EUR/USD - European Session EUR/USD" width="1596" height="746">

EUR/USD" width="1596" height="746">

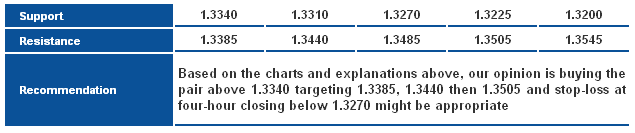

The pair managed to stabilize above the 1.3345 represented in 61.8% shown on graph. Therefore, the possibility of extending the bullish move is valid today. Linear Regression Indicators are positive, supporting our expectations.

The trading range for today is among the key support at 1.3225 and key resistance at 1.3505.

The general trend over short term basis is to the upside targeting 1.3600, as far as areas of 1.2970 remain intact.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

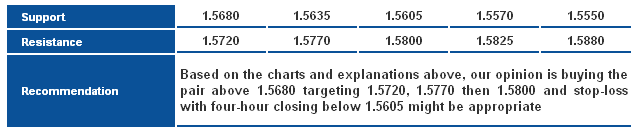

Despite moving to the downside, the pair is trading around 1.5680 levels which is our intraday interval in the upcoming period. Stability above 1.5605 is positive and might push the pair further to the upside; the first suggested target resides at 1.5770 followed by 1.5975 if the first level was breached. Despite negative signals shown on momentum indicators, we find the positive Linear Regression Indicators supports extending the upside move unless levels 1.5605 were broken, and the pair stabilized below.

The trading range for today is among key support at 1.5535, and key resistance at 1.5880.

The general trend over short term basis is to the upside as far as areas of 1.5150 remain intact targeting 1.5975.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

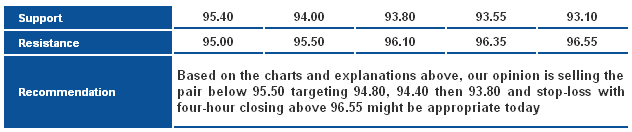

The pair is fluctuating within a limited range below Linear Regression Indicator 34, keeping the possibility of a downside move valid. The pair will face a barrier before extending bearishness, which is 38.2% correction at 93.55 shown on graph. Breaking 93.55 levels might get the pair into a new downside wave.

The trading range for today is among key support at 92.30 and key resistance at 96.35.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

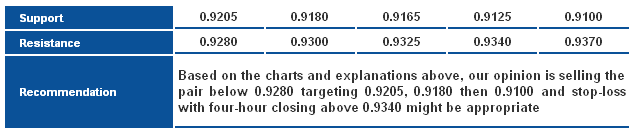

Since last week, the pair’s bullish bias wasn’t enough to push it to stabilizing above the harmonic upside support shown on the graph. Linear Regression Indicator 34 weakens the upside momentum of the pair and keeps the overall bearish bias. Trading below 0.9345 keeps the possibility of a downside move valid, but the pair has to break 0.9205 levels to confirm this negative outlook.

The trading range for today is among key support at 0.9100, and key resistance at 0.9370.

The general trend over short term basis is to the downside, stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1594" height="718">

USD/CAD" width="1594" height="718">

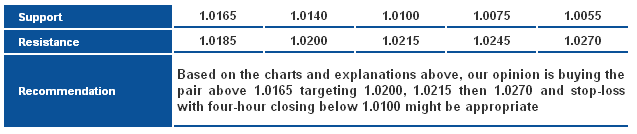

In our previous report, we referred to the possibility of a rebound, but the pair failed to further approach the bullish key support level and touch around 78.6% correction. Instead it rebounded to the upside, and is now trading above 1.0165. Trading above 1.0165 is positive now, and might push the pair towards a new attempt to the upside. Breaking 1.0055 levels will fail the upside move, but we will consider today levels 1.0100 as the significant intraday interval that matches the Risk/Reward ratio.

The trading range for today is between the key support at 1.0055 and the key resistance at 1.0270.

The general trend over short term basis is to the upside with steady daily closing above levels 0.9800 targeting 1.0485.

AUD/USD AUD/USD" width="1596" height="746">

AUD/USD" width="1596" height="746">

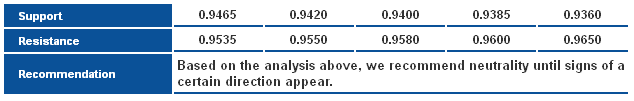

The AUD/USD pair's return below 0.9535 weakens the uptrend significantly yet, makes it difficult to suggest the extension of the downtrend because the pair is trading positively above Linear Regression Indicator 34. We opt to be neutral to see if the pair stays below the aforesaid level in order to give specific suggestions for the upcoming stage.

**Trading range expected today is between the key support at 0.9360 and the key resistance 0.9650.

**Short-term trend is downside targeting 0.9000 if 1.0000 remains intact.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

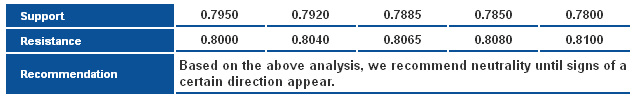

The NZD/USD pair dropped on Monday and Tuesday, steadying below the resistance of a setup similar to a Broadening Wedge Pattern, and dropped below 0.8065 as well. These technical events weaken the momentum of positivity quite clearly however, at the same time, make it difficult for us to suggest a downtrend since the pair is steady above 0.7920. With Stochastic entering oversold areas, we believe it is best to stand aisde in the European Session report.

**Trading range expected today is between the key support at 0.7800 and the key resistance 0.8135.

**Short-term trend is downside targeting 0.7715 if 0.8400 remains intact.

GBP/JPY GBP/JPY" width="1596" height="746">

GBP/JPY" width="1596" height="746">

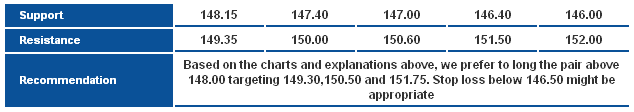

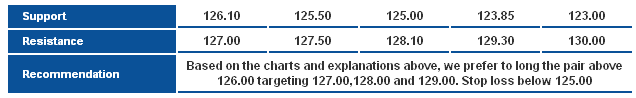

The GBPJPY pair attempted to move higher yesterday, after testing the pivotal support area at the ascending trend line for the whole bullish trend, and the horizontal key support near 148.00. However, the pair retreats approaching this support again,where holding above this support is necessary for the bullish rebound scenario to remain possible.

EUR/JPY EUR/JPY" width="1596" height="746">

EUR/JPY" width="1596" height="746">

The pair EURJPY rebounded slightly yesterday after testing the key horizontal support at 125.00 level. The bullish correctional bounce could extend further possibly towards a retest of the broken ascending support near 128.00. The bullish sceanrio requires 125.00 pivotal level to remain intact.

EUR/GBP EUR/GBP" width="1596" height="746">

EUR/GBP" width="1596" height="746">

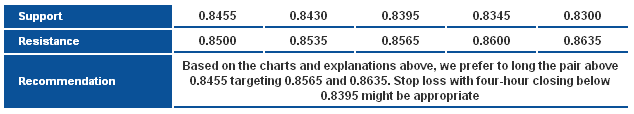

The pair continues to fluctuate within a sideways range around 0.8500 level, and above the ascending support shown on the daily chart above, and thus we maintain our bullish outlook for the pair.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Daily Technical Report: Major And Cross Currencies - June 18, 2013

Published 06/18/2013, 07:00 AM

Updated 07/09/2023, 06:31 AM

Daily Technical Report: Major And Cross Currencies - June 18, 2013

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.