD_S&R" title="AUD/USD_S&R" width="635" height="114">

NZD/USD NZD/USD" title="NZD/USD" width="1233" height="616">

NZD/USD" title="NZD/USD" width="1233" height="616">

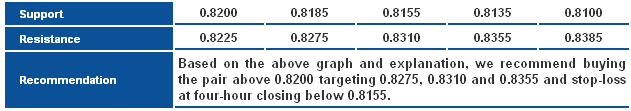

The NZD/USD pair's bearish attempts are contained in levels above the resistance of the downtrend, where support and resistance converged. The pair also resides above 0.8155 – basis of our expectation for an uptrend. Stability above that level helps carry the pair into a bullish wave. In order to confirm that outlook, the pair should stabilize above 0.8275.

– The trading range expected today is between the key support at 0.8155 and the key resistance at 0.8355

– The short-term trend is upside targeting 0.8845 if 0.8130 remains intact NZD/USD_S&R" title="NZD/USD_S&R" width="631" height="111">

NZD/USD_S&R" title="NZD/USD_S&R" width="631" height="111">

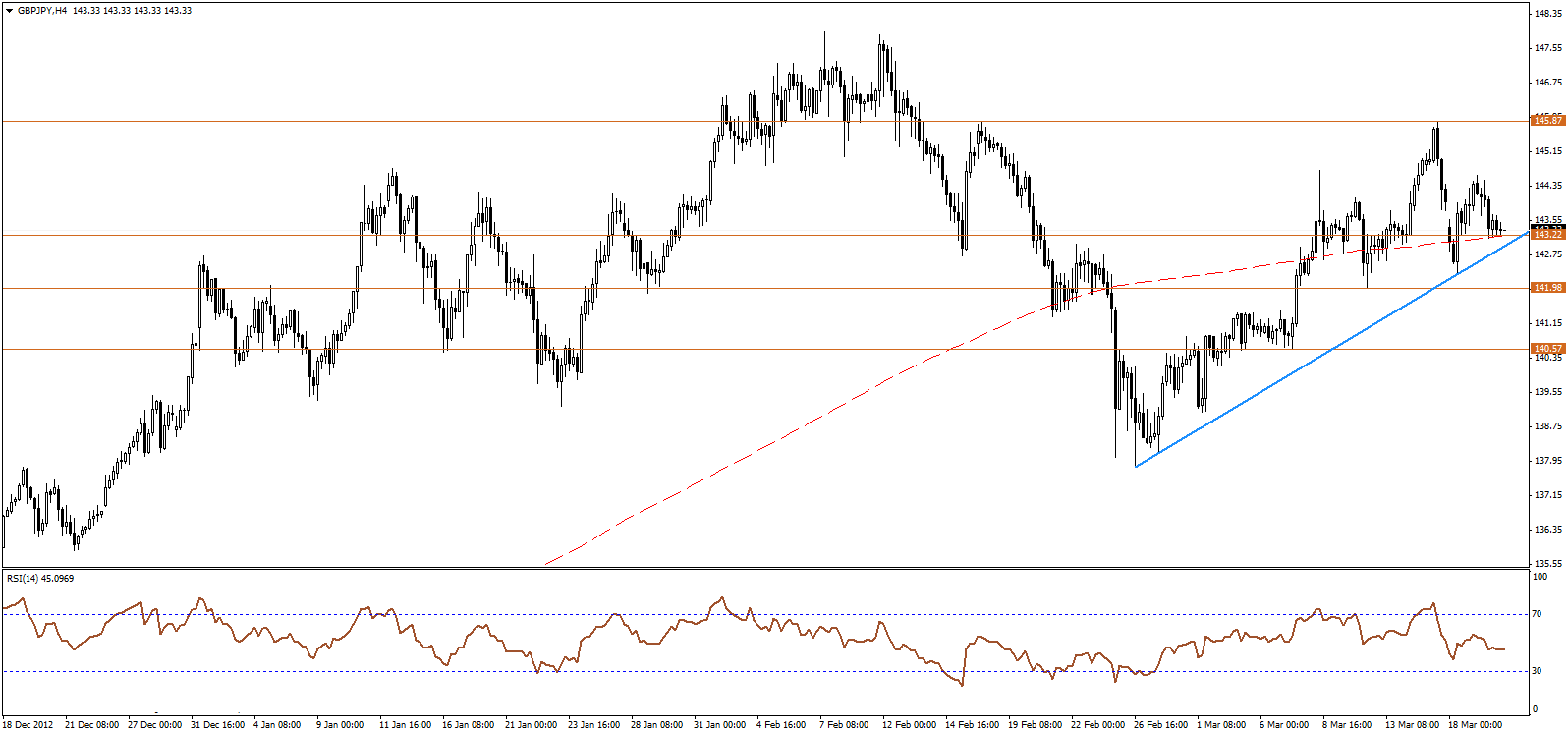

GBP/JPY GBP/JPY" title="GBP/JPY" width="1596" height="746">

GBP/JPY" title="GBP/JPY" width="1596" height="746">

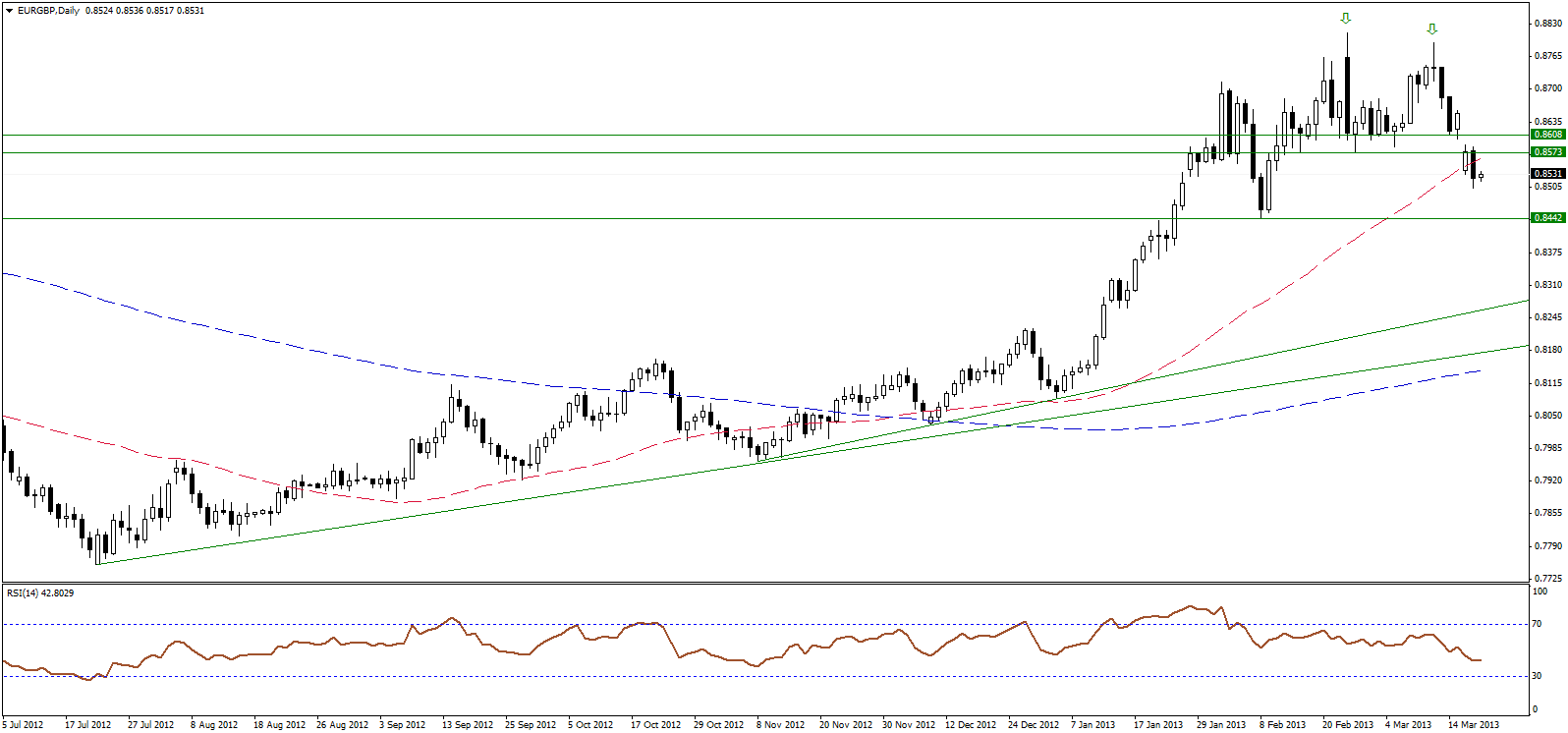

The GBP/JPY pair is consolidating at the 50-days SMA, just above the ascending trend line shown on image, while RSI turns slightly negative. We prefer to be neutral this morning, and monitor price action around this support area, as a decisive break below 123.00 could signal further downside attempts.  GBP/JPY_S&R" title="GBP/JPY_S&R" width="632" height="85">

