EUR/USD" width="1596" height="746">

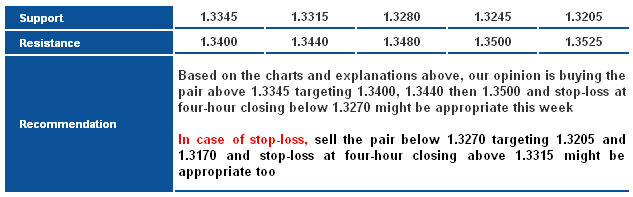

EUR/USD" width="1596" height="746">The pair managed to move to the upside during Friday’s session; and with the kick start of trading this week it failed to stabilize below 1.3270 levels. Stability above the referred to level is positive, meanwhile the pair has to stabilize above Linear Regression Indicators around 1.3400 levels to support the idea of a bullish move. Trading between 1.3270 and 1.3400 keeps the pair’s trend sideways. Of note, breaking 1.3315 might trigger a bearish correction. Anyhow, we will benefit from stability above 1.3270 to suggest an upside move, because the pair managed to breach the descending resistance that dominated the pair’s trading since the top placed at 1.3711.

The trading range for this week is among the key support at 1.3115 and key resistance at 1.3620.

The general trend over short term basis is sideways targeting 1.2775 as far as 1.3600 is daily-closing.

GBP/USD GBP/USD" width="1596" height="746">

GBP/USD" width="1596" height="746">

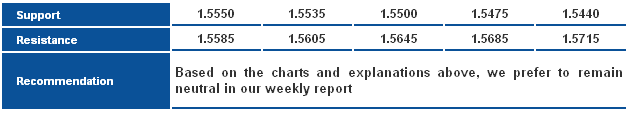

The pair’s drop last week took it to trade around 78.6% correction at 1.5550 shown on graph, which will be considered the intraday interval this week. Linear Regression Indicators are still positive, but the pair has to stabilize above 1.5645 to confirm the upside move. Therefore, we prefer to remain neutral in our weekly report waiting for confirmation signals, especially that the technical contradiction between Stochastic and RSI requires confirmation from 1.5550; a confirmed breakout will support bearishness.

The trading range for this week is among the key support at 1.5390 and key resistance at 1.5875.

The general trend over short term basis is to the upside as far as areas of 1.5100 remains intact targeting 1.6010.

USD/JPY USD/JPY" width="1596" height="746">

USD/JPY" width="1596" height="746">

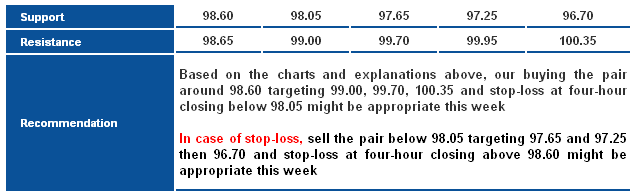

The pair is trading around key resistance level of the descending channel that dominated the pair’s trading since the top 101.53 as shown on graph. The referred to resistance is close to 38.2% correction at 98.60 which is the intraday interval for the pair this week. Risk/Reward Ratio are appropriate because the pair is close to the referred to 98.60. Therefore, we will suggest an upside move this week. Of note, breaking 98.05 indicates trading again within the descending channel which may trigger a trend reversal to the downside.

The trading range for this week is among key support at 96.70 and key resistance at 100.35

The general trend over short term basis is to the downside as far as areas of 103.50 remain intact targeting 93.50.

USD/CHF USD/CHF" width="1596" height="746">

USD/CHF" width="1596" height="746">

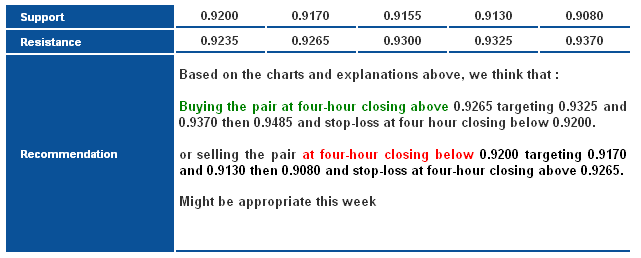

The pair traded most of last week between 0.9265 and 0.9200. Trading between these levels is considered sideways, as the pair should stabilize above the resistance represented in 78.6% correction or break support level 0.9200 represented in 88.6% correction to determine the trend. Therefore, we count on breaching 0.9265 or breaking 0.9200 in our expectations of the pair’s move for this week.

The trading range for this week is among key support at 0.9080 and key resistance at 0.9485.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

USD/CAD USD/CAD" width="1596" height="719">

USD/CAD" width="1596" height="719">

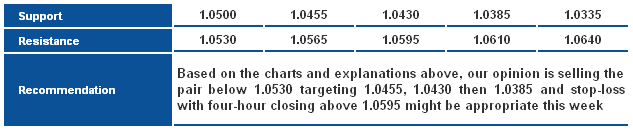

The pair reversed to the downside after proving the bearish harmonic Bat Pattern that achieved the pattern’s rules perfectly. The overall move for this week is bearish unless levels 1.0565 were breached and the pair stabilized above it. The first target of the harmonic pattern is 1.0455 represented in 38.2% correction of CD Leg of the pattern, followed by 61.8% correction at 1.0385 if the pair traded below the first target. It’s possible to witness some volatility and perhaps some bullish correction due to intraday oversold signals showing on Stochastic, but we think the downside move is valid and more credible by breaking 1.0500 and stabilizing below it.

The trading range for this week is between the key support at 1.0335 and the key resistance at 1.0640.

The general trend over short term basis is to the upside with steady daily closing above levels 1.0100 targeting 1.0775.

AUD/USD AUD/CAD" width="1596" height="746">

AUD/CAD" width="1596" height="746">

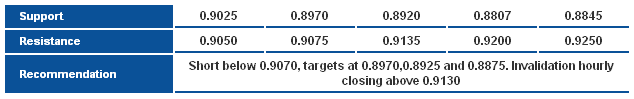

The pair is pushing gradually higher, attempting to retest the broken key support at 0.9070 area, which has turned into a potential resistance level, and may force price to resume the overall bearish bias, which remains favored for this week. Settling back above 0.9070 may weaken the bearish scenario.

NZD/USD NZD/USD" width="1596" height="746">

NZD/USD" width="1596" height="746">

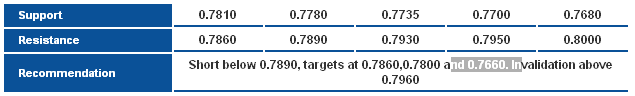

The pair is recovering some the earlier strong losses, while the price remains below the 50-days SMA and 0.7930 broken support turned resistance, accordingly, the bearish bias remains favored for this week. We may see a correctional move higher due to the significant oversold conditions over the intraday time intervals, for a possible retest of the 50-days Average, however only a break back above 0.7930 may revive the bullish chances.