EUR/USD - European Session

EUR/USD" width="1596" height="746" />

EUR/USD" width="1596" height="746" />

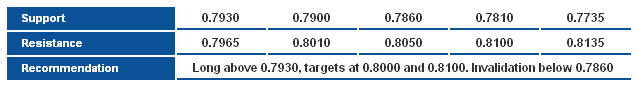

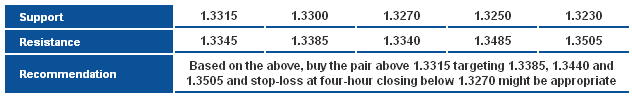

The pair breached 1.3315 activating a new bullish wave for EUR/USD. The bullish bias remains favored with stability above 1.3270 but we prefer to see the pair consolidate above the breached resistance –now support- at 1.3315 to further support bullishness.

The trading range for today is among the key support at 1.3230 and key resistance at 1.3505.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD

GBP/USD" width="1596" height="746" />

GBP/USD" width="1596" height="746" />

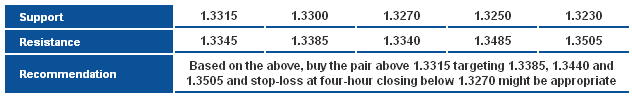

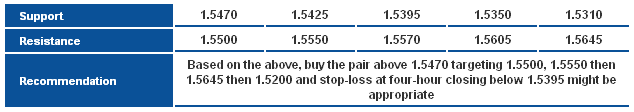

The pair moved sharply higher yesterday and we expect the upside wave to extend today. Stability above the Linear Regression Indicators 34 & 55 alongside consolidation above 1.5395 -61.8% correction- supports the expected bullishness. A breach of 1.550 is required today to trigger another bullish wave toward 1.5645.

The trading range for today is among key support at 1.5395 and key resistance at 1.5645.

The general trend over short term basis is to the downside as far as areas of 1.5605 remains intact targeting 1.4550.

USD/JPY

USD/JPY" width="1596" height="746" />

USD/JPY" width="1596" height="746" />

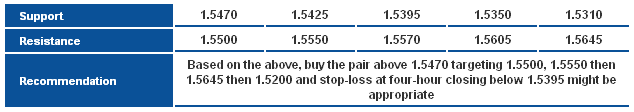

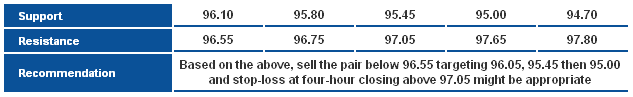

The pair moved lower yesterday and currently trading below 96.75 which supports the extension of the downside move. Linear Regression Indicators favor the downside move especially after the breakout below the mentioned 61.8% correction. The initial target resides at 78.6% correction at 95.45. Momentum indicators are trading in oversold areas but with stability below 96.75 we will ignore those signals.

The trading range for today is among key support at 94.65 and key resistance at 97.65.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

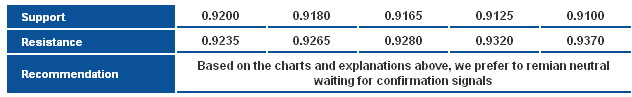

USD/CHF

USD/CHF" width="1596" height="746" />

USD/CHF" width="1596" height="746" />

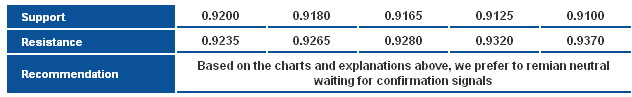

Despite the downside move, the pair remains limited within the same trading range between 78.6% correction at 0.9265 and 88.6% correction at 0.9200. There are a number of negative signals seen from stability below Linear Regression Indicators and trading within the descending channel shown on graph, but with the oversold signals on momentum indicators and the confined range we prefer to stay on the sidelines for now awaiting more confirmations for the next move.

The trading range for today is among key support at 0.9125 and key resistance at 0.9370.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

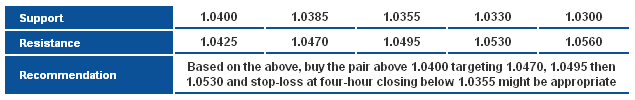

USD/CAD

USD/CAD" width="1596" height="719" />

USD/CAD" width="1596" height="719" />

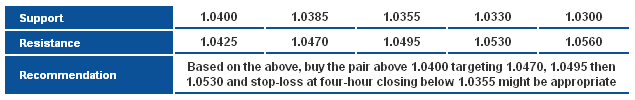

With the kicks-start of trading today, the pair is stable below 50% correction shown on graph at 1.0425. Nevertheless, trading above 1.0385 is still considered positive and accordingly we will favor the extension of the upside move, especially with the pair returning above the Linear Regression Indicators for the first time since July 10. Momentum indicators are trading in overbought areas but will be offset with stability above 1.0385.