GBP/JPY_S&R" title="GBP/JPY_S&R" width="632" height="85">

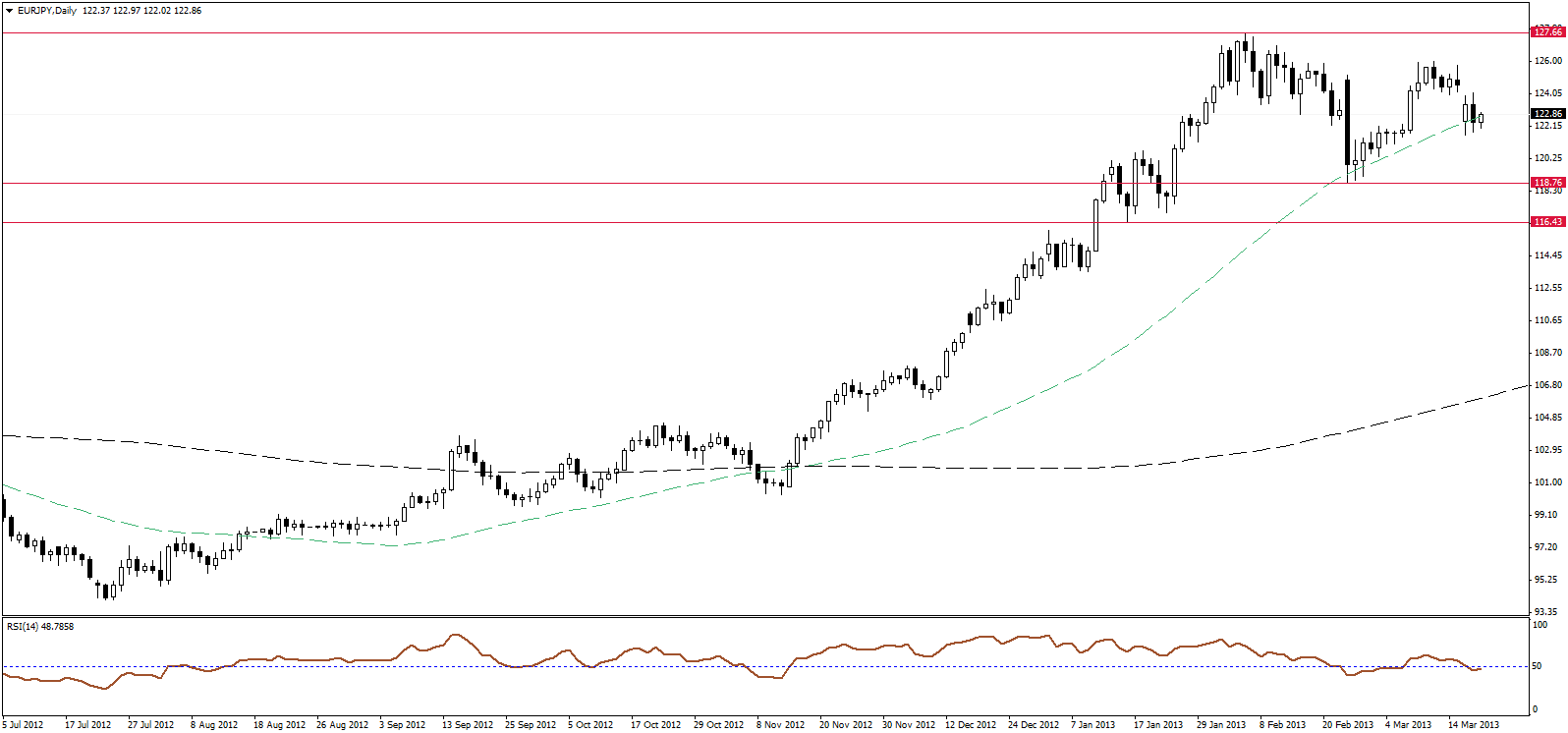

EUR/JPY EUR/JPY" title="EUR/JPY" width="1596" height="746">

EUR/JPY" title="EUR/JPY" width="1596" height="746">

The EUR/JPY pair moved higher this morning, to trigger our entry level at 122.70, activating our intraday bearish scenario, which remanins valid as long as 123.70 is intact. EUR/JPY_S&R" title="EUR/JPY_S&R" width="636" height="83">

EUR/JPY_S&R" title="EUR/JPY_S&R" width="636" height="83">

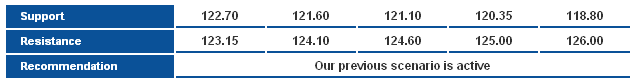

EUR/GBP EUR/GBP" title="EUR/GBP" width="1596" height="746">

EUR/GBP" title="EUR/GBP" width="1596" height="746">

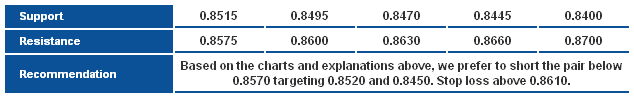

The EUR/GBP pair moved lower yesterday, and acquired our first downside target at 0.8520. The pair has decisively broken the 50-day SMA, following the earlier break below the neckline of the double top reversal pattern. We maintain our bearish view for the pair, towards the main target at 0.8450. Holding below 0.8610 is necessary for the bearish bias to remain dominant. EUR/GBP_S&R" title="EUR/GBP_S&R" width="634" height="97">

EUR/GBP_S&R" title="EUR/GBP_S&R" width="634" height="97">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Technical Report: Major And Cross Currencies - March 20, 2013

Published 03/20/2013, 05:15 AM

Updated 07/09/2023, 06:31 AM

Daily Technical Report: Major And Cross Currencies - March 20, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.