The trading range for today is between the key support at 1.0330 and the key resistance at 1.0530.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

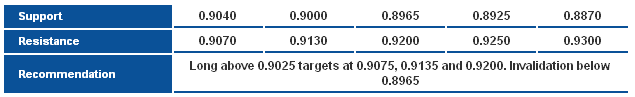

AUD/USD

AUD/CAD" width="1596" height="746" />

AUD/CAD" width="1596" height="746" />

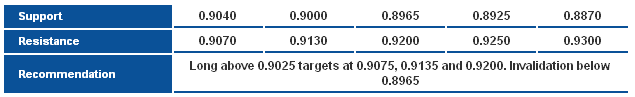

The pair broke back above 0.9000, and completed an inverted head and shoulders pattern, reversing the short term bias to bullish, and suggesting the bullish bounce may extend further, the next potential upside target at 0.9135. Holding above 0.9000 keeps the bullish rebound scenario intact.

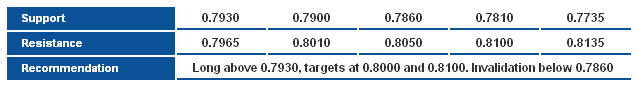

NZD/USD

NZD/USD" width="1596" height="746" />

NZD/USD" width="1596" height="746" />

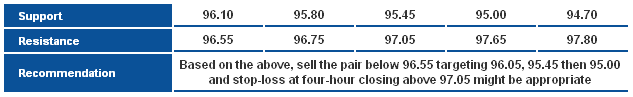

The pair maintained the bullish direction, breaking above 0.7900 resistance level and the 50-days SMA, and thus reversed the intraday bias to bullish. The next potential upside target is at 0.8010 and 0.8100 levels.

EUR/USD" width="1596" height="746" />

EUR/USD" width="1596" height="746" />The pair breached 1.3315 activating a new bullish wave for EUR/USD. The bullish bias remains favored with stability above 1.3270 but we prefer to see the pair consolidate above the breached resistance –now support- at 1.3315 to further support bullishness.

The trading range for today is among the key support at 1.3230 and key resistance at 1.3505.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD

GBP/USD" width="1596" height="746" />

GBP/USD" width="1596" height="746" />The pair moved sharply higher yesterday and we expect the upside wave to extend today. Stability above the Linear Regression Indicators 34 & 55 alongside consolidation above 1.5395 -61.8% correction- supports the expected bullishness. A breach of 1.550 is required today to trigger another bullish wave toward 1.5645.

The trading range for today is among key support at 1.5395 and key resistance at 1.5645.

The general trend over short term basis is to the downside as far as areas of 1.5605 remains intact targeting 1.4550.

USD/JPY

USD/JPY" width="1596" height="746" />

USD/JPY" width="1596" height="746" />The pair moved lower yesterday and currently trading below 96.75 which supports the extension of the downside move. Linear Regression Indicators favor the downside move especially after the breakout below the mentioned 61.8% correction. The initial target resides at 78.6% correction at 95.45. Momentum indicators are trading in oversold areas but with stability below 96.75 we will ignore those signals.

The trading range for today is among key support at 94.65 and key resistance at 97.65.

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF

USD/CHF" width="1596" height="746" />

USD/CHF" width="1596" height="746" />Despite the downside move, the pair remains limited within the same trading range between 78.6% correction at 0.9265 and 88.6% correction at 0.9200. There are a number of negative signals seen from stability below Linear Regression Indicators and trading within the descending channel shown on graph, but with the oversold signals on momentum indicators and the confined range we prefer to stay on the sidelines for now awaiting more confirmations for the next move.

The trading range for today is among key support at 0.9125 and key resistance at 0.9370.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD

USD/CAD" width="1596" height="719" />

USD/CAD" width="1596" height="719" />With the kicks-start of trading today, the pair is stable below 50% correction shown on graph at 1.0425. Nevertheless, trading above 1.0385 is still considered positive and accordingly we will favor the extension of the upside move, especially with the pair returning above the Linear Regression Indicators for the first time since July 10. Momentum indicators are trading in overbought areas but will be offset with stability above 1.0385.

The trading range for today is between the key support at 1.0330 and the key resistance at 1.0530.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD

AUD/CAD" width="1596" height="746" />

AUD/CAD" width="1596" height="746" />The pair broke back above 0.9000, and completed an inverted head and shoulders pattern, reversing the short term bias to bullish, and suggesting the bullish bounce may extend further, the next potential upside target at 0.9135. Holding above 0.9000 keeps the bullish rebound scenario intact.

NZD/USD

NZD/USD" width="1596" height="746" />

NZD/USD" width="1596" height="746" />The pair maintained the bullish direction, breaking above 0.7900 resistance level and the 50-days SMA, and thus reversed the intraday bias to bullish. The next potential upside target is at 0.8010 and 0.8100 levels